Question: Using excel to solve Problem 2 Cho-Sen Company is considering purchasing additional equipment that would have an initial cost of $55,000. They estimate it would

Using excel to solve

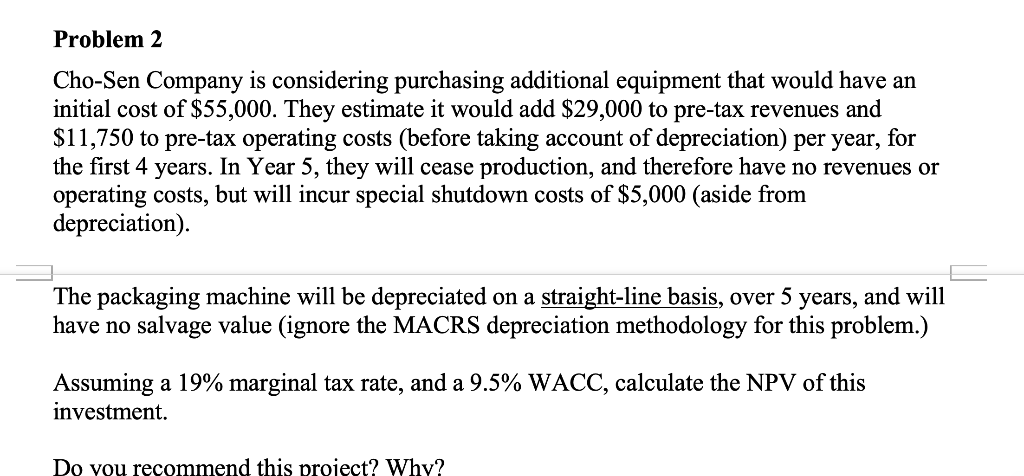

Problem 2 Cho-Sen Company is considering purchasing additional equipment that would have an initial cost of $55,000. They estimate it would add $29,000 to pre-tax revenues and $11,750 to pre-tax operating costs (before taking account of depreciation) per year, for the first 4 years. In Year 5, they will cease production, and therefore have no revenues or operating costs, but will incur special shutdown costs of $5,000 (aside from depreciation) The packaging machine will be depreciated on a straight-line basis, over 5 years, and will have no salvage value (ignore the MACRS depreciation methodology for this problem.) Assuming a 19% marginal tax rate, and a 9.5% WACC, calculate the NPV of this investment. Do you recommend this project? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts