Question: Using information provided in exercise 1, calculate the average returns, the variance and the standard deviation of returns of a portfolio composed by Al Fajar

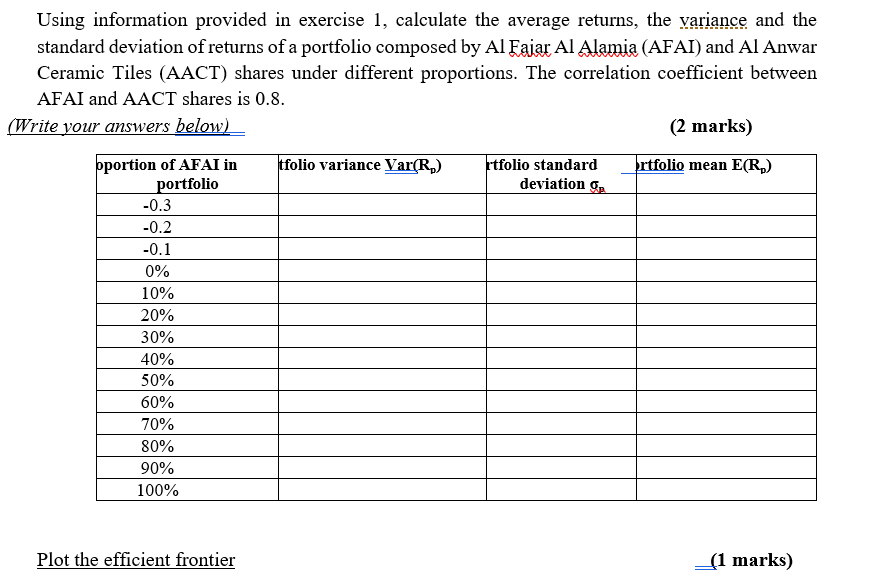

Using information provided in exercise 1, calculate the average returns, the variance and the standard deviation of returns of a portfolio composed by Al Fajar Al Alamia (AFAI) and Al Anwar Ceramic Tiles (AACT) shares under different proportions. The correlation coefficient between AFAI and AACT shares is 0.8. (Write your answers below) (2 marks) tfolio variance Var(R) brtfolio mean E(R) rtfolio standard deviation pportion of AFAI in portfolio -0.3 -0.2 -0.1 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Plot the efficient frontier (1 marks) Using information provided in exercise 1, calculate the average returns, the variance and the standard deviation of returns of a portfolio composed by Al Fajar Al Alamia (AFAI) and Al Anwar Ceramic Tiles (AACT) shares under different proportions. The correlation coefficient between AFAI and AACT shares is 0.8. (Write your answers below) (2 marks) tfolio variance Var(R) brtfolio mean E(R) rtfolio standard deviation pportion of AFAI in portfolio -0.3 -0.2 -0.1 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Plot the efficient frontier (1 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts