Question: Using MS Excel complete the problems: 1. Using the Specific Identification inventory method, calculate: (a) The Ending Inventory, (b) The Cost of Goods Sold. Based

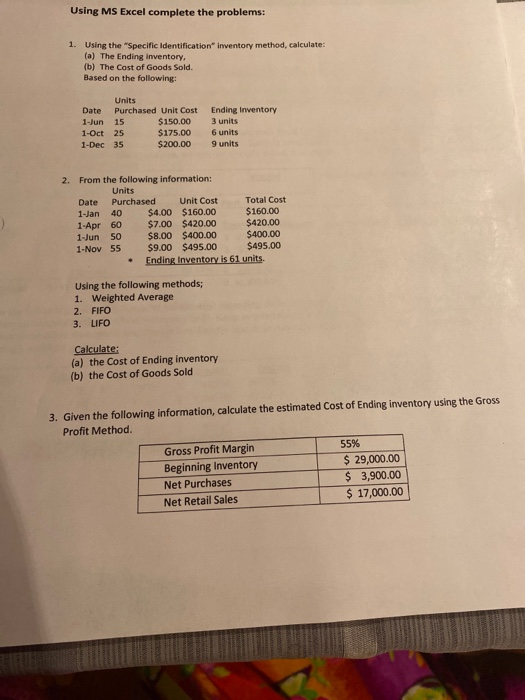

Using MS Excel complete the problems: 1. Using the Specific Identification inventory method, calculate: (a) The Ending Inventory, (b) The Cost of Goods Sold. Based on the following: Units Date Purchased Unit Cost 1-Jun 15 $150.00 1-Oct 25 $175.00 1-Dec 35 $200.00 Ending Inventory 3 units 6 units 9 units 2. From the following information: Units Date Purchased Unit Cost Total Cost 1-Jan 40 $4.00 $160.00 $160.00 1-Apr 60 $7.00 $420.00 $420.00 1-Jun 50 $8.00 $400.00 $400.00 1-Nov 55 $9.00 $495.00 $495.00 Ending Inventory is 61 units. Using the following methods; 1. Weighted Average 2. FIFO 3. LIFO Calculate: (a) the Cost of Ending inventory (b) the Cost of Goods Sold 3. Given the following information, calculate the estimated Cost of Ending inventory using the Gross Profit Method. Gross Profit Margin Beginning Inventory Net Purchases Net Retail Sales 55% $ 29,000.00 $ 3,900.00 $ 17,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts