Question: Using Last Twelve Months ( LTM ) EBITDA The EV / EBITDA metric is commonly used in relative valuation analysis. This metric compares the value

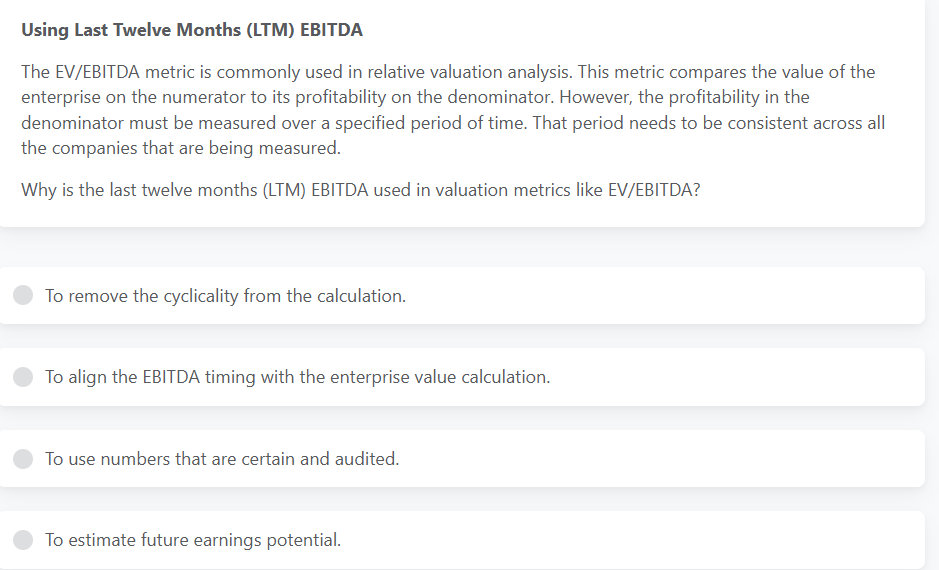

Using Last Twelve Months LTM EBITDA

The EVEBITDA metric is commonly used in relative valuation analysis. This metric compares the value of the enterprise on the numerator to its profitability on the denominator. However, the profitability in the denominator must be measured over a specified period of time. That period needs to be consistent across all the companies that are being measured.

Why is the last twelve months LTM EBITDA used in valuation metrics like EVEBITDA

To remove the cyclicality from the calculation.

To align the EBITDA timing with the enterprise value calculation.

To use numbers that are certain and audited.

To estimate future earnings potential.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock