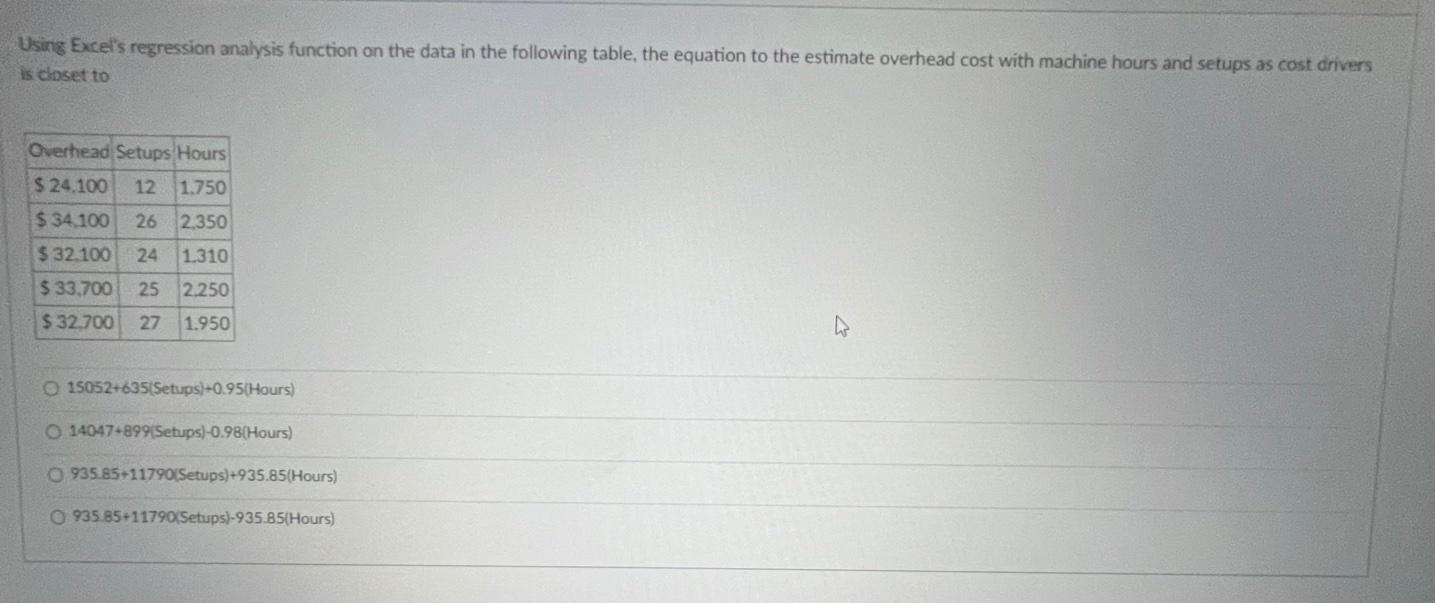

Question: Using Excel's regression analysis function on the data in the following table, the equation to the estimate overhead cost with machine hours and setups as

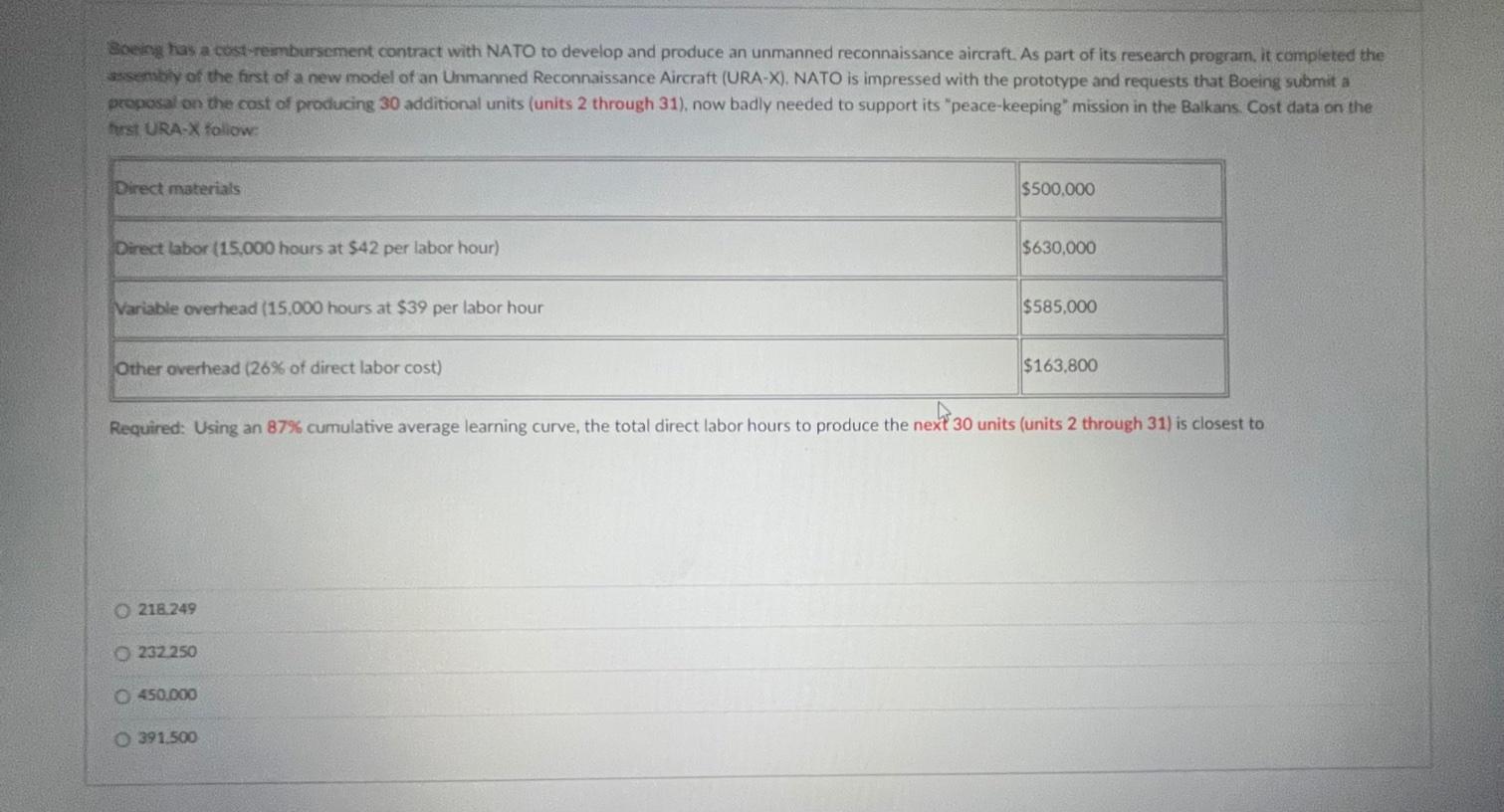

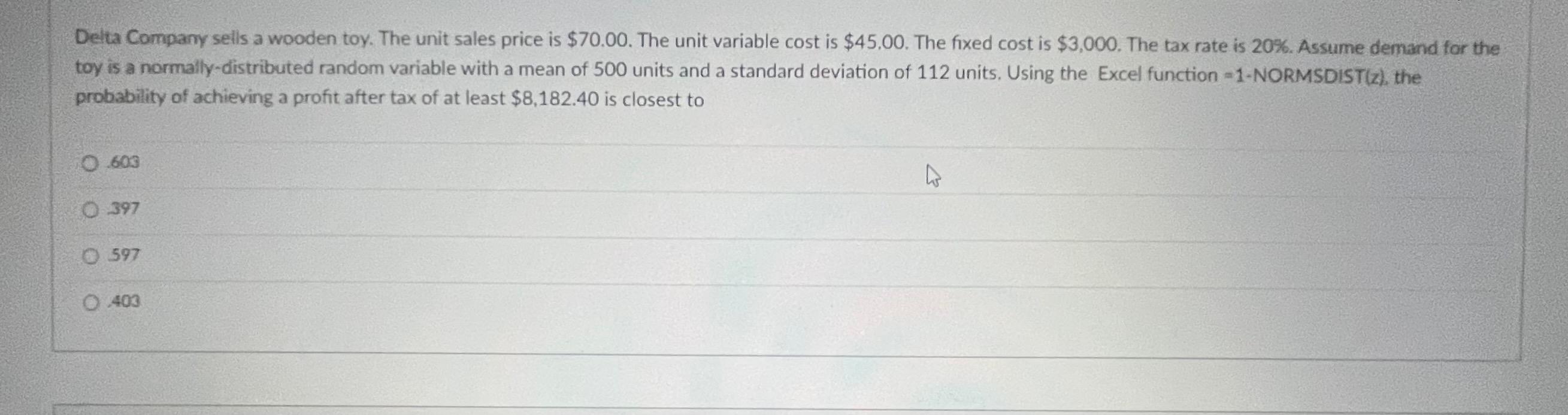

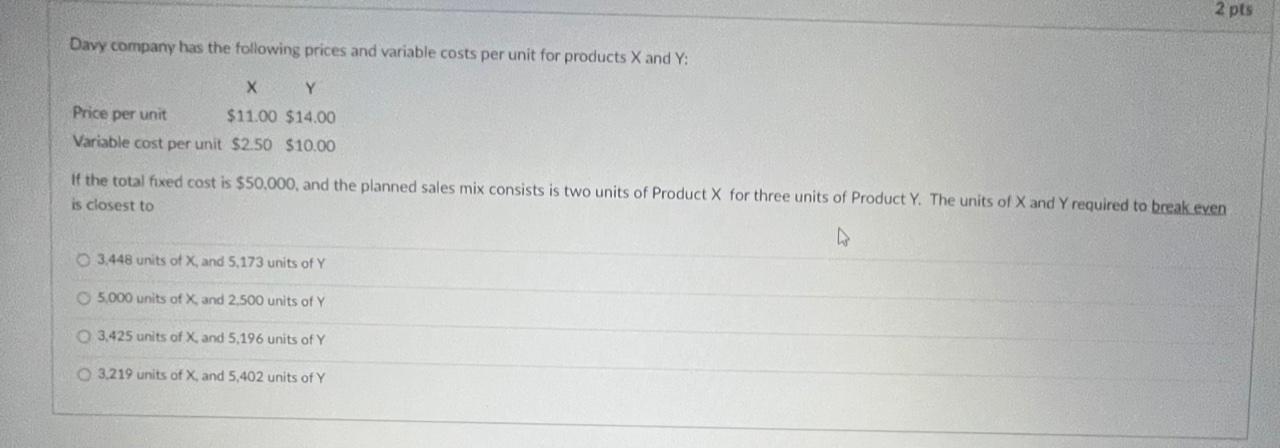

Using Excel's regression analysis function on the data in the following table, the equation to the estimate overhead cost with machine hours and setups as cost drivers is closet to Overhead Setups Hours $ 24.100 12. 1.750 $ 34 100 26 2.350 $32.100 24 1.310 25 2.250 $ 33.700 $32.700 27 1.950 w O 15052-635[Setups)+0.95(Hours) O 14047-8991Setups)-0.98 Hours) 935.85+11790 Setups)+935.85(Hours) 935 85+11790(Setups)-935.85(Hours) Boeing has a cost-reimbursement contract with NATO to develop and produce an unmanned reconnaissance aircraft. As part of its research program. it completed the assembly of the first of a new model of an Unmanned Reconnaissance Aircraft (URA-X). NATO is impressed with the prototype and requests that Boeing submit a proposal on the cost of producing 30 additional units (units 2 through 31). now badly needed to support its "peace-keeping" mission in the Balkans. Cost data on the burst URA-X follow: Direct materials $500.000 Direct labor (15.000 hours at $42 per labor hour) $630,000 Variable overhead (15.000 hours at $39 per labor hour $585,000 Other overhead (26% of direct labor cost) $163,800 Required: Using an 87% cumulative average learning curve, the total direct labor hours to produce the next 30 units (units 2 through 31) is closest to 218.249 232250 0 450.000 0 391.500 Delta Company sells a wooden toy. The unit sales price is $70.00. The unit variable cost is $45.00. The fixed cost is $3,000. The tax rate is 20%. Assume demand for the toy is a normally-distributed random variable with a mean of 500 units and a standard deviation of 112 units. Using the Excel function =1-NORMSDIST(z), the probability of achieving a profit after tax of at least $8,182.40 is closest to O 603 0 397 0 597 403 2 pts Davy company has the following prices and variable costs per unit for products X and Y: X Y Price per unit $11.00 $14.00 Variable cost per unit $2.50 $10.00 If the total fixed cost is $50.000, and the planned sales mix consists is two units of Product X for three units of Product Y. The units of X and Y required to break even is closest to 3,448 units of X and 5.173 units of Y 5.000 units of X, and 2.500 units of Y 3,425 units of X and 5,196 units of Y 3.219 units of X, and 5,402 units of Y Using Excel's regression analysis function on the data in the following table, the equation to the estimate overhead cost with machine hours and setups as cost drivers is closet to Overhead Setups Hours $ 24.100 12. 1.750 $ 34 100 26 2.350 $32.100 24 1.310 25 2.250 $ 33.700 $32.700 27 1.950 w O 15052-635[Setups)+0.95(Hours) O 14047-8991Setups)-0.98 Hours) 935.85+11790 Setups)+935.85(Hours) 935 85+11790(Setups)-935.85(Hours) Boeing has a cost-reimbursement contract with NATO to develop and produce an unmanned reconnaissance aircraft. As part of its research program. it completed the assembly of the first of a new model of an Unmanned Reconnaissance Aircraft (URA-X). NATO is impressed with the prototype and requests that Boeing submit a proposal on the cost of producing 30 additional units (units 2 through 31). now badly needed to support its "peace-keeping" mission in the Balkans. Cost data on the burst URA-X follow: Direct materials $500.000 Direct labor (15.000 hours at $42 per labor hour) $630,000 Variable overhead (15.000 hours at $39 per labor hour $585,000 Other overhead (26% of direct labor cost) $163,800 Required: Using an 87% cumulative average learning curve, the total direct labor hours to produce the next 30 units (units 2 through 31) is closest to 218.249 232250 0 450.000 0 391.500 Delta Company sells a wooden toy. The unit sales price is $70.00. The unit variable cost is $45.00. The fixed cost is $3,000. The tax rate is 20%. Assume demand for the toy is a normally-distributed random variable with a mean of 500 units and a standard deviation of 112 units. Using the Excel function =1-NORMSDIST(z), the probability of achieving a profit after tax of at least $8,182.40 is closest to O 603 0 397 0 597 403 2 pts Davy company has the following prices and variable costs per unit for products X and Y: X Y Price per unit $11.00 $14.00 Variable cost per unit $2.50 $10.00 If the total fixed cost is $50.000, and the planned sales mix consists is two units of Product X for three units of Product Y. The units of X and Y required to break even is closest to 3,448 units of X and 5.173 units of Y 5.000 units of X, and 2.500 units of Y 3,425 units of X and 5,196 units of Y 3.219 units of X, and 5,402 units of Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts