Question: using info in image from text answer In what circumstances is a local government subject to the single audit requirement? Single Audit Requirement for Recipients

using info in image from text answer "In what circumstances is a local government subject to the single audit requirement?

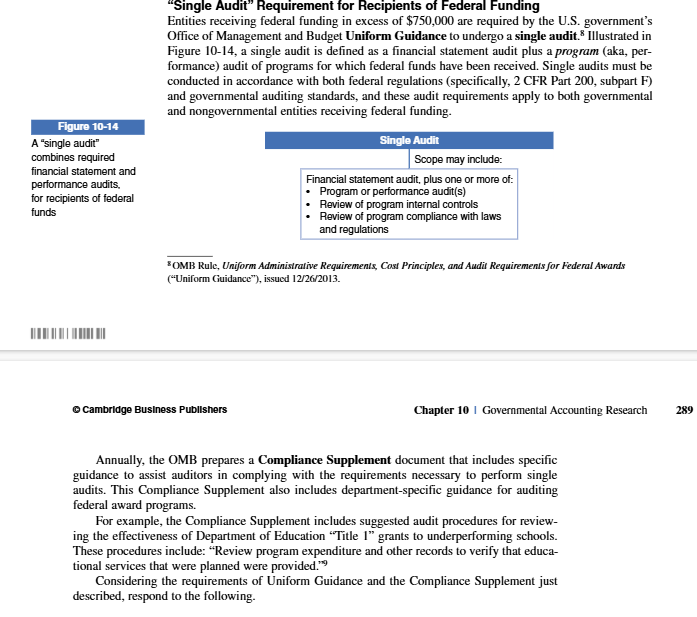

"Single Audit" Requirement for Recipients of Federal Funding Entities receiving federal funding in excess of $750,000 are required by the U.S. government's Office of Management and Budget Uniform Guidance to undergo a single audit.* Illustrated in Figure 10-14, a single audit is defined as a financial statement audit plus a program (aka, per- formance) audit of programs for which federal funds have been received. Single audits must be conducted in accordance with both federal regulations (specifically, 2 CFR Part 200, subpart F) and governmental auditing standards, and these audit requirements apply to both governmental and nongovernmental entities receiving federal funding. Figure 10-14 A "single audit" Single Audit combines required Scope may include: financial statement and performance audits. Financial statement audit, plus one or more of: for recipients of federal Program or performance audit(s) Review of program internal controls funds Review of program compliance with laws and regulations BOMB Rule, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards ("Uniform Guidance"), issued 12/26/2013. @Cambridge Business Publishers Chapter 10 | Governmental Accounting Research 289 Annually, the OMB prepares a Compliance Supplement document that includes specific guidance to assist auditors in complying with the requirements necessary to perform single audits. This Compliance Supplement also includes department-specific guidance for auditing federal award programs. For example, the Compliance Supplement includes suggested audit procedures for review- ing the effectiveness of Department of Education "Title 1" grants to underperforming schools. These procedures include: "Review program expenditure and other records to verify that educa- tional services that were planned were provided." Considering the requirements of Uniform Guidance and the Compliance Supplement just described, respond to the following

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts