Question: Using Figure 14.1, answer the following questions: a. What was the settle price for March 2016 corn futures on this date? What is the total

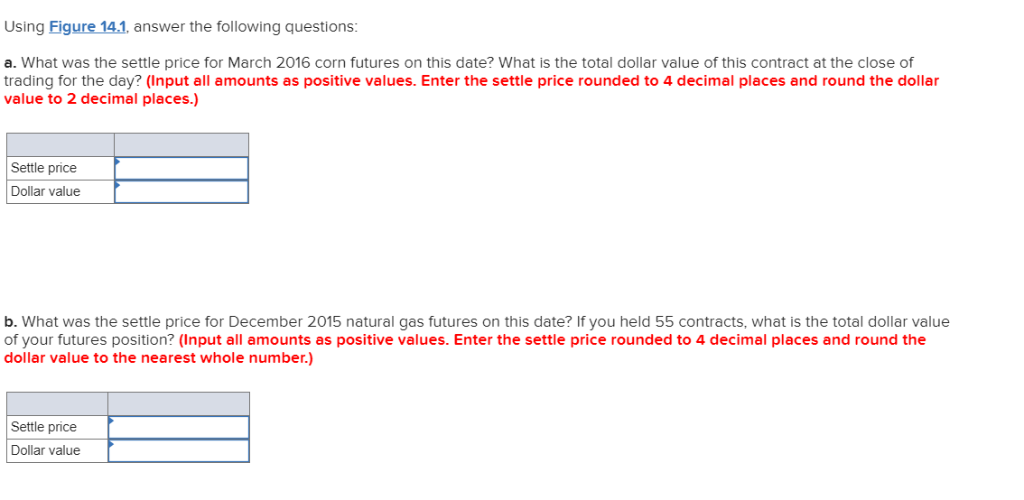

Using Figure 14.1, answer the following questions: a. What was the settle price for March 2016 corn futures on this date? What is the total dollar value of this contract at the close of trading for the day? (Input all amounts as positive values. Enter the settle price rounded to 4 decimal places and round the dollar value to 2 decimal places.) Settle price Dollar value b. What was the settle price for December 2015 natural gas futures on this date? If you held 55 contracts, what is the total dollar value of your futures position? (Input all amounts as positive values. Enter the settle price rounded to 4 decimal places and round the dollar value to the nearest whole number.) Settle price Dollar value c.Suppose you held a long position of 45 March 2016 mini Dow Jones Industrial Average futures on this day. What is the change in the total dollar value of your position for this day's trading? (A negative value should be indicated by a minus sign.) Dollar value d. Suppose you are short 60 January 2016 soybean oil futures contracts. Would you have made a profit or a loss on this day? O Profit O Loss Using Figure 14.1, answer the following questions: a. What was the settle price for March 2016 corn futures on this date? What is the total dollar value of this contract at the close of trading for the day? (Input all amounts as positive values. Enter the settle price rounded to 4 decimal places and round the dollar value to 2 decimal places.) Settle price Dollar value b. What was the settle price for December 2015 natural gas futures on this date? If you held 55 contracts, what is the total dollar value of your futures position? (Input all amounts as positive values. Enter the settle price rounded to 4 decimal places and round the dollar value to the nearest whole number.) Settle price Dollar value c.Suppose you held a long position of 45 March 2016 mini Dow Jones Industrial Average futures on this day. What is the change in the total dollar value of your position for this day's trading? (A negative value should be indicated by a minus sign.) Dollar value d. Suppose you are short 60 January 2016 soybean oil futures contracts. Would you have made a profit or a loss on this day? O Profit O Loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts