Question: using Pe^rt 1) A reasonable way to put a value on a share of stock is to discount the stream of expected future dividends (annual

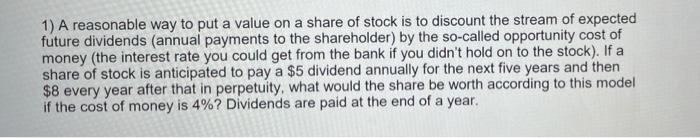

1) A reasonable way to put a value on a share of stock is to discount the stream of expected future dividends (annual payments to the shareholder) by the so-called opportunity cost of money (the interest rate you could get from the bank if you didn't hold on to the stock). If a share of stock is anticipated to pay a $5 dividend annually for the next five years and then i $8 every year after that in perpetuity, what would the share be worth according to this model if the cost of money is 4% ? Dividends are paid at the end of a year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts