Question: using financial calculator SECTION B (12 points) ABTS Co Ltd is considering the purchase of a new machine. Two alternative machines (A and B) have

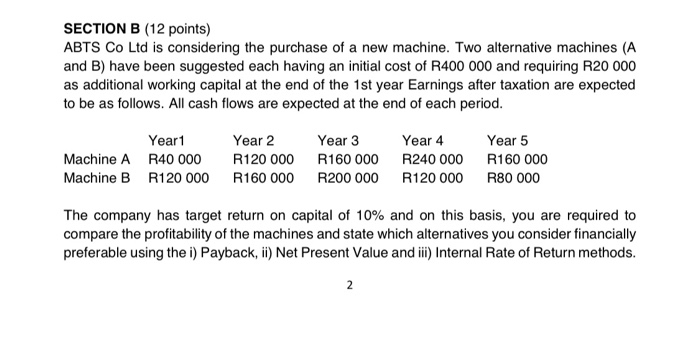

SECTION B (12 points) ABTS Co Ltd is considering the purchase of a new machine. Two alternative machines (A and B) have been suggested each having an initial cost of R400 000 and requiring R20 000 as additional working capital at the end of the 1st year Earnings after taxation are expected to be as follows. All cash flows are expected at the end of each period. Year 1 Year 2 Year 3 Year 4 Year 5 Machine A R40 000 R120 000 R160 000 R240 000 R160 000 Machine B R120 000 R160 000 R200 000 R120 000 R80 000 The company has target return on capital of 10% and on this basis, you are required to compare the profitability of the machines and state which alternatives you consider financially preferable using the i) Payback, i) Net Present Value and iii) Internal Rate of Return methods. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts