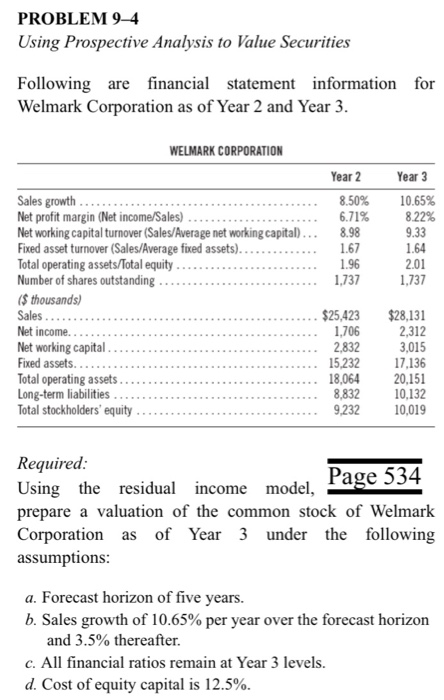

Question: Using Prospective Analysis to Value Securities Following are financial statement information for Welmark Corporation as of Year 2 and Year 3. Using the residual income

Using Prospective Analysis to Value Securities Following are financial statement information for Welmark Corporation as of Year 2 and Year 3. Using the residual income model, prepare a valuation of the common stock of Welmark Corporation as of Year 3 under the following assumptions: a. Forecast horizon of five years. b. Sales growth of 10.65% per year over the forecast horizon and 3.5% thereafter. c. All financial ratios remain at Year 3 levels. d. Cost of equity capital is 12.5%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock