Question: Using his margin account, which has interest compounding monthly, and borrowing the maximum 50% allowed, Warren sells short $3,000 of a common stock that pays

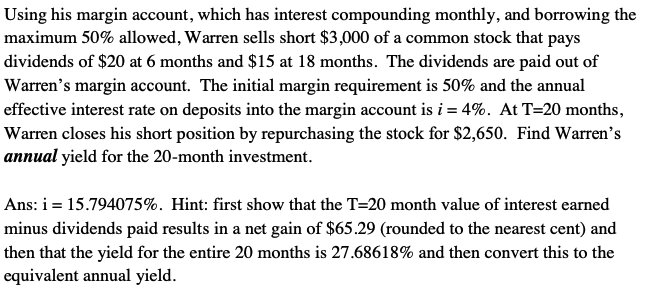

Using his margin account, which has interest compounding monthly, and borrowing the maximum 50% allowed, Warren sells short $3,000 of a common stock that pays dividends of $20 at 6 months and $15 at 18 months. The dividends are paid out of Warren's margin account. The initial margin requirement is 50% and the annual effective interest rate on deposits into the margin account is i=4%. At T=20 months, Warren closes his short position by repurchasing the stock for $2,650. Find Warren's annual yield for the 20 -month investment. Ans: i=15.794075%. Hint: first show that the T=20 month value of interest earned minus dividends paid results in a net gain of $65.29 (rounded to the nearest cent) and then that the yield for the entire 20 months is 27.68618% and then convert this to the equivalent annual yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts