Question: Using information you have learned in the text and elsewhere, evaluate Dollarama's profitability for 2018 compared with 2017. In your analysis, you should compute the

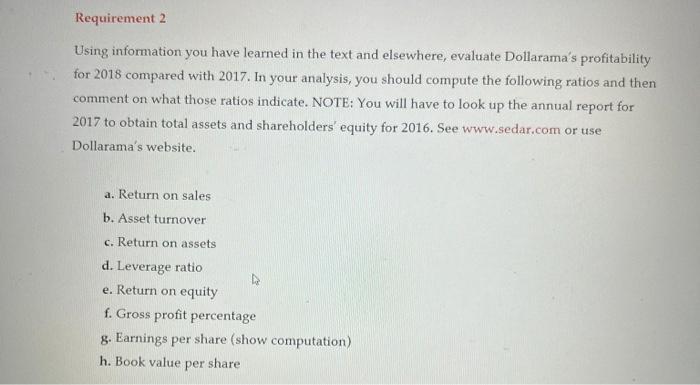

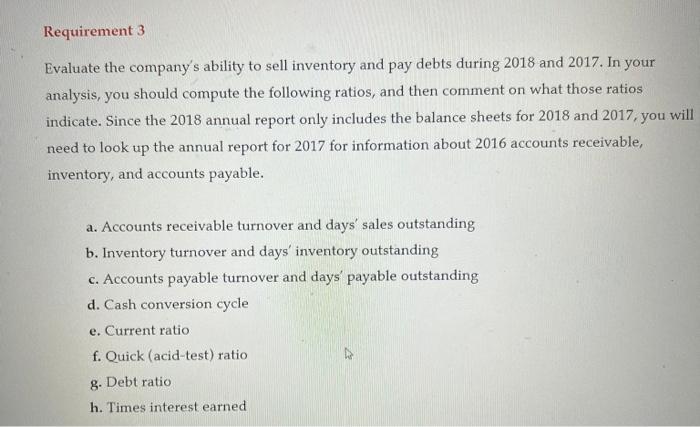

Using information you have learned in the text and elsewhere, evaluate Dollarama's profitability for 2018 compared with 2017. In your analysis, you should compute the following ratios and then comment on what those ratios indicate. NOTE: You will have to look up the annual report for 2017 to obtain total assets and shareholders' equity for 2016. See www.sedar.com or use Dollarama's website. a. Return on sales b. Asset turnover c. Return on assets d. Leverage ratio e. Return on equity f. Gross profit percentage g. Earnings per share (show computation) h. Book value per share Evaluate the company's ability to sell inventory and pay debts during 2018 and 2017. In your analysis, you should compute the following ratios, and then comment on what those ratios indicate. Since the 2018 annual report only includes the balance sheets for 2018 and 2017, you will need to look up the annual report for 2017 for information about 2016 accounts receivable, inventory, and accounts payable. a. Accounts receivable turnover and days' sales outstanding b. Inventory turnover and days' inventory outstanding c. Accounts payable turnover and days' payable outstanding d. Cash conversion cycle e. Current ratio f. Quick (acid-test) ratio g. Debt ratio h. Times interest earned

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts