Question: using JavaScript 05. Given the Australian Tax Bracket information for residents in the year 2020-21: Resident tax rates 2020-21 Taxable income Tax on this income

using JavaScript

using JavaScript

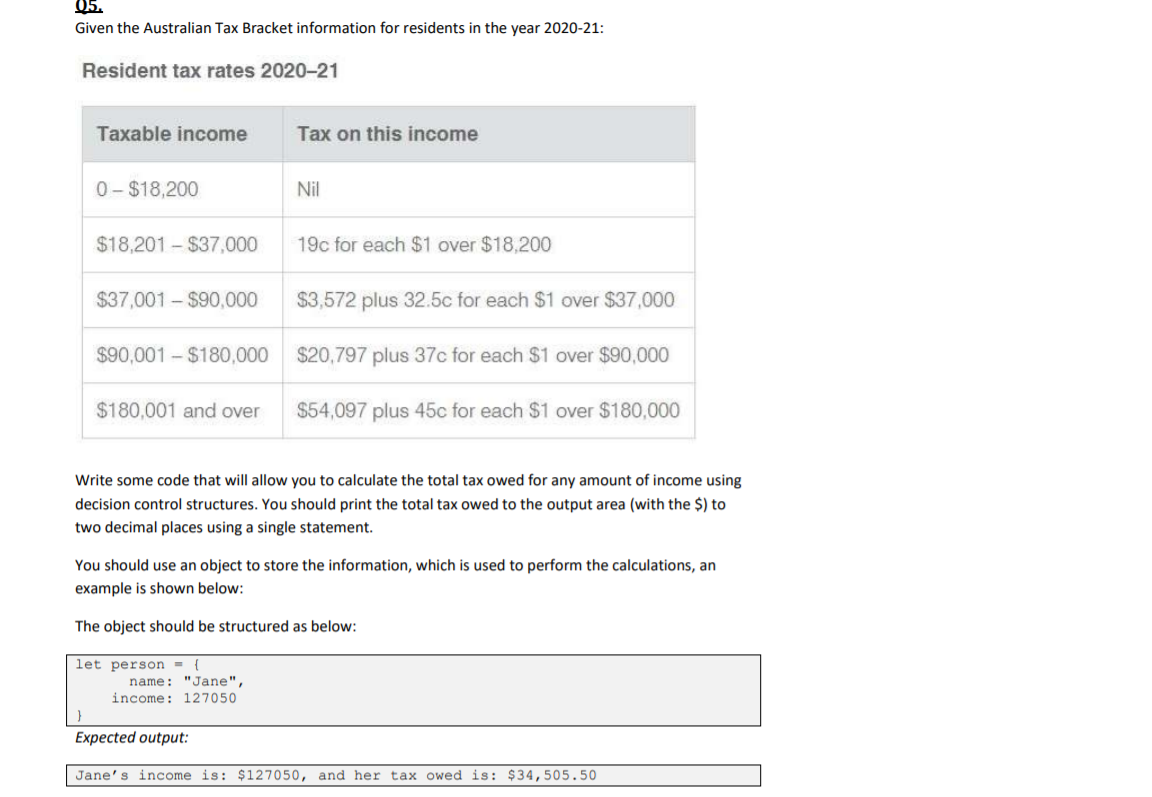

05. Given the Australian Tax Bracket information for residents in the year 2020-21: Resident tax rates 2020-21 Taxable income Tax on this income 0-$18,200 Nil $18,201 - $37,000 19c for each $1 over $18.200 $37,001 - $90,000 $3,572 plus 32.5c for each $1 over $37,000 $90,001 - $180,000 $20,797 plus 37c for each $1 over $90,000 $180,001 and over $54,097 plus 45c for each $1 over $180,000 Write some code that will allow you to calculate the total tax owed for any amount of income using decision control structures. You should print the total tax owed to the output area (with the $) to two decimal places using a single statement. You should use an object to store the information, which is used to perform the calculations, an example is shown below: The object should be structured as below: let person = { name: "Jane", income: 127050 } Expected output: Jane's income is: $127050, and her tax owed is: $34,505.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts