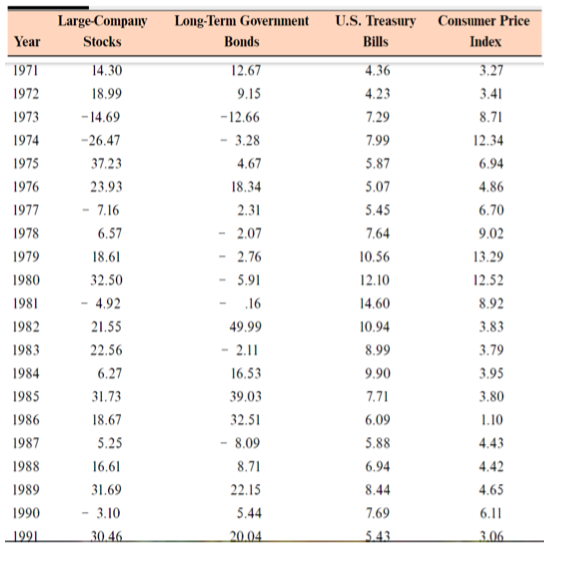

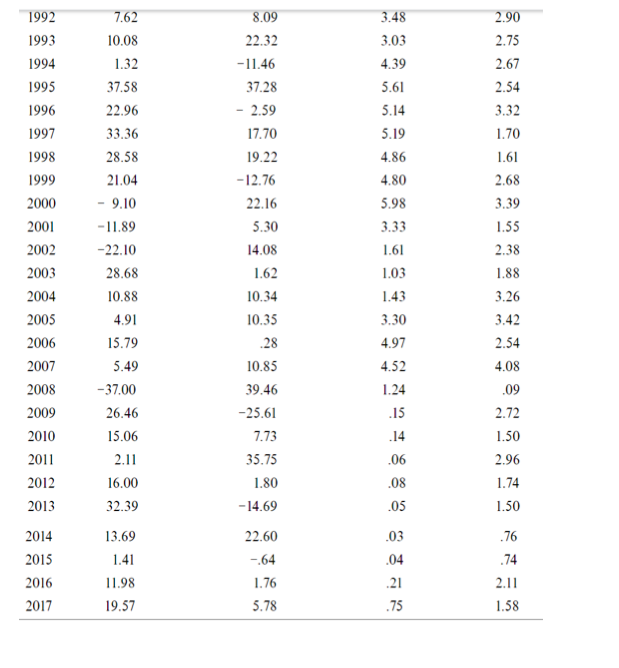

Question: Using information for the above problem suppose the average inflation rate over this. Was three point 1% and the average T bill rate over the

Using information for the above problem suppose the average inflation rate over this. Was three point 1% and the average T bill rate over the period was four point 1% .

-

what was the average real return on the stock?

what was the average nominal risk premium on the stock?

what was the average nominal risk premium on the stock?

Long-Term Government Bonds U.S. Treasury Bills Consumer Price Index Year 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 Large-Company Stocks 14.30 18.99 - 14.69 -26.47 37.23 23.93 - 7.16 6.57 18.61 32.50 - 4.92 21.55 22.56 12.67 9.15 -12.66 3.28 4.67 18.34 2.31 2.07 2.76 5.91 .16 49.99 - 2.11 16.53 39.03 32.51 - 8.09 8.71 22.15 5.44 4.36 4.23 7.29 7.99 5.87 5.07 5.45 7.64 10.56 12.10 14.60 10.94 8.99 9.90 7.71 6.09 5.88 6.94 8.44 7.69 5.43 3.27 3.41 8.71 12.34 6.94 4.86 6.70 9.02 13.29 12.52 8.92 3.83 3.79 3.95 3.80 1.10 4.43 4.42 6.27 31.73 18.67 5.25 16.61 31.69 3.10 4.65 6.11 3.06 30.46 20.04 8.09 22.32 -11.46 37.28 - 2.59 17.70 19.22 -12.76 22.16 5.30 14.08 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 7.62 10.08 1.32 37.58 22.96 33.36 28.58 21.04 - 9.10 -11.89 -22.10 28.68 10.88 4.91 15.79 5.49 - 37.00 26.46 15.06 2.11 16.00 32.39 3.48 3.03 4.39 5.61 5.14 5.19 4.86 4.80 5.98 3.33 1.61 1.03 1.43 3.30 2.90 2.75 2.67 2.54 3.32 1.70 1.61 2.68 3.39 1.55 2.38 1.88 3.26 3.42 2.54 4.08 .09 2.72 1.50 2.96 1.74 1.50 1.62 10.34 10.35 .28 4.97 10.85 39.46 -25.61 7.73 35.75 1.80 - 14.69 4.52 1.24 .15 .14 .06 .08 .05 2014 2015 2016 2017 13.69 1.41 11.98 19.57 22.60 -.64 1.76 5.78 .03 .04 .21 .75 .76 .74 2.11 1.58 Long-Term Government Bonds U.S. Treasury Bills Consumer Price Index Year 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 Large-Company Stocks 14.30 18.99 - 14.69 -26.47 37.23 23.93 - 7.16 6.57 18.61 32.50 - 4.92 21.55 22.56 12.67 9.15 -12.66 3.28 4.67 18.34 2.31 2.07 2.76 5.91 .16 49.99 - 2.11 16.53 39.03 32.51 - 8.09 8.71 22.15 5.44 4.36 4.23 7.29 7.99 5.87 5.07 5.45 7.64 10.56 12.10 14.60 10.94 8.99 9.90 7.71 6.09 5.88 6.94 8.44 7.69 5.43 3.27 3.41 8.71 12.34 6.94 4.86 6.70 9.02 13.29 12.52 8.92 3.83 3.79 3.95 3.80 1.10 4.43 4.42 6.27 31.73 18.67 5.25 16.61 31.69 3.10 4.65 6.11 3.06 30.46 20.04 8.09 22.32 -11.46 37.28 - 2.59 17.70 19.22 -12.76 22.16 5.30 14.08 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 7.62 10.08 1.32 37.58 22.96 33.36 28.58 21.04 - 9.10 -11.89 -22.10 28.68 10.88 4.91 15.79 5.49 - 37.00 26.46 15.06 2.11 16.00 32.39 3.48 3.03 4.39 5.61 5.14 5.19 4.86 4.80 5.98 3.33 1.61 1.03 1.43 3.30 2.90 2.75 2.67 2.54 3.32 1.70 1.61 2.68 3.39 1.55 2.38 1.88 3.26 3.42 2.54 4.08 .09 2.72 1.50 2.96 1.74 1.50 1.62 10.34 10.35 .28 4.97 10.85 39.46 -25.61 7.73 35.75 1.80 - 14.69 4.52 1.24 .15 .14 .06 .08 .05 2014 2015 2016 2017 13.69 1.41 11.98 19.57 22.60 -.64 1.76 5.78 .03 .04 .21 .75 .76 .74 2.11 1.58

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts