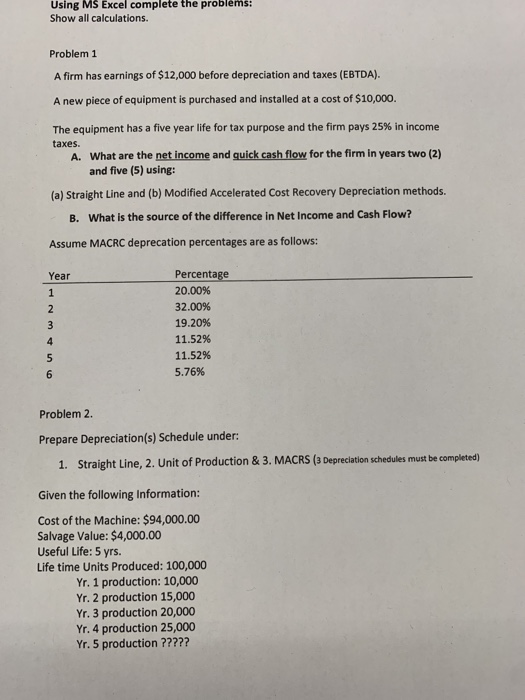

Question: Using MS Excel complete the problems: Show all calculations. Problem 1 A firm has earnings of $12,000 before depreciation and taxes (EBTDA). A new plece

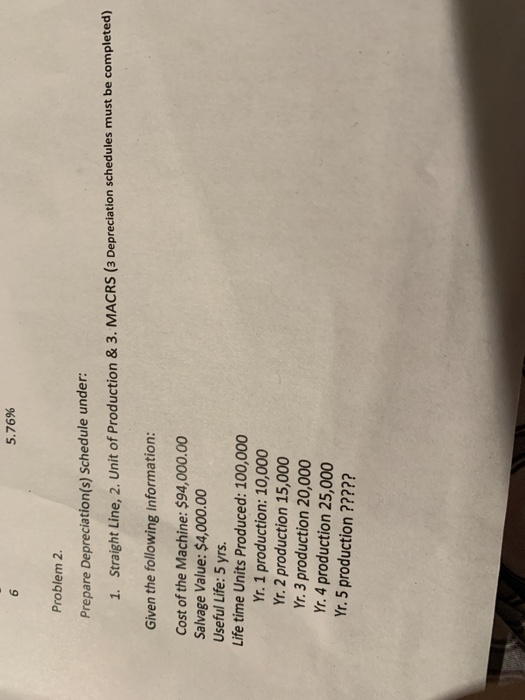

Using MS Excel complete the problems: Show all calculations. Problem 1 A firm has earnings of $12,000 before depreciation and taxes (EBTDA). A new plece of equipment is purchased and installed at a cost of $10,000. The equipment has a five year life for tax purpose and the firm pays 25% in income taxes. A. What are the net income and quick cash flow for the firm in years two (2) and five (5) using: (a) Straight Line and (b) Modified Accelerated Cost Recovery Depreciation methods. B. What is the source of the difference in Net Income and Cash Flow? Assume MACRC deprecation percentages are as follows: Year Percentage 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% Problem 2. Prepare Depreciation(s) Schedule under: 1. Straight Line, 2. Unit of Production & 3. MACRS (3 Depreciation schedules must be completed) Given the following Information: Cost of the Machine: $94,000.00 Salvage Value: $4,000.00 Useful Life: 5 yrs. Life time Units Produced: 100,000 Yr. 1 production: 10,000 Yr. 2 production 15,000 Yr. 3 production 20,000 Yr. 4 production 25,000 Yr. 5 production ????? 5.76% Problem 2. Prepare Depreciation(s) Schedule under: 1. Straight Line, 2. Unit of Production & 3. MACRS (3 Depreciation schedules must be completed) Given the following information: Cost of the Machine: $94,000.00 Salvage Value: $4,000.00 Useful Life: 5 yrs. Life time Units Produced: 100,000 Yr. 1 production: 10,000 Yr. 2 production 15,000 Yr. 3 production 20,000 Yr. 4 production 25,000 Yr. 5 production

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts