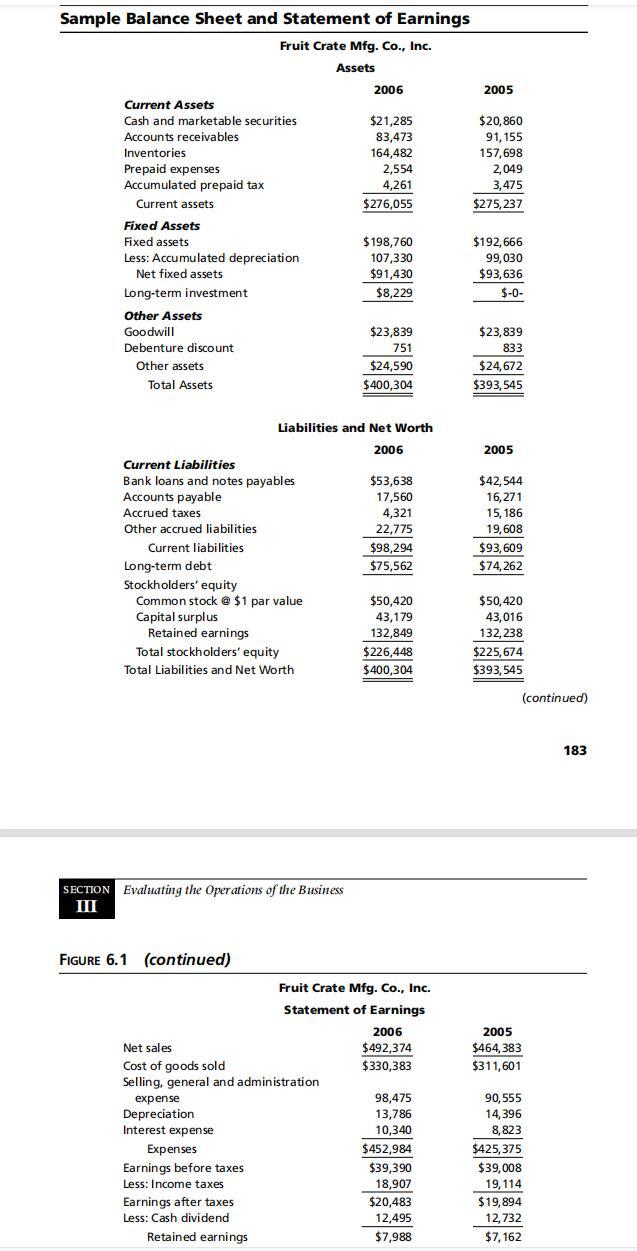

Question: Using information from Figure 6.1 Sample Balance Sheet and Statement of Earnings, calculating the following ratios. Formula of each ratio should be included in your

- Using information from Figure 6.1 Sample Balance Sheet and Statement of Earnings, calculating the following ratios. Formula of each ratio should be included in your answer.

- Current ratio

- Debt to net worth

- Net profit margin

- Asset turnover ratio

- Asset turnover ratio

Sample Balance Sheet and Statement of Earnings Fruit Crate Mfg.Co., Inc. Assets 2006 2005 Current Assets Cash and marketable securities Accounts receivables Inventories Prepaid expenses Accumulated prepaid tax $21,285 83,473 164,482 2,554 $20,860 91, 155 157,698 2,049 3,475 $275,237 4,261 Current assets $276,055 Fixed Assets Fixed assets Less: Accumulated depreciation Net fixed assets $198,760 107,330 $91,430 $8,229 $ $192,666 99,030 $93,636 $-0- Long-term investment Other Assets Goodwill Debenture discount $23,839 751 $23,839 833 Other assets $24,590 $400,304 $24,672 $393,545 Total Assets Liabilities and Net Worth 2006 2005 $53,638 $ 17,560 4,321 22,775 $98,294 $75,562 $42,544 16,271 15,186 19,608 Current Liabilities Bank loans and notes payables Accounts payable Accrued taxes Other accrued liabilities Current liabilities Long-term debt Stockholders' equity Common stock @ $1 par value Capital surplus Retained earnings Total stockholders' equity Total Liabilities and Net Worth $93,609 $74,262 $50,420 43,179 132,849 $226,448 $400,304 $50,420 43,016 132,238 $225,674 $393,545 (continued) ( 183 SECTION Evaluating the Operations of the Business III FIGURE 6.1 (continued) Fruit Crate Mfg.Co., Inc. Statement of Earnings 2006 $492,374 2005 $464,383 $311,601 $330,383 Net sales Cost of goods sold Selling, general and administration expense Depreciation Interest expense Expenses Earnings before taxes Less: Income taxes Earnings after taxes Less: Cash dividend : Retained earnings 98,475 13,786 10,340 $452,984 $39,390 18,907 $20,483 12,495 $7,988 90,555 14,396 8,823 $425,375 $39,008 19,114 $19,894 12,732 $7,162

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts