Question: using excel, with the given information, what formulas are needed, and how would i type them in to solve for part d? Bolden Health Syatem

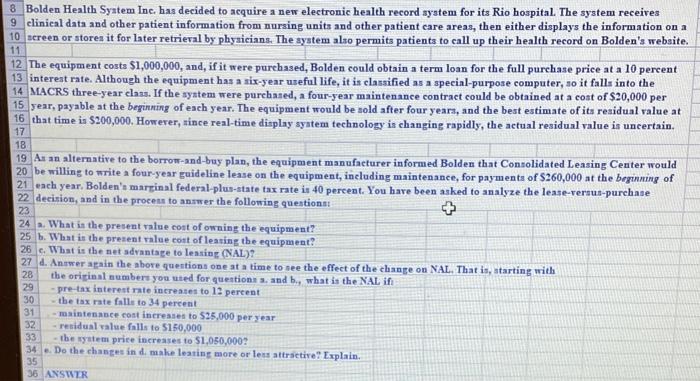

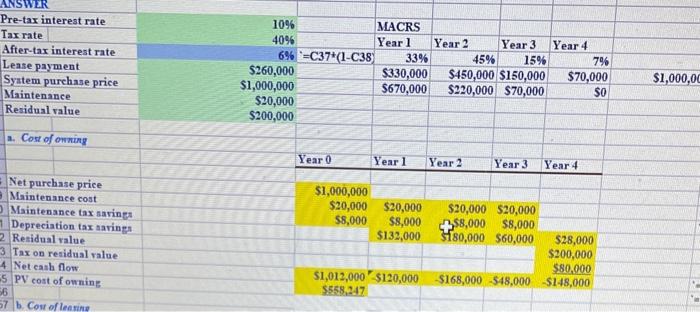

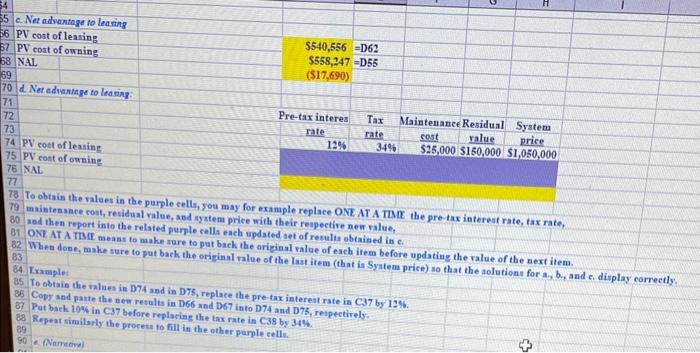

Bolden Health Syatem Inc. has decided to acquire a new electronic health record aystem for its Rio hospital. The system receives clinical data and other patient information from nursing units and other patient care areas, then either displays the information on a screen or stores it for later retrieval by physicians. The aystem also permits patients to call up their health record on Bolden's website. The equipment costs $1,000,000, and, if it were purchased, Bolden could obtain a term loan for the full purchase price at a 10 percent interest rate. Although the equipment has a six-year useful life, it is classified as a special-purpose computer, so it falls into the 4 MACRS three-year class. If the syatem were purchased, a four-year maintenance contract could be obtained at a cost of $20,000 per 15 year, payable at the beginning of each year. The equipment would be sold after four yeara, and the best estimate of its residual value at 16 that time is $200,000. Howerer, rince real-time display syatem technology is changing rapidly, the actual residual value is uncertain. As an alternative to the borrom-and-buy plan, the equipment manufacturer informed Bolden that Consolidated Leasing Center would be willing to write a four-year guideline lease on the equipment, including maintenance, for payments of $260,000 at the beginning of each year. Bolden's marginal federal-plus-state tax rate is 40 perceat. You have been asked to analyze the lease-veraus-purchase decision, and in the process to answer the following questionst a. What in the present ralue cost of owning the equipment? b. What is the present ralue cont of learing the equipment? c. What is the net advantage to leasing (NAL)? d. Answer apain the abore quentions one at a time to see the effect of the change on NAL. That is, atarting with the orizinal numbers you uted for queationn 3 , and b., what is the NAL if - pre-tax interest rate increases to 12 percent - the tax rate falle to 34 percent - maintenanee cost increases to 525,000 per year - retidual value falls to 5150,000 - the syatem prize increases to 51,050,000 ? 6. Do the changes in d. make leating more or less attractire? Explain. a. Cost of owning \begin{tabular}{lllll} Year 0 & Year 1 & Year 2 & Year 3 & Year 4 \\ \hline \end{tabular} Net purchase price Maintenance cost Maintenance tax saringa Depreciation tax aaring Retidual value Tax on residual value Net eash flow PV cost of owning b. Con of lenving 10 obtain the ralues in the purple celle, you anay for example replace ONE AT A TMI the pre-tax intereat rate, tax rate, maintenance cont, residual ralue, and aystem price with their respective new ralue, and then report into the related purple cells each updated set of resulta obtained in c. ONI. AT A TMAI means to make rure to put back the orizinal value of each item before updating the ralue of the next item. D2. Whrn done, make sure to put back the original ralue of the last item (that in Syatem price) so that the aolutions for a., b., and er dirplay correctly. H4 Ixample: 85 To obtain the values is D74 and in D75, replace the pre-tax interent rate is C37 by 1246 . 25 Copy and paste the new results in D66 and D67 into D74 and D75, retpectirely. 28 Repeat similarly the process to fill in the other purple celle. Bolden Health Syatem Inc. has decided to acquire a new electronic health record aystem for its Rio hospital. The system receives clinical data and other patient information from nursing units and other patient care areas, then either displays the information on a screen or stores it for later retrieval by physicians. The aystem also permits patients to call up their health record on Bolden's website. The equipment costs $1,000,000, and, if it were purchased, Bolden could obtain a term loan for the full purchase price at a 10 percent interest rate. Although the equipment has a six-year useful life, it is classified as a special-purpose computer, so it falls into the 4 MACRS three-year class. If the syatem were purchased, a four-year maintenance contract could be obtained at a cost of $20,000 per 15 year, payable at the beginning of each year. The equipment would be sold after four yeara, and the best estimate of its residual value at 16 that time is $200,000. Howerer, rince real-time display syatem technology is changing rapidly, the actual residual value is uncertain. As an alternative to the borrom-and-buy plan, the equipment manufacturer informed Bolden that Consolidated Leasing Center would be willing to write a four-year guideline lease on the equipment, including maintenance, for payments of $260,000 at the beginning of each year. Bolden's marginal federal-plus-state tax rate is 40 perceat. You have been asked to analyze the lease-veraus-purchase decision, and in the process to answer the following questionst a. What in the present ralue cost of owning the equipment? b. What is the present ralue cont of learing the equipment? c. What is the net advantage to leasing (NAL)? d. Answer apain the abore quentions one at a time to see the effect of the change on NAL. That is, atarting with the orizinal numbers you uted for queationn 3 , and b., what is the NAL if - pre-tax interest rate increases to 12 percent - the tax rate falle to 34 percent - maintenanee cost increases to 525,000 per year - retidual value falls to 5150,000 - the syatem prize increases to 51,050,000 ? 6. Do the changes in d. make leating more or less attractire? Explain. a. Cost of owning \begin{tabular}{lllll} Year 0 & Year 1 & Year 2 & Year 3 & Year 4 \\ \hline \end{tabular} Net purchase price Maintenance cost Maintenance tax saringa Depreciation tax aaring Retidual value Tax on residual value Net eash flow PV cost of owning b. Con of lenving 10 obtain the ralues in the purple celle, you anay for example replace ONE AT A TMI the pre-tax intereat rate, tax rate, maintenance cont, residual ralue, and aystem price with their respective new ralue, and then report into the related purple cells each updated set of resulta obtained in c. ONI. AT A TMAI means to make rure to put back the orizinal value of each item before updating the ralue of the next item. D2. Whrn done, make sure to put back the original ralue of the last item (that in Syatem price) so that the aolutions for a., b., and er dirplay correctly. H4 Ixample: 85 To obtain the values is D74 and in D75, replace the pre-tax interent rate is C37 by 1246 . 25 Copy and paste the new results in D66 and D67 into D74 and D75, retpectirely. 28 Repeat similarly the process to fill in the other purple celle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts