Question: Using only the information provided in Exhibit 1, explain why further analysis of physician visits maybe needed. Compare the profitability of hospital and surgical services

Using only the information provided in Exhibit 1, explain why further analysis of physician visits maybe needed. Compare the profitability of hospital and surgical services to physician services, using the allocation of revenue that was given. Show the breakdown of the $260 premium using a column chart. Does the allocation of the $260 per employee per month payment across the types of health care services seem reasonable, given the past two months’ utilization?

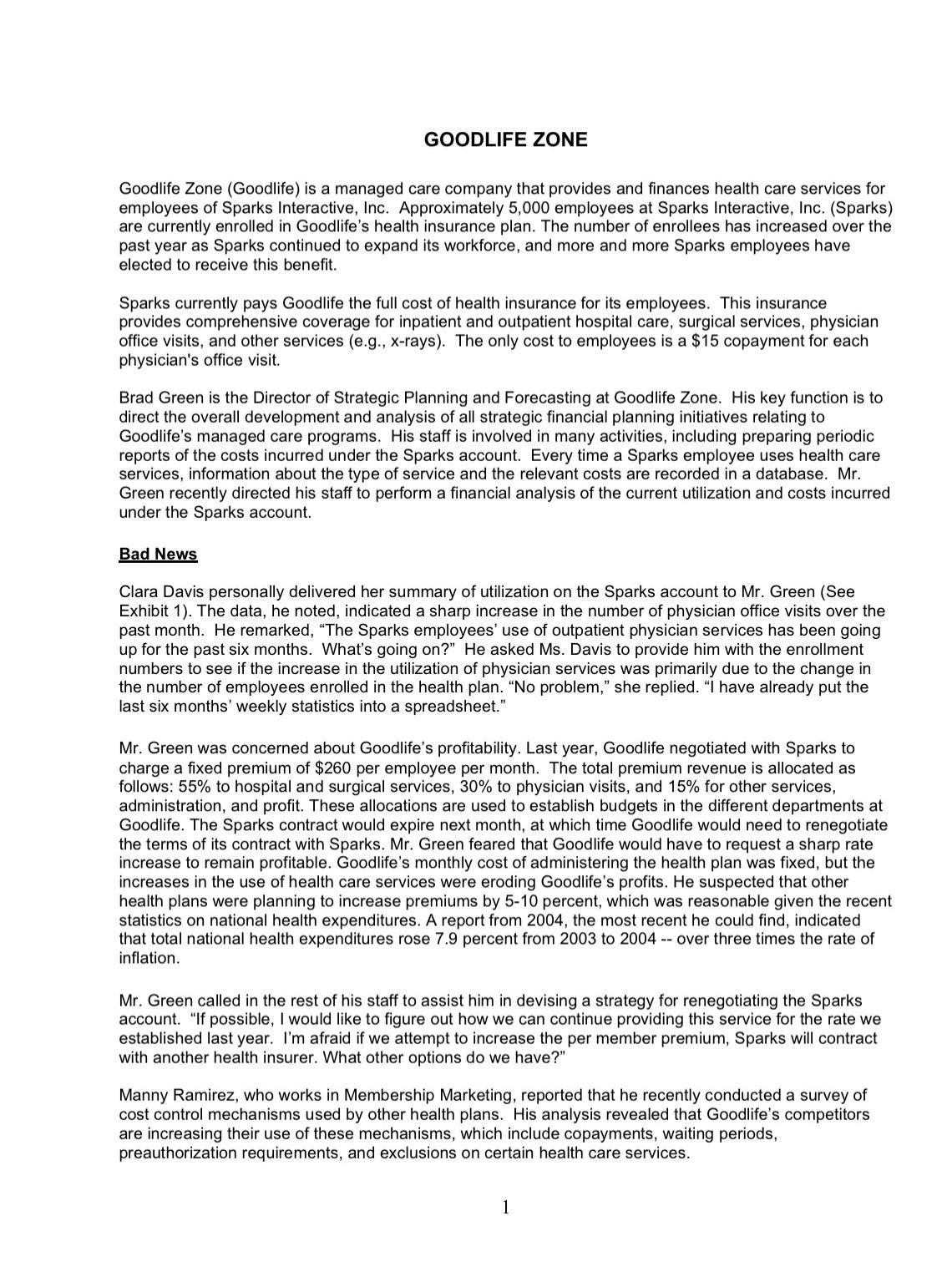

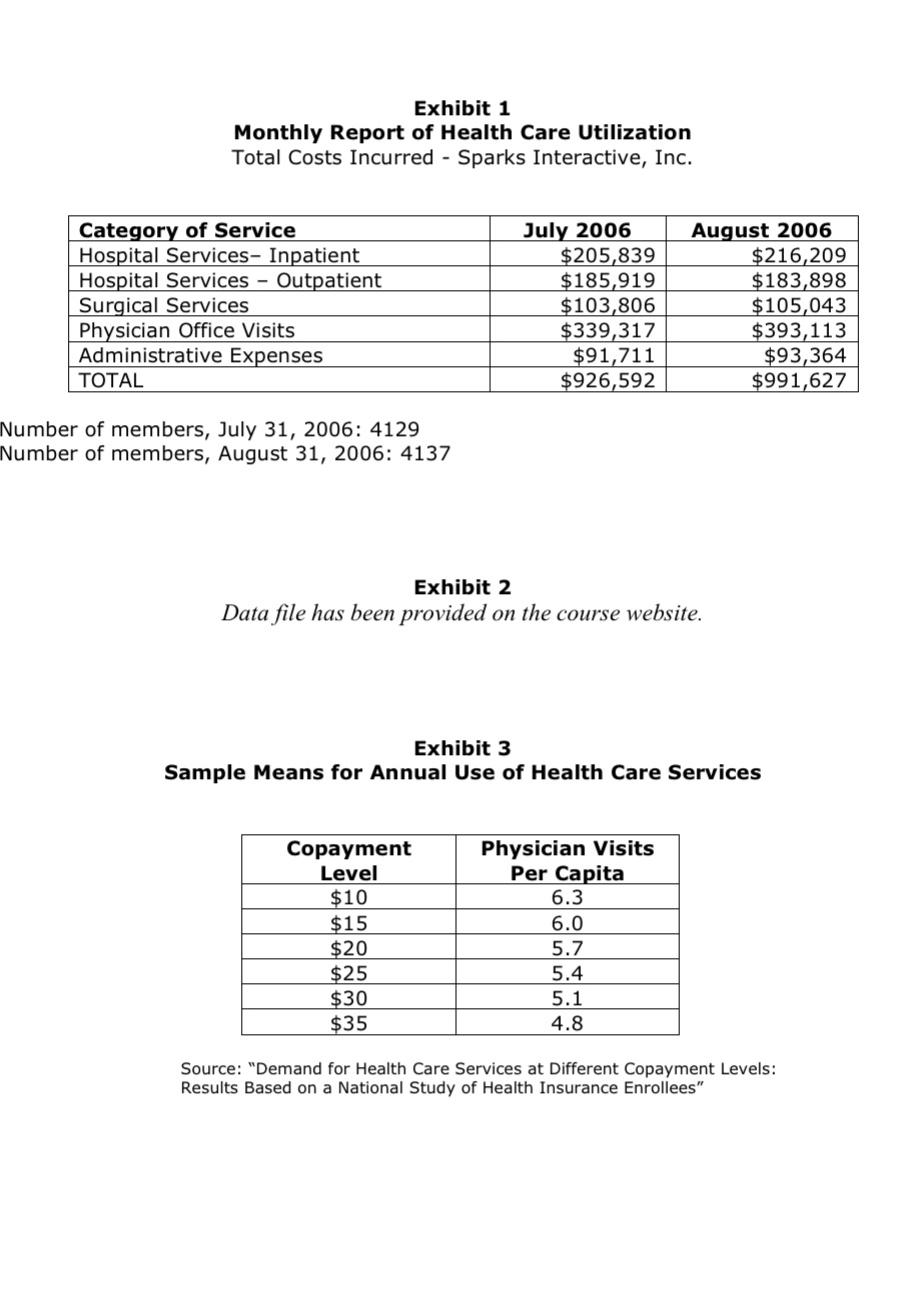

GOODLIFE ZONE Goodlife Zone (Goodlife) is a managed care company that provides and finances health care services for employees of Sparks Interactive, Inc. Approximately 5,000 employees at Sparks Interactive, Inc. (Sparks) are currently enrolled in Goodlife's health insurance plan. The number of enrollees has increased over the past year as Sparks continued to expand its workforce, and more and more Sparks employees have elected to receive this benefit. Sparks currently pays Goodlife the full cost of health insurance for its employees. This insurance provides comprehensive coverage for inpatient and outpatient hospital care, surgical services, physician office visits, and other services (e.g., x-rays). The only cost to employees is a $15 copayment for each physician's office visit. Brad Green is the Director of Strategic Planning and Forecasting at Goodlife Zone. His key function is to direct the overall development and analysis of all strategic financial planning initiatives relating to Goodlife's managed care programs. His staff is involved in many activities, including preparing periodic reports of the costs incurred under the Sparks account. Every time a Sparks employee uses health care services, information about the type of service and the relevant costs are recorded in a database. Mr. Green recently directed his staff to perform a financial analysis of the current utilization and costs incurred under the Sparks account. Bad News Clara Davis personally delivered her summary of utilization on the Sparks account to Mr. Green (See Exhibit 1). The data, he noted, indicated a sharp increase in the number of physician office visits over the past month. He remarked, "The Sparks employees' use of outpatient physician services has been going up for the past six months. What's going on?" He asked Ms. Davis to provide him with the enrollment numbers to see if the increase in the utilization of physician services was primarily due to the change in the number of employees enrolled in the health plan. "No problem," she replied. "I have already put the last six months' weekly statistics into a spreadsheet." Mr. Green was concerned about Goodlife's profitability. Last year, Goodlife negotiated with Sparks to charge a fixed premium of $260 per employee per month. The total premium revenue is allocated as follows: 55% to hospital and surgical services, 30% to physician visits, and 15% for other services, administration, and profit. These allocations are used to establish budgets in the different departments at Goodlife. The Sparks contract would expire next month, at which time Goodlife would need to renegotiate the terms of its contract with Sparks. Mr. Green feared that Goodlife would have to request a sharp rate increase to remain profitable. Goodlife's monthly cost of administering the health plan was fixed, but the increases in the use of health care services were eroding Goodlife's profits. He suspected that other health plans were planning to increase premiums by 5-10 percent, which was reasonable given the recent statistics on national health expenditures. A report from 2004, the most recent he could find, indicated that total national health expenditures rose 7.9 percent from 2003 to 2004 -- over three times the rate of inflation. Mr. Green called in the rest of his staff to assist him in devising a strategy for renegotiating the Sparks account. "If possible, I would like to figure out how we can continue providing this service for the rate we established last year. I'm afraid if we attempt to increase the per member premium, Sparks will contract with another health insurer. What other options do we have?" Manny Ramirez, who works in Membership Marketing, reported that he recently conducted a survey of cost control mechanisms used by other health plans. His analysis revealed that Goodlife's competitors are increasing their use of these mechanisms, which include copayments, waiting periods, preauthorization requirements, and exclusions on certain health care services. 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts