Question: Using only Excel functions, answer the following questions: Excel Financial Functions - Use them to De-mystify and Simplify Managerial Finance 0 12 3 5 Year

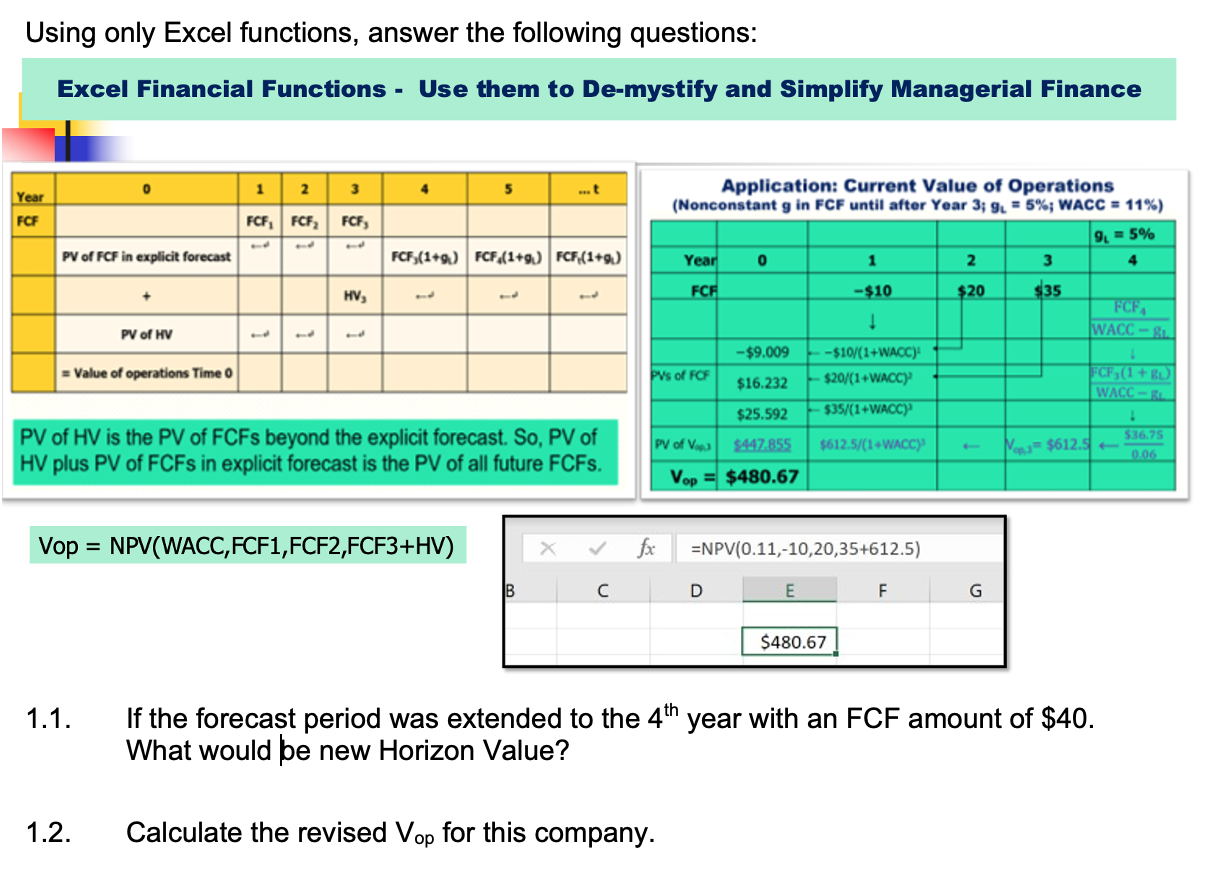

Using only Excel functions, answer the following questions: Excel Financial Functions - Use them to De-mystify and Simplify Managerial Finance 0 12 3 5 Year FCF Application: Current Value of Operations (Nonconstant g in FCF until after Year 3; 9. = 5%; WACC = 11%) FCF FCF FCF 9. = 5% PV of FCF in explicit forecast FCF3(1+9.) FCF.(1+9.) FCF (1+9) Year 0 1 2 3 4 HV, FCF -$10 $20 $35 FCE, ! PV of HV WACC - SL = Value of operations Time 0 -$9.009 $16.232 -$10/(1+WACC) $20/(1+WACC) pvs of FCF FCF (1+ WACCER $25.592 $35/(1+WACC) PV of HV is the PV of FCFs beyond the explicit forecast. So, PV of plus PV of FCFs in explicit forecast is the PV of all future FCFs. PV of $447.855 $612.5/(1+WACC) N- $612.5 536.75 0.00 Vop = $480.67 Vop = NPV(WACC, FCF1,FCF2,FCF3+HV) fx =NPV(0.11,-10,20,35+612.5) | D E F G $480.67 1.1. If the forecast period was extended to the 4th year with an FCF amount of $40. What would be new Horizon Value? 1.2. Calculate the revised Vop for this company. Using only Excel functions, answer the following questions: Excel Financial Functions - Use them to De-mystify and Simplify Managerial Finance 0 12 3 5 Year FCF Application: Current Value of Operations (Nonconstant g in FCF until after Year 3; 9. = 5%; WACC = 11%) FCF FCF FCF 9. = 5% PV of FCF in explicit forecast FCF3(1+9.) FCF.(1+9.) FCF (1+9) Year 0 1 2 3 4 HV, FCF -$10 $20 $35 FCE, ! PV of HV WACC - SL = Value of operations Time 0 -$9.009 $16.232 -$10/(1+WACC) $20/(1+WACC) pvs of FCF FCF (1+ WACCER $25.592 $35/(1+WACC) PV of HV is the PV of FCFs beyond the explicit forecast. So, PV of plus PV of FCFs in explicit forecast is the PV of all future FCFs. PV of $447.855 $612.5/(1+WACC) N- $612.5 536.75 0.00 Vop = $480.67 Vop = NPV(WACC, FCF1,FCF2,FCF3+HV) fx =NPV(0.11,-10,20,35+612.5) | D E F G $480.67 1.1. If the forecast period was extended to the 4th year with an FCF amount of $40. What would be new Horizon Value? 1.2. Calculate the revised Vop for this company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts