Question: Using implied forward rates, estimate the yield curve one-year from the present (rates on one-year, two-year, three-year, and four-year bonds). If you bought the three-year

Using implied forward rates, estimate the yield curve one-year from the present (rates on one-year, two-year, three-year, and four-year bonds).

If you bought the three-year bond and held it for one year, what would your expected rate of return be if your calculations were based on implied forward rates?

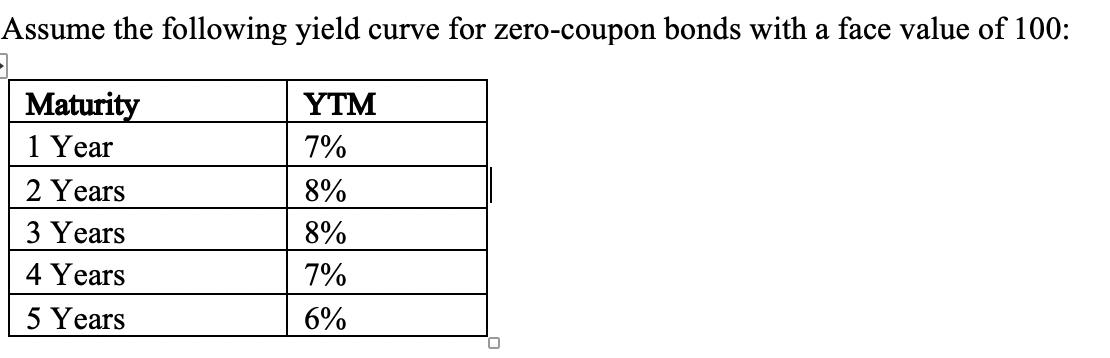

Assume the following yield curve for zero-coupon bonds with a face value of 100: Maturity 1 Year 2 Years 3 Years 4 Years 5 Years YTM 7% 8% 8% 7% 6%

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

3Year Bond Yield 8 ... View full answer

Get step-by-step solutions from verified subject matter experts