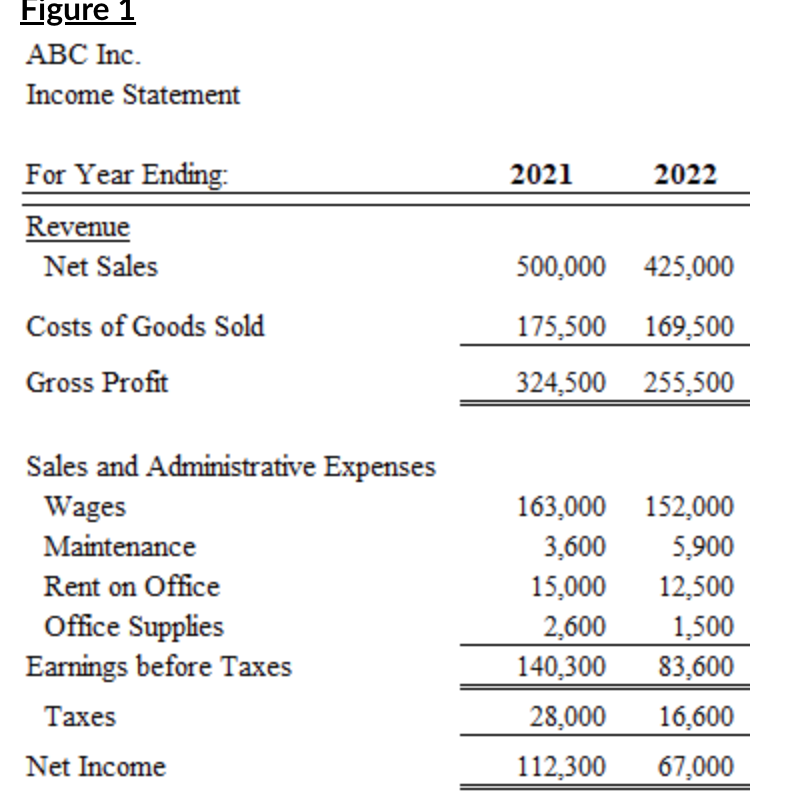

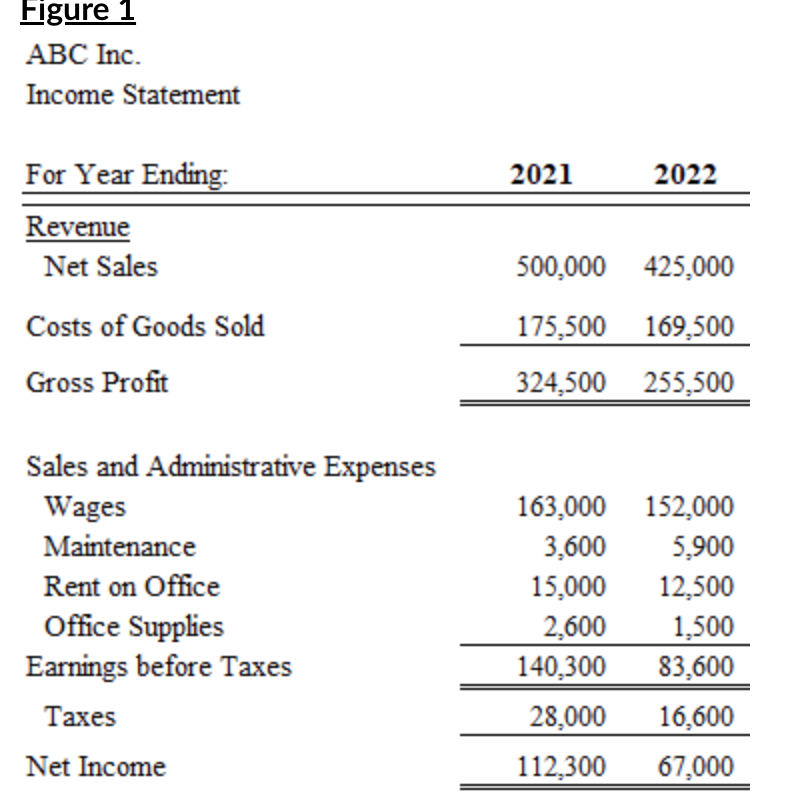

Question: Using Figure 1 , suppose that ABC Inc. changed its method of recognizing revenue in 2022 which accounted for nearly the entire fall in net

Using Figure 1, suppose that ABC Inc. changed its method of recognizing revenue in 2022 which accounted for nearly the entire fall in net sales. Which statement do you agree with?

Using Figure 1, suppose that ABC Inc. changed its method of recognizing revenue in 2022 which accounted for nearly the entire fall in net sales. Which statement do you agree with?

This is immaterial since sales is sales. If sales fall, this means the firm is doing worse.

Using horizontal analysis allows the user to adjust for changes in accounting approaches.

This change may be material and requires additional analysis beyond this simple approach.

This does not matter since this firm is paying less in taxes which is always the goal of any firm.

Figure 1 ABC Inc. Income Statement For Year Ending: 20212022 \begin{tabular}{lrr} \hline Revenue & & \\ \hline Net Sales & 500,000 & 425,000 \\ Costs of Goods Sold & 175,500 & 169,500 \\ \cline { 2 - 3 } Gross Profit & 324,500 & 255,500 \\ \hline \hline \end{tabular} Sales and Administrative Expenses \begin{tabular}{lrr} Wages & 163,000 & 152,000 \\ Maintenance & 3,600 & 5,900 \\ Rent on Office & 15,000 & 12,500 \\ Office Supplies & 2,600 & 1,500 \\ Earnings before Taxes & 140,300 & 83,600 \\ \hline Taxes & 28,000 & 16,600 \\ \hline Net Income & 112,300 & 67,000 \\ \hline \hline \end{tabular} Figure 1 ABC Inc. Income Statement For Year Ending: 20212022 \begin{tabular}{lrr} \hline Revenue & & \\ \hline Net Sales & 500,000 & 425,000 \\ Costs of Goods Sold & 175,500 & 169,500 \\ \cline { 2 - 3 } Gross Profit & 324,500 & 255,500 \\ \hline \hline \end{tabular} Sales and Administrative Expenses \begin{tabular}{lrr} Wages & 163,000 & 152,000 \\ Maintenance & 3,600 & 5,900 \\ Rent on Office & 15,000 & 12,500 \\ Office Supplies & 2,600 & 1,500 \\ Earnings before Taxes & 140,300 & 83,600 \\ \hline Taxes & 28,000 & 16,600 \\ \hline Net Income & 112,300 & 67,000 \\ \hline \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts