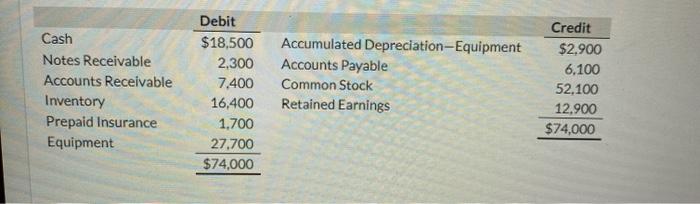

Question: using picture 1 and 4, answer 3 1. The statement from Jackson County Bank on December 31 showed a balance of $26,651. A comparison of

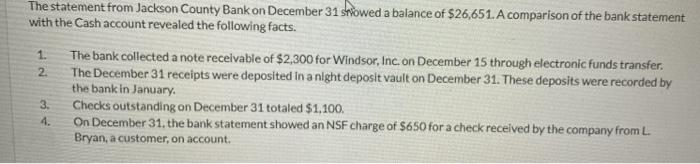

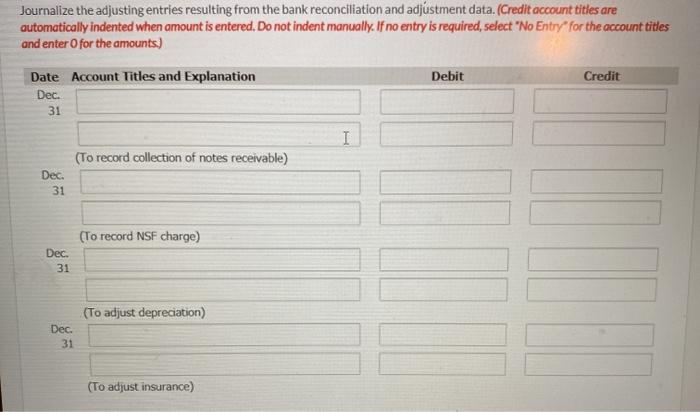

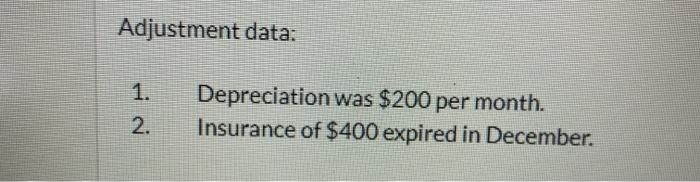

1. The statement from Jackson County Bank on December 31 showed a balance of $26,651. A comparison of the bank statement with the Cash account revealed the following facts. The bank collected a note receivable of $2,300 for Windsor, Inc. on December 15 through electronic funds transfer 2 The December 31 receipts were deposited in a night deposit vault on December 31. These deposits were recorded by the bank in January 3. Checks outstanding on December 31 totaled $1,100. On December 31, the bank statement showed an NSF charge of $650 for a check received by the company from L. Bryan, a customer, on account. 4. Journalize the adjusting entries resulting from the bank reconciliation and adjustment data. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31 1 (To record collection of notes receivable) Dec 31 (To record NSF charge) Dec. 31 (To adjust depreciation) Dec. 31 (To adjust insurance) Adjustment data: 1. Depreciation was $200 per month. Insurance of $400 expired in December. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts