Question: Using financial calculator, write down steps or reasoning behind: Question Completion Status: 10 points Saved QUESTION 1 Consider an annual coupon bond with a $1000

Using financial calculator, write down steps or reasoning behind:

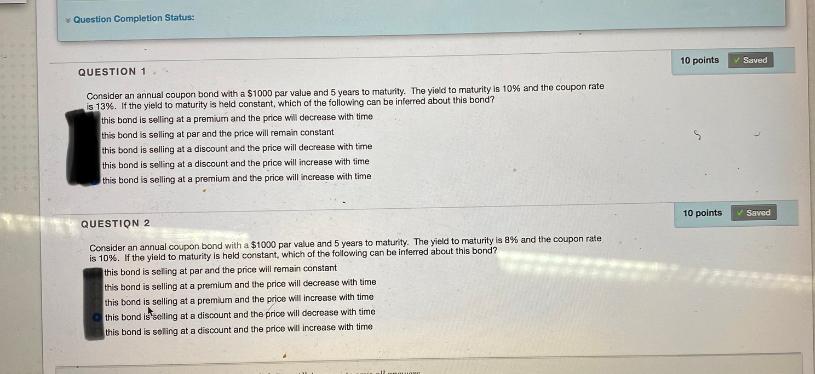

Question Completion Status: 10 points Saved QUESTION 1 Consider an annual coupon bond with a $1000 par value and 5 years to maturity. The yield to maturity is 10% and the coupon rate is 13%. If the yield to maturity is held constant, which of the following can be inferred about this bond? this bond is selling at a premium and the price will decrease with time this bond is selling at par and the price will remain constant this bond is selling at a discount and the price will decrease with time this bond is selling at a discount and the price will increase with time this bond is selling at a premium and the price will increase with time 5 10 points Saved QUESTION 2 Consider an annual coupon bond with a $1000 par value and 5 years to maturity. The yield to maturity is 8% and the coupon rate is 10%. If the yield to maturity is held constant, which of the following can be inferred about this bond? this bond is selling at par and the price will remain constant this band is selling at a premium and the price will decrease with time this bond is selling at a premium and the price will increase with time this bond is selling at a discount and the price will decrease with time this bond is selling at a discount and the price will increase with time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts