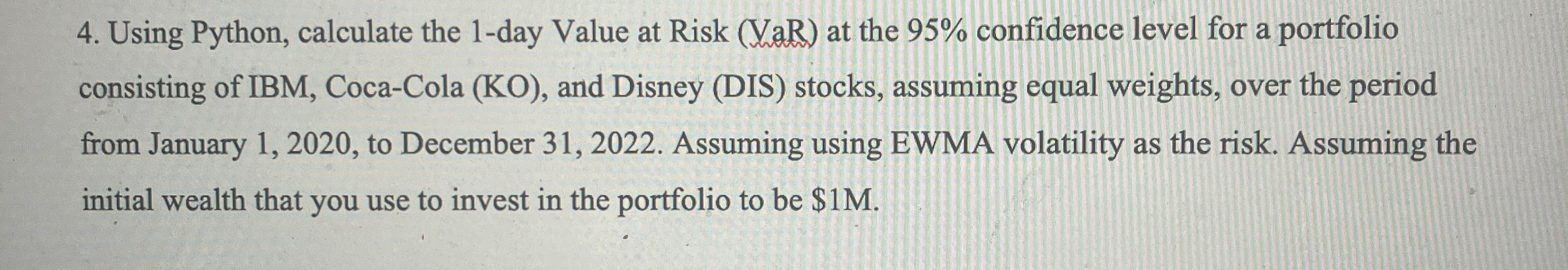

Question: Using Python, calculate the 1 - day Value at Risk ( VaR ) at the 9 5 % confidence level for a portfolio consisting of

Using Python, calculate the day Value at Risk VaR at the confidence level for a portfolio consisting of IBM, CocaCola KO and Disney DIS stocks, assuming equal weights, over the period from January to December Assuming using EWMA volatility as the risk. Assuming the initial wealth that you use to invest in the portfolio to be $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock