Question: USING FIFO METHOD-could you help me with the ones that are incorrect please? Eire Products is a specialty lubricants company. The Lake Plant produces a

USING FIFO METHOD-could you help me with the ones that are incorrect please?

Eire Products is a specialty lubricants company. The Lake Plant produces a single product in three departments: Filtering, Blending, and Packaging. Additional materials are added in the Blending Process when units are 50 to 55 percent complete with respect to conversion. Information for operations in June in the Blending process appear as follows.

Work in process on June 1 consisted of 9,200 barrels with the following costs.

| Amount | Degree of Completion | |||||

| Filtering costs transferred in | $ | 10,600 | 100 | % | ||

| Costs added in Blending | ||||||

| Direct materials | $ | 0 | 0 | % | ||

| Conversion costs | 18,500 | 30 | % | |||

| $ | 18,500 | |||||

| Work in process June 1 | $ | 29,100 | ||||

During June, 117,000 barrels were transferred in from Filtering at a cost of $154,440. The following costs were added in Blending in June.

| Direct materials | $ | 393,744 | |

| Conversion costs | 549,056 | ||

| Total costs added | $ | 942,800 | |

Blending finished 116,000 barrels in June and transferred them to Packaging. At the end of June, there were 10,200 barrels in work in process inventory. The units were 60 percent complete with respect to conversion costs.

The Blending Department uses the FIFO method of process costing. The Filtering Department at Eire uses the weighted-average method of process costing. The cost analyst in Blending has learned that if the Filtering Department at Eire had used the FIFO method, the amount of costs transferred in from Filtering would have been $12,000 in the beginning work in process and $152,000 for the amount transferred in this month.

Required:

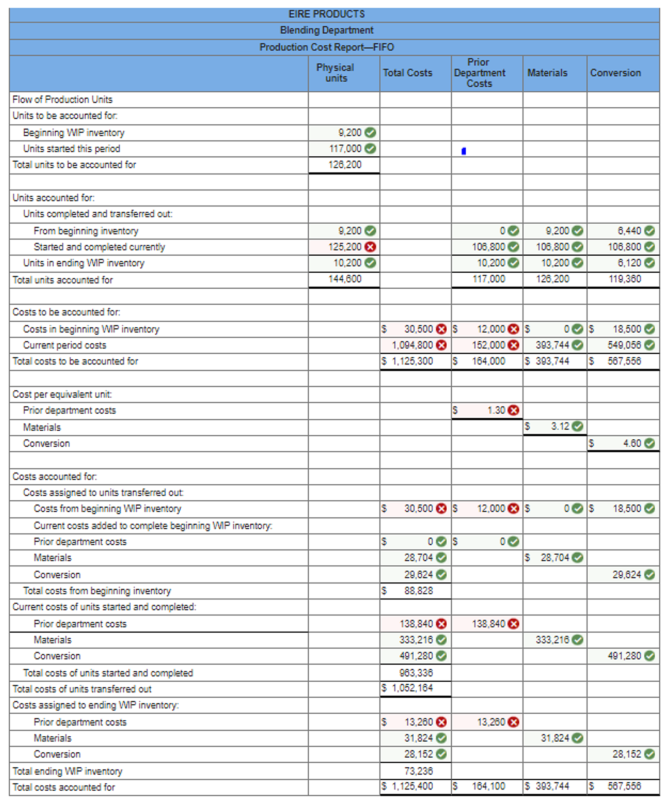

Prepare a production cost report for June for the Blending Department. (Round "Cost per equivalent unit" to 2 decimal places.)

EIRE PRODUCTS Blending Department Production Cost Report-FIFO Physical units Total Costs Prior Department Costs Materials Conversion Flow of Production Units Units to be accounted for Beginning WP inventory Units started this period Total units to be accounted for 9.200 117.000 126.200 Units accounted for: Units completed and transferred out: From beginning inventory Started and completed currently Units in ending WIP inventory Total units accounted for 9.200 125.200 10.200 144,600 0 108.800 10.200 117,000 9.200 108.800 10,200 128,200 6.440 106,800 6,120 119,360 Costs to be accounted for: Costs in beginning WIP inventory Current period costs Total costs to be accounted for $ 30,500 $ 12,000 $ os 18,500 1,094,800 152,000 393.744 549,058 $ 1,125,300 $164,000 $ 393.744 $ 587,558 S 1.30 Cost per equivalent unit Prior department costs Materials Conversion $ 3.12 4.60 $ 30,500 $ 12.000 $ 05 18,500 $ 0 $ 28.704 0$ 28,704 29,624 88,828 29,624 $ 138,840 Costs accounted for Costs assigned to units transferred out Costs from beginning WIP inventory Current costs added to complete beginning WIP inventory Prior department costs Materials Conversion Total costs from beginning inventory Current costs of units started and completed: Prior department costs Materials Conversion Total costs of units started and completed Total costs of units transferred out Costs assigned to ending WP inventory Prior department costs Materials Conversion Total ending WP inventory Total costs accounted for 333.216 138.840 % 333216 491,280 963,336 $ 1,052,164 491.280 13.280 31,824 $ 13.2603 31,824 28,152 73.236 $ 1,125,400 S 28,152 184,100 $ 393.744 $ 587,558

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts