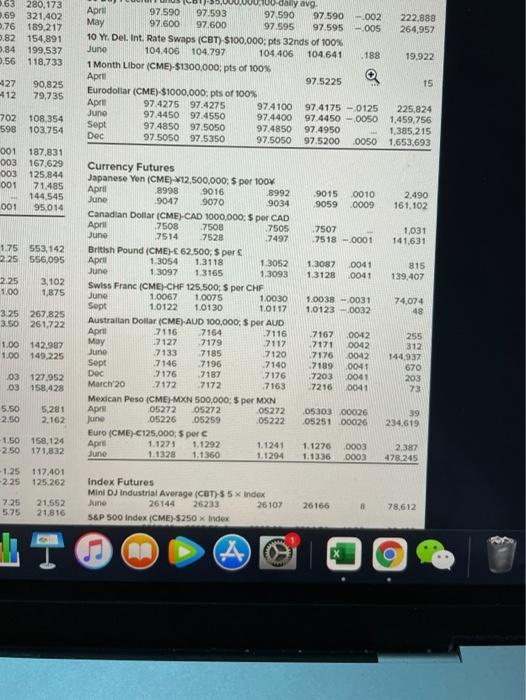

Question: Using Figure 14.1: a. What is the total open interest on the March 2020 Australian dollar contract? b. Does it represent long positions, short positions,

Using Figure 14.1:

a. What is the total open interest on the March 2020 Australian dollar contract?

b. Does it represent long positions, short positions, or both?

multiple choice

- Long positions

- Short positions

- Both

c. Based on the settle price on the contract, what is the dollar value of the open interest? (Do not round intermediate calculations. Round your answer to the nearest whole dollar.)

SCRIT SUOMI Suoma Using Eigure 141 1 1 a. What is the total open interest on the March 2020 Australian dollar contract? Number of open interest contracts 8 00 5400 b. Does it represent long positions, short positions, or both? O Long positions Short positions Both c. Based on the settle price on the contract, what is the dollar value of the open interest? (Do not round Intermediate calculations. Round your answer to the nearest whole dollar.) Dollar value Mc Graw 0.63 280,173 9.69 321.402 0.76 189.217 0.82 154,891 0.84 199,537 0.56 118,733 100.gally avg April 97 590 97.593 97.590 97.590-002 222,888 May 97.600 97.600 97.595 97.595 005 264,957 10 Y. Del. Int. Rate Swaps (CBT) $100,000; pts 32nds of 100% Juno 104.406 104.797 104 406 104,641 188 19,922 1 Month Libor (CME)-$1300,000, pts of 100% April 97.5225 15 Eurodollar (CME) $1000,000: pts of 100% Apre 97.4275 97.4275 97.4 100 97.4175 - 0125 225,824 June 97.445097.4550 97.4400 97.4450-0050 1,459,756 Sept 97.4850 97,5050 97.4850 97.4950 1.385,215 Dec 97.5050 97.5350 97.5050 97.5200 .0050 1.653,693 427 412 90,825 79,735 702 598 108.354 103.754 001 003 003 001 187,831 167.629 125.844 71.485 144.545 95014 June 9015 9059 0010 .0009 2.490 161,102 001 .7507 7518 - 0001 1,031 141,631 1.75 553,142 2.25 556,095 1.3087 13128 0041 .0041 815 139,407 2.25 1.00 3,102 1.875 June Currency Futures Japanese Yen (CME) 12.500,000: per 100% April 8998 9016 8992 9047 9070 9034 Canadian Dollar (CME) CAD 1000,000; per CAD Aprill 7508 7508 7505 June 7514 7528 7497 British Pound (CME)- 62.500, 5 perc April 1 3054 1.3118 1.3052 June 1.3097 1 3165 1.3093 Swiss Franc (CME-CHF 125.500, S per CHF 1.0067 10075 1.0030 Sept 1.0122 1.0130 1.0117 Australian Dollar (CME) AUD 100,000 $ per AUD April 7116 7164 7116 May 7127 7179 7117 June 7133 7185 7120 Sept 7146 7196 7140 Doc 7176 7187 7176 March 20 7172 7172 7163 Mexican Peso (CME-MXN 500,000; 5 per MXN Apr 05272 05272 05272 June 05226 05259 05222 Euro (CME) C125,000; 5 perc Apr 1.1271 1.1292 1.1241 June 1.1328 1.1360 1.1294 1.0038 - 0031 1.0123 - 0032 74.074 48 3.25 267.825 3.50 261.722 1.00 142.907 1.00 149.225 7167 7171 17176 7189 7203 7216 0042 0042 0042 0041 0041 10041 255 312 144,937 670 203 73 03 127.952 03 158,428 5.50 -2.50 5.281 2.162 05303 00026 05251 00026 39 234.619 -1.50 158,124 -2.50 171,832 1.1276 1.1336 0003 0003 2.387 478 245 -1.25 117,401 -2.25 125.262 7.25 575 21.552 21.816 Index Futures Mini DJ Industrial Average (CBT) $ 5 x index June 26144 26233 26107 S&P 500 Index (CME)-$250 x Index 26166 8 78,612 AN SCRIT SUOMI Suoma Using Eigure 141 1 1 a. What is the total open interest on the March 2020 Australian dollar contract? Number of open interest contracts 8 00 5400 b. Does it represent long positions, short positions, or both? O Long positions Short positions Both c. Based on the settle price on the contract, what is the dollar value of the open interest? (Do not round Intermediate calculations. Round your answer to the nearest whole dollar.) Dollar value Mc Graw 0.63 280,173 9.69 321.402 0.76 189.217 0.82 154,891 0.84 199,537 0.56 118,733 100.gally avg April 97 590 97.593 97.590 97.590-002 222,888 May 97.600 97.600 97.595 97.595 005 264,957 10 Y. Del. Int. Rate Swaps (CBT) $100,000; pts 32nds of 100% Juno 104.406 104.797 104 406 104,641 188 19,922 1 Month Libor (CME)-$1300,000, pts of 100% April 97.5225 15 Eurodollar (CME) $1000,000: pts of 100% Apre 97.4275 97.4275 97.4 100 97.4175 - 0125 225,824 June 97.445097.4550 97.4400 97.4450-0050 1,459,756 Sept 97.4850 97,5050 97.4850 97.4950 1.385,215 Dec 97.5050 97.5350 97.5050 97.5200 .0050 1.653,693 427 412 90,825 79,735 702 598 108.354 103.754 001 003 003 001 187,831 167.629 125.844 71.485 144.545 95014 June 9015 9059 0010 .0009 2.490 161,102 001 .7507 7518 - 0001 1,031 141,631 1.75 553,142 2.25 556,095 1.3087 13128 0041 .0041 815 139,407 2.25 1.00 3,102 1.875 June Currency Futures Japanese Yen (CME) 12.500,000: per 100% April 8998 9016 8992 9047 9070 9034 Canadian Dollar (CME) CAD 1000,000; per CAD Aprill 7508 7508 7505 June 7514 7528 7497 British Pound (CME)- 62.500, 5 perc April 1 3054 1.3118 1.3052 June 1.3097 1 3165 1.3093 Swiss Franc (CME-CHF 125.500, S per CHF 1.0067 10075 1.0030 Sept 1.0122 1.0130 1.0117 Australian Dollar (CME) AUD 100,000 $ per AUD April 7116 7164 7116 May 7127 7179 7117 June 7133 7185 7120 Sept 7146 7196 7140 Doc 7176 7187 7176 March 20 7172 7172 7163 Mexican Peso (CME-MXN 500,000; 5 per MXN Apr 05272 05272 05272 June 05226 05259 05222 Euro (CME) C125,000; 5 perc Apr 1.1271 1.1292 1.1241 June 1.1328 1.1360 1.1294 1.0038 - 0031 1.0123 - 0032 74.074 48 3.25 267.825 3.50 261.722 1.00 142.907 1.00 149.225 7167 7171 17176 7189 7203 7216 0042 0042 0042 0041 0041 10041 255 312 144,937 670 203 73 03 127.952 03 158,428 5.50 -2.50 5.281 2.162 05303 00026 05251 00026 39 234.619 -1.50 158,124 -2.50 171,832 1.1276 1.1336 0003 0003 2.387 478 245 -1.25 117,401 -2.25 125.262 7.25 575 21.552 21.816 Index Futures Mini DJ Industrial Average (CBT) $ 5 x index June 26144 26233 26107 S&P 500 Index (CME)-$250 x Index 26166 8 78,612 AN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts