Question: A manufacturer sells trophies for winners of athletic and other events. Its manufacturing plant has the capacity to produce 11,000 trophies each month; current

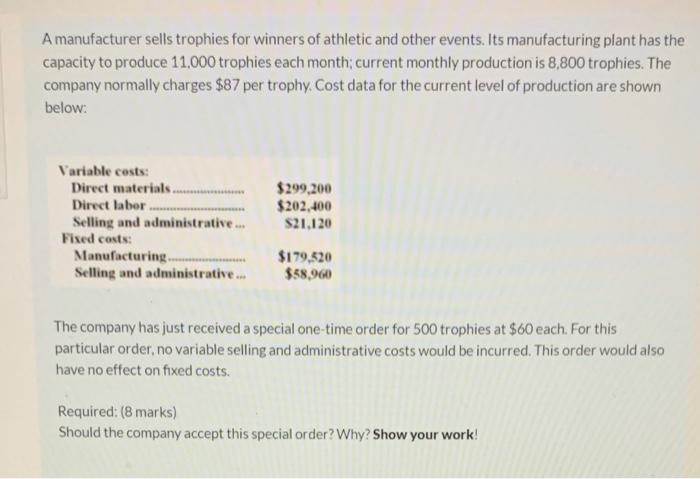

A manufacturer sells trophies for winners of athletic and other events. Its manufacturing plant has the capacity to produce 11,000 trophies each month; current monthly production is 8,800 trophies. The company normally charges $87 per trophy. Cost data for the current level of production are shown below: Variable costs: Direct materials. Direct labor. Selling and administrative... Fixed costs: Manufacturing..... Selling and administrative... ********** $299,200 $202,400 $21,120 $179,520 $58,960 The company has just received a special one-time order for 500 trophies at $60 each. For this particular order, no variable selling and administrative costs would be incurred. This order would also have no effect on fixed costs. Required: (8 marks) Should the company accept this special order? Why? Show your work!

Step by Step Solution

There are 3 Steps involved in it

Without special order with special order incremental ana... View full answer

Get step-by-step solutions from verified subject matter experts