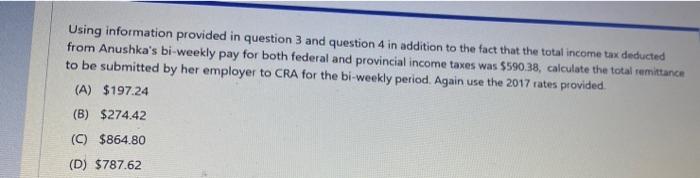

Question: Using information provided in question 3 and question 4 in addition to the fact that the total income tax deducted from Anushka's bi-weekly pay for

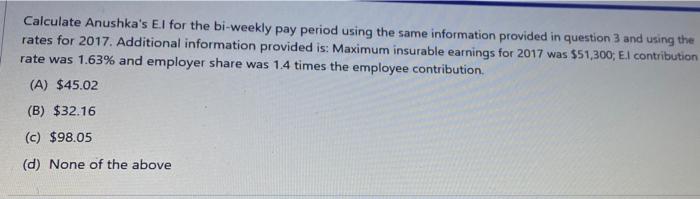

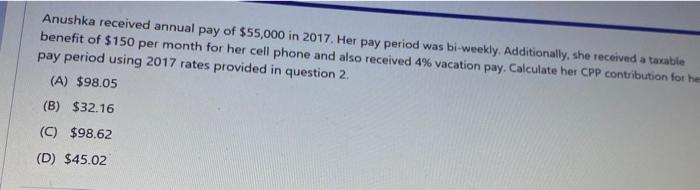

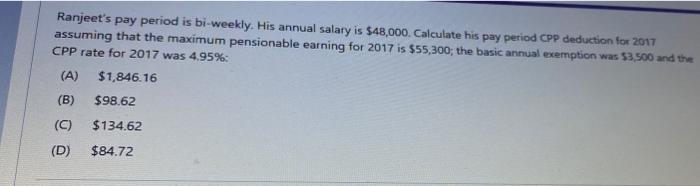

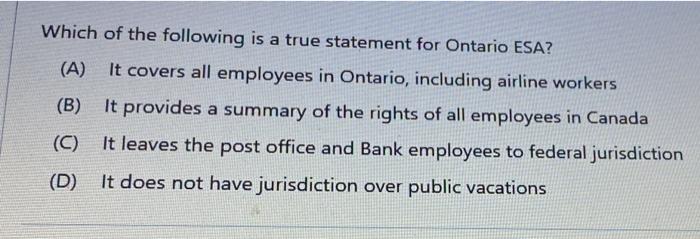

Using information provided in question 3 and question 4 in addition to the fact that the total income tax deducted from Anushka's bi-weekly pay for both federal and provincial income taxes was 5590.38, calculate the total remittance to be submitted by her employer to CRA for the bi-weekly period. Again use the 2017 rates provided. (A) $197.24 (8) $274.42 (C) $864.80 (D) $787.62 Calculate Anushka's El for the bi-weekly pay period using the same information provided in question 3 and using the rates for 2017. Additional information provided is: Maximum insurable earnings for 2017 was $51,300, El contribution rate was 1.63% and employer share was 1.4 times the employee contribution (A) $45.02 (B) $32.16 (c) $98.05 (d) None of the above Anushka received annual pay of $55,000 in 2017. Her pay period was bi-weekly. Additionally, she received a taxable benefit of $150 per month for her cell phone and also received 4% vacation pay. Calculate her CPP contribution for her pay period using 2017 rates provided in question 2 (A) $98.05 (B) $32.16 (C) $98.62 (D) $45.02 Ranjeet's pay period is bi-weekly. His annual salary is $48,000. Calculate his pay period CPP deduction for 2017 assuming that the maximum pensionable earning for 2017 is $55,300; the basic annual exemption was 53,500 and the CPP rate for 2017 was 4.95%: $1,846.16 $98.62 (A) (B) (C) $134.62 (D) $84.72 Which of the following is a true statement for Ontario ESA? (A) It covers all employees in Ontario, including airline workers (B) It provides a summary of the rights of all employees in Canada (C) It leaves the post office and Bank employees to federal jurisdiction (D) It does not have jurisdiction over public vacations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts