Question: Using Normal Costing a. Prepare variable costing and absorption costing income statements for 2015 and 2016. b. Prepare a numerical reconciliation explaining the difference between

Using Normal Costing a. Prepare variable costing and absorption costing income statements for 2015 and 2016. b. Prepare a numerical reconciliation explaining the difference between operating income using variable costing versus absorption costing for both 2015 and 2016.

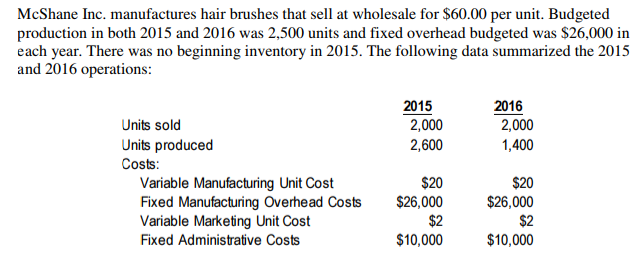

McShane Inc. manufactures hair brushes that sell at wholesale for $60.00 per unit. Budgeted production in both 2015 and 2016 was 2,500 units and fixed overhead budgeted was $26,000 in each year. There was no beginning inventory in 2015. The following data summarized the 2015 and 2016 operations: 2015 2016 Units sold 2,000 2,000 1,400 Units produced 2,600 Costs: $20 $20 Variable Manufacturing Unit Cost Fixed Manufacturing Overhead Costs $26,000 $26,000 Variable Marketing Unit Cost $10,000 $10,000 Fixed Administrative Co

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts