Question: Using ONLY the TMV tables calculate the following: (do NOT use financial calculater) please show/explain how you found your answer using the table You have

Using ONLY the TMV tables calculate the following: (do NOT use financial calculater)

please show/explain how you found your answer using the table

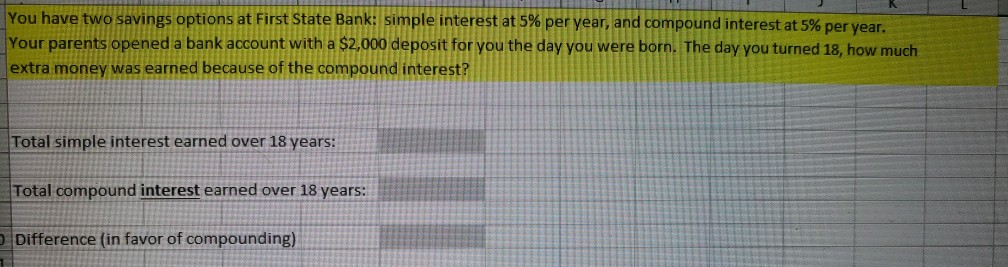

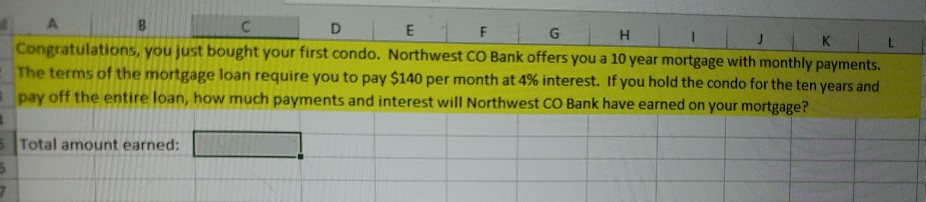

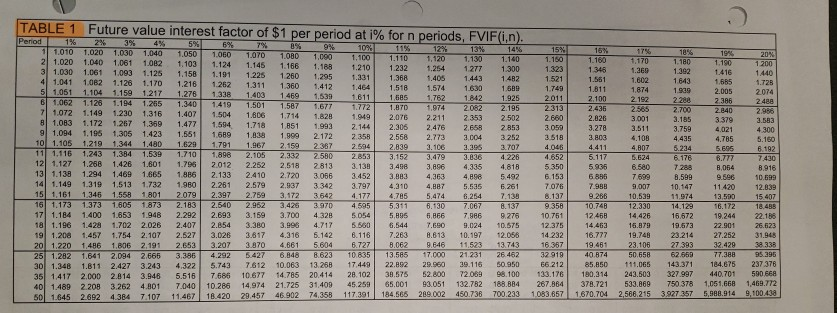

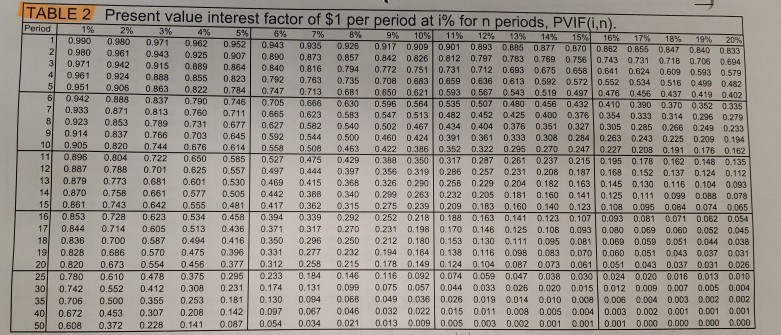

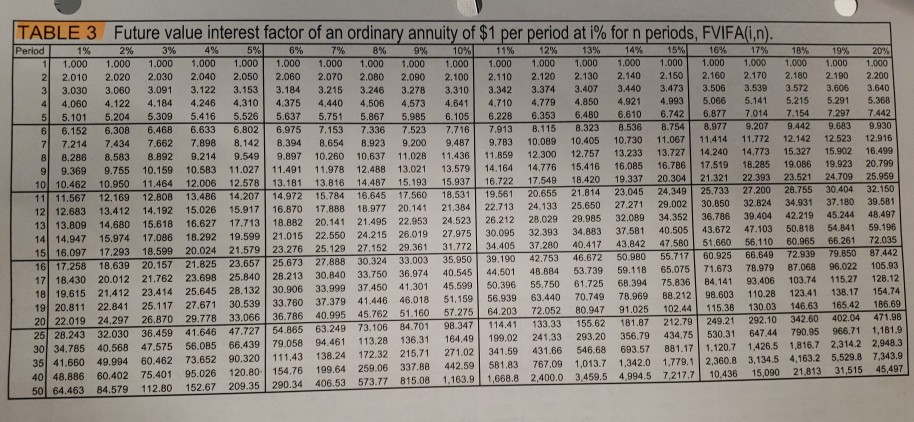

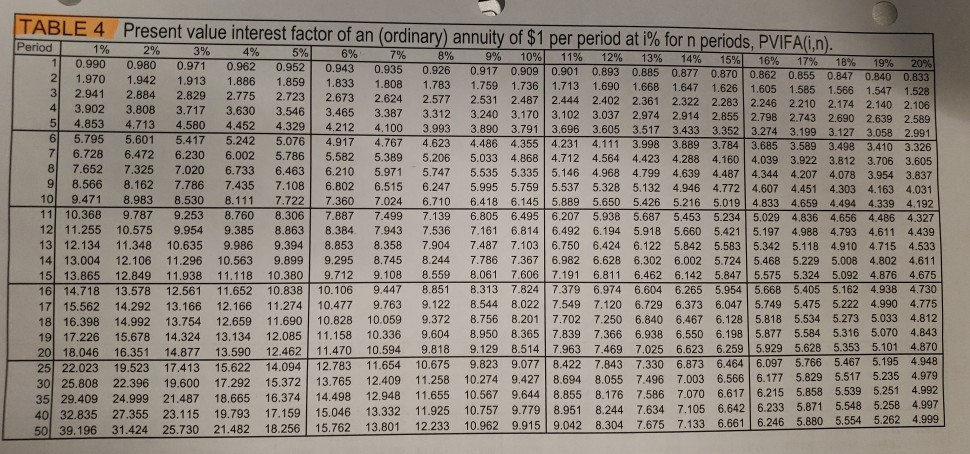

You have two savings options at First State Bank: simple interest at 5% per year, and compound interest at 5% per year Your parents opened a bank account with a $2,000 deposit for you the day you were born. The day you turned 18, how much extra money was earned because of the compound interest? Total simple interest earned over 18 years: Total compound interest earned over 18 years: Difference (in favor of compounding) Congratulations, you just bought your first condo. Northwest co Bank offers you a 10ye The terms of the mortgage loan require you to pay $140 per month at 4% interest, if you hold the condo for the ten years and pay off the entire loan, how much payments and interest will Northwest Co Bank have earned on your mortgage? ar mortgage vw Total amount earned: TABLE 1 Future va 12 1.127 1.268 1.426 1.601 1.796 2.012 2252 2,518 2813 313 3498 896 4.335 4.818 13 1.138 1.294 1.469 1.665 1.886 2.133 2.410 2.720 3.066 3.452 3.883 4363 48 5492 14 1.149 1319 1.513 1.732 1.980 2.261 2.579 2.937 3.342 3797 4.310 4.887 5535 6.261 161 1346 1.558 1.801 2079 | 2.397 2.759 3.172 3642 4177 | 4.785 5474 6.264 7.1M 3 1.373 1.605 1873 2.183 2.540 2.9623,425 3970 4.595 17 1.184 1.400 1853 1.948 2.292 2.693 3.159 3.700 4.328 5.054 5.895 6.866 7.886 9.276 18 1.196 1.428 1.702 2.026 2.407 2.854 3.380 3.99 4.717 5.560 19 1,208 1457 1.754 2.107 2.6273.028 3817 4.316 6.142 8.116 7.283 8.613 10.197 12.058 20 1.220 1,486 1.806 2.1912.653 3.207 3.870 4.661 5.604 6.727 8.062 9.646 11.523 13.743 25 1.282 1.641 2.094 2.665 3.386 4.292 427 6.848 8623 10 835 30 1.348 1.811 2.427 3.243 4.322 5.743 7612 10.063 13.268 7.449 22.892 29.960 39.116 50.950 6212 35 1417 2.000 2.814 3.946 5.516 7.686 10.677 14.785 20.414 28.102 38.575 52800 72069 8.100 133.176 180.314 243.503 327.997 440.701 590 668 1.489 2.208 3.262 4.801 7040 10.286 14,974 21.725 31409 45.259 65.001 93051 132.782 188.884 267.864 378.721 533.869 750.378 1,051,668 1,469.772 50 1845 2692 4384 7107 11467 18.420 29457 46 902 74.358 117.391 184565 289002 450.738 700.233 1083,657 1870.704 2566 215 3927 357 5.988.914 9,100438 TABLE 2 Present value interest factor of $1 per period at i% for n periods, PVIF(in 0.990 0.980 0.971 0962 052 0.943 0.93 0.926 0.917 0.909 0.901 0.893 0885 0.877 0.870 0.862 0855 0.847 0.840 0.833 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0694 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0888 0.855 0.823| 0.792 0.763 0.735 0.708 0.683| 0.659 0.636 0.613 0.592 0.572| 0.552 0534 0.516 0499 0.482 ,784| 0.747 0.713 0.681 0.650 0.621| 0.593 05670543 0.5190.497|04760.456 0.437 0419 0.402 0.906 0.863 0.822 0 0.888 6 0.942 .837 - 0.790- 0.746 -05--0.666 6300.596 0.564 0.535 -0.507-0.480- 0.456 0 432 0.410 -0.390 -0.370 035 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 11| 0.896 0.804 O.722 0.650 0.585 0.527 0.475 0429 O 38803-17 0.287 0201 0.237 0.215 95 0.178 0.162 0.148 on 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.12 13 0.879 0.773 0.681 0.601 0.530 0469 0.415 0.368 0.326 0.290 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 14 0.87 0.758 0.661 0.577 0.505 0.442 0.38B 0.340 0.299 0.263 0.232 0.205 0.181 0.160 0.141 0.125 0.111 0.089 0.088 0.078 1.861 0.743 0.642 5 O ! 17 0.362 0. 5 0.275-0239|0.209 0.183 0.160 0.140 0.123| 0.108 0095 0084 0074 0065 16| 0.353 - 0.728 0.623 0534 0458-0394 0.339 0.292 0.252 0.21 0,188-0.163- .123 7 0.093 0.081 0,071 0,062 0.0 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 9 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.138 0.116 0.098 0.083 0.070 0,060D 0.051 0.043 0.037 0.031 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 25 0.780 0.610 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 0.047 0.038 0.030 0.024 0.020 0.016 0.013 0.010 30 0.742 0.552 0.412 0.308 0.231 0.174 0.13 0.099 0.075 0.057 0.044 0.033 0.026 0.020 0.015 0,012 0.009 0.007 0.005 0.004 35 0.706 0.500 0.355 0.253 0.181 0.130 0.094 0.068 0.049 0.036 0.026 0.019 0.014 0.010 0.008 0.006 0.004 0.003 0.002 0.002 40| 0.672 0.453 0.307 0.208 0.14 0.097 0.067 0046 00320022 0015 0.011 0.008 0.005 0.004 |0.003 0.002 0.001 00010001 0.608 0.372 0.228 0.141 0.087 0.054 0.034 0.021 0.013 0.009 0.005 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 TABLE 3 Future value interest factor of an ordinary annuity of $1 per period at i% for n periods, FVIFAGn Period 11 1.000 1.000 1.000 1.000 1.000 | 1.000 1.000 1.000 1.000 1.000 | 1.000 1.000 1.000 1.000 1.000 | 1.000 1.000 1.000 1.000 1.000 2 2.010 2.020 2.030 2.040 2.050 2.060 2.070 2.080 2.090 2.100 2.110 4 4.060 4.122 4.184 4.246 4,310 4.375 4.440 4.506 4573 4.641 4.710 4.779 4,850 4.921 4.993 5.066 5.141 5.215 5.291 5.368 5.101 5.204 5.309 5.416 5.526 | 5.637 5.751 5.867 5.985 6.105 | 6.228 6.353 6.480 6.610 6.742 6.877 7.014 y-154 7.297 7.442 .152 -6.308-6.468 6.633-6 802 -6.975-7.153 7.336 523 716 -.913-8 115- 8.323- .536 -8754 - 37 -,20- 9.442 - 9 683 g.930 7.214 7.434 7.662 7.898 8.142 8.394 8.654 8.923 9.200 9.487 9.783 10.089 10.405 10.730 11.067 11.414 11.772 12.142 12.523 12.916 8 8.286 8.583 8.892 9.214 9.549 9.897 10.260 10.637 11.028 11.436 11859 12.300 12.757 13.233 13.727 14.240 14.773 15.327 15.902 16.499 9 9.369 9.755 10.159 10.583 11.027 11.491 11.978 12.488 13,021 13,57914.164 4.776 15.416 16.085 16.786 17.519 18.285 19.086 19.923 20.799 7.549 18.420 19.337 20.304 21.321 22.393 23.521 24.709 25.959 10 10.462 10.950 11.464 12.006 12.578 13.181 13.816 14.487 15.193 15.937 16.722 1 11.567 12.169 12.808 13.486 14.207 14.972 15.784 16.645 17,560 18.531 19.561 20.655 21.814 23.045 24.349 25.733 27200 28. 12 12.683 13.412 14.192 15.026 15.917 16.870 17.888 18.977 20.141 21.384 22.713 24.133 25.650 27.271 29.002 30.850 32.824 13 13.809 14.680 15.618 16.627 17.713 18.882 20.141 21.495 22.953 24.523 26.212 28.029 29.985 32.089 34.352 36.7 14 14.947 15.974 17.086 18.292 19.599 21.015 22.550 24.215 26019 27.975 30.095 3 15 16.097 17.293 18,599 20024 21.579 23.276 25,129 27,152 29.361 31.772 34.405 37.280 40.417 16 17.258 18.639 20.157 21.825 23.657 25.673 27.888 30,324 33.003 17 18.430 20.012 21.762 23.698 25.840 28.213 30.840 33.750 36.974 40.545 18 19.615 21.412 23.414 25.645 28.132 30.9 19 20.811 22.841 25.117 27.671 30.539 33.760 37.379 41.446 56.939 34.931 37.180 39.581 86 39.404 42.219 45.244 48.497 32.393 34.883 37.581 40.505 43.672 47.103 50.818 54.841 59.196 43842 47.580 51.660 56,110 60.965 66.26172.035 35,950 39.190 42.753 46.672 50.980 ,717 60.925 66.649 72.939 79.850 87.442 59.118 65.075 71.673 78.979 87.068 96.022 105.83 44.501 48.884 53.739 .725 68.394 75,836 84.141 93,406 103,74 115.27 128.12 46.018 51.159 56.93 63.440 70.749 78.969 88.212 98.603 110.28 123.41 138.17 154.74 052 80.94791.025 102.44 115.38 130.03 146.63 165.42 186.69 73.106 84.701 98.347 114.41 133.33 155.62 181.87 212.79 249.21 292:10 342.60 402.04 471.98 906 33.999 37.450 41.301 45.599 50.396 55.750 61 22.019 24.297 26870 29.778 33,.066 36,786 40.995 45,762 51.160 57.275 64.203 72.0 28.243 32.030 36.459 41.646 47.727 54.865 63.249 30 34.785 40.568 47.575 56.085 66.439 79.058 94.461 113.28 136.31 164.49 199.02 241.33 293.20 356. 35 41.660 49.994 60.462 73.652 90.320 111.43 138.24 172.32 215.71 271.0 40 48.886 60.402 75.401 95.026 120.80 154.76 199.64 259.06 337 50 64.463 84.579 112.80 152.67 209.35 290.34 406.53 573.77 8 1,120.7 1426.5 1,816.7 2,314.2 2,948.3 2,360.8 3,134.5 4,163.2 5,529.8 7,343.9 4994.5 7.217.7 10.436 15,090 21.813 31.515 45,497 341.59 431.66 546.68 693.57 881.17 7.88 442.59 581.83 767.09 1,013.7 1,342.0 1,779.1 815.08 1.163.9 1,668.8 2,400.0 3,459.5 TABLE 4 Present value interest factor of an ordinary annuity of $1 per period at % for n periods, VFA n) Period 1% 2% 3% 9% 10%) 11% 12% 13% 14%-15% 17% 18% -19%-20% 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0847 0.840 0.833 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 1.690 1.668 1.647 1.626 1.605 1585 1.566 1.547 1.528 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.444 2.402 2.361 2.322 2.283 2.246 2.210 2.174 2.140 2.106 4% 5% 6% 8% 2 1.970 1.942 3 2.941 2.884 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2690 2.639 2.589 3.993 3.890 3.791 3.696 3605 3.517 3.433 3352 3.274 3.199 3,127 3.058 2.991 5 4.853 4.713 4.580 4.452 4.329 4.212 4.100 6 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3410 3.326 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605 8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 4.799 4.639 4.487 4.344 4207 4.078 3.954 3.837 9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 5.132 4.946 4.772 4.607 4451 4.303 4.163 4.031 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5,650 5.426 5.216 5.019 4.833 4.659 4494 4.339 4,192 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 5.687 5,453 5.234 5.029 4836 4.656 4,486 4.327 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 5.918 5.660 5,421 5.197 4.988 4.793 4.611 4.43 13 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.1036.750 6,424 6.122 5.842 5.583 5.342 5.118 4.910 4.715 4.533 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4,611 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 7.191 6.811 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.549 7.120 6.729 6.373 6.047 5.749 5.475 5.222 4.990 4.775 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 7.250 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.839 7.366 6.938 6.550 6.198 5.877 5.584 5.316 5.070 4.843 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.963 7.469 7.025 6.623 6.259 5.929 5.628 5.353 5.101 4.870 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 7.843 7.330 6.873 6.464 6.097 5.766 5.467 5.195 4.948 30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 7.496 7.003 6.566 6.177 5.829 5.517 5.235 4979 35 29.409 24.999 21.487 18.665 16.374 14498 12.948 11.655 10.567 9.644 8.855 8.176 7.586 7.070 6.617 6.215 5.858 5.539 5.251 4.992 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.951 8.244 7.634 7.105 6.642 6.233 5.871 5.548 5.258 4.997 39.196 31.424 25.730 21.482 18.256| 15.762 13.801 12.233 10962 9 915 9042 8304 7675 -66616w

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts