Question: Using quick books record this 1. Opening Trial Balance (March 31,2022) 2. Journal Entries (April 1- 28, 2022) 3. Trial Balance (March 31-April 28, 2022)

Using quick books record this

1. Opening Trial Balance (March 31,2022) 2. Journal Entries (April 1- 28, 2022) 3. Trial Balance (March 31-April 28, 2022) 4. Income Statement (Profit and Loss) March 31 - (April 28, 2022) 5. Balance Sheet As of (April 28, 2022) 6. Closing Entries (May 1, 2022) 7. Post- Closing Trial Balance (May 2, 2022)

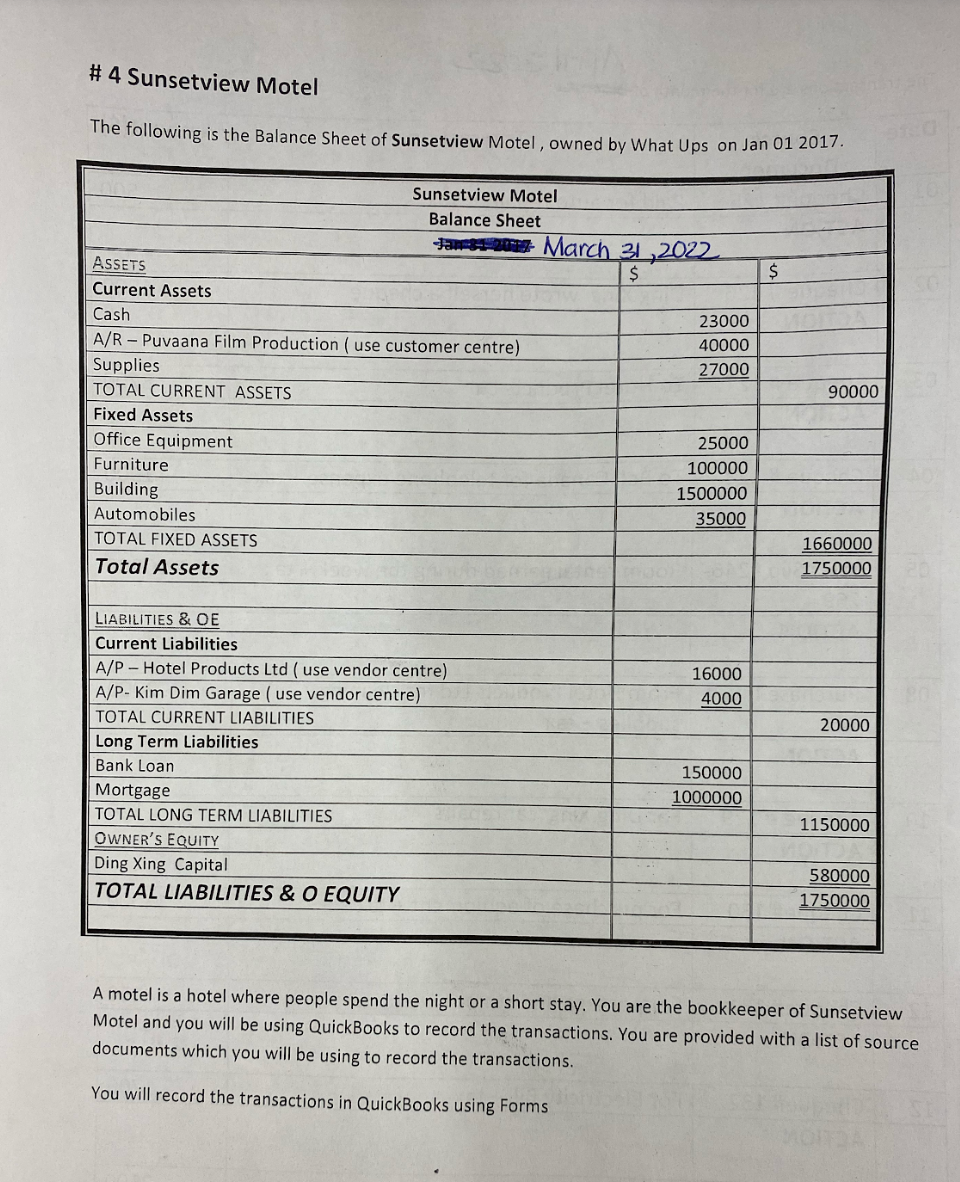

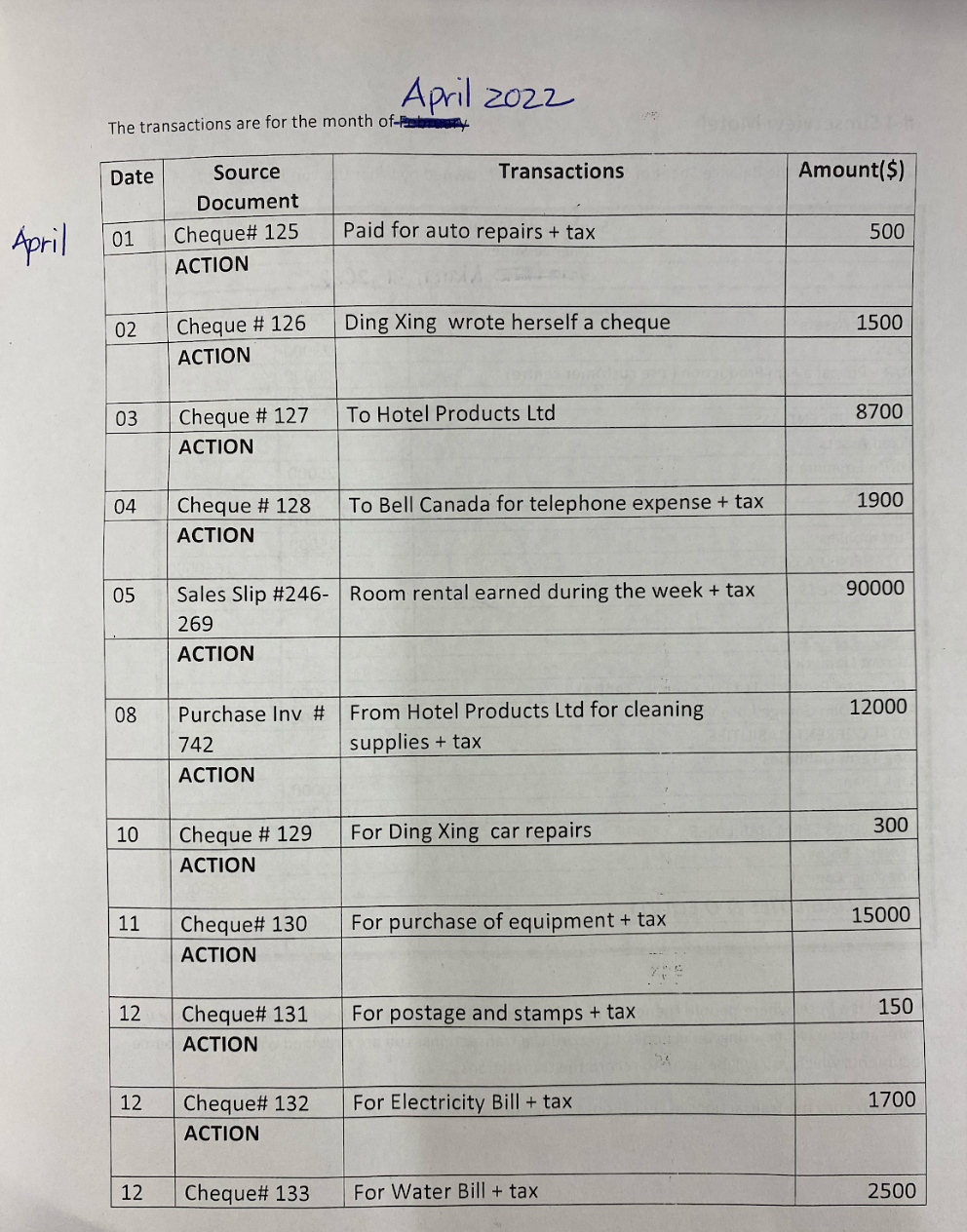

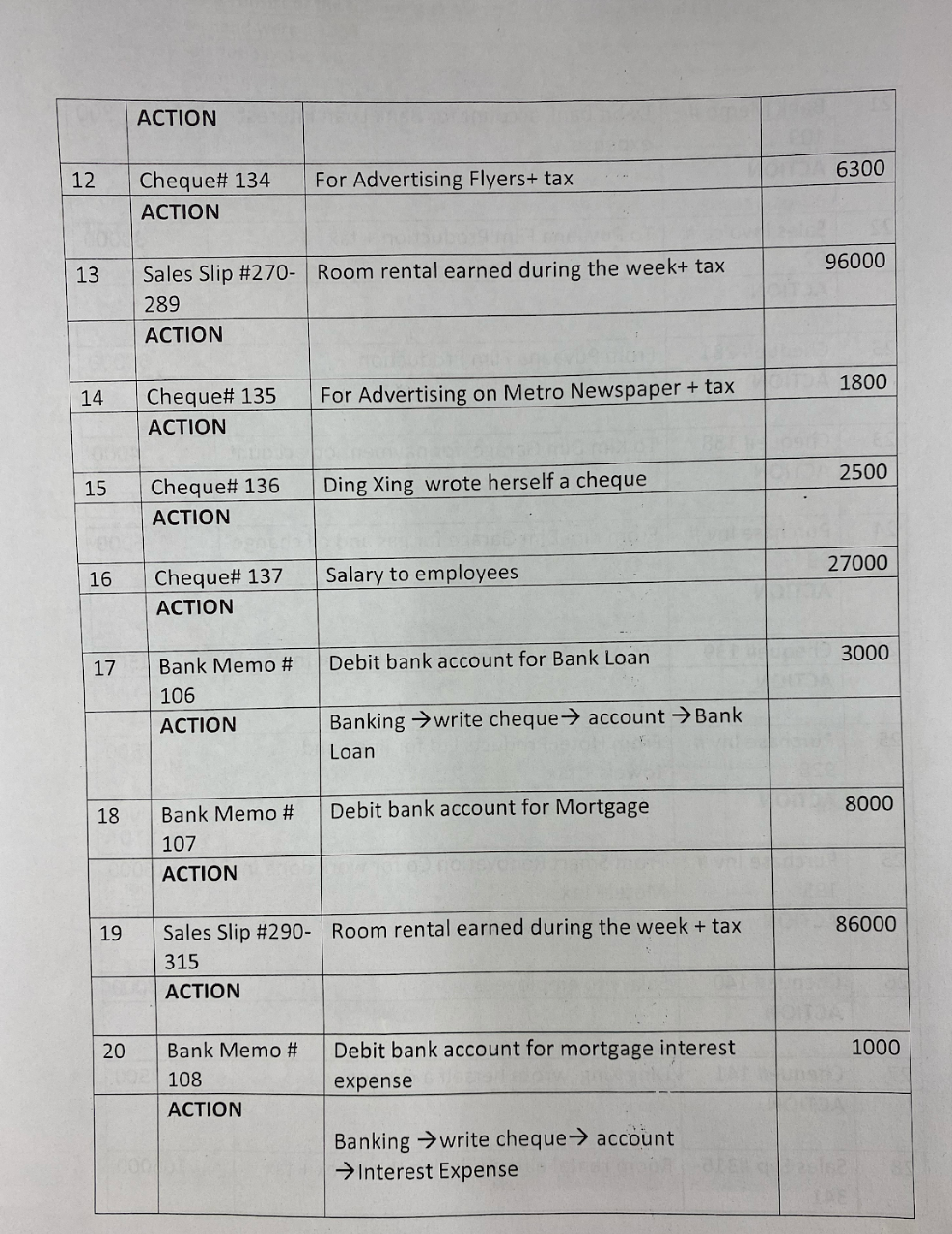

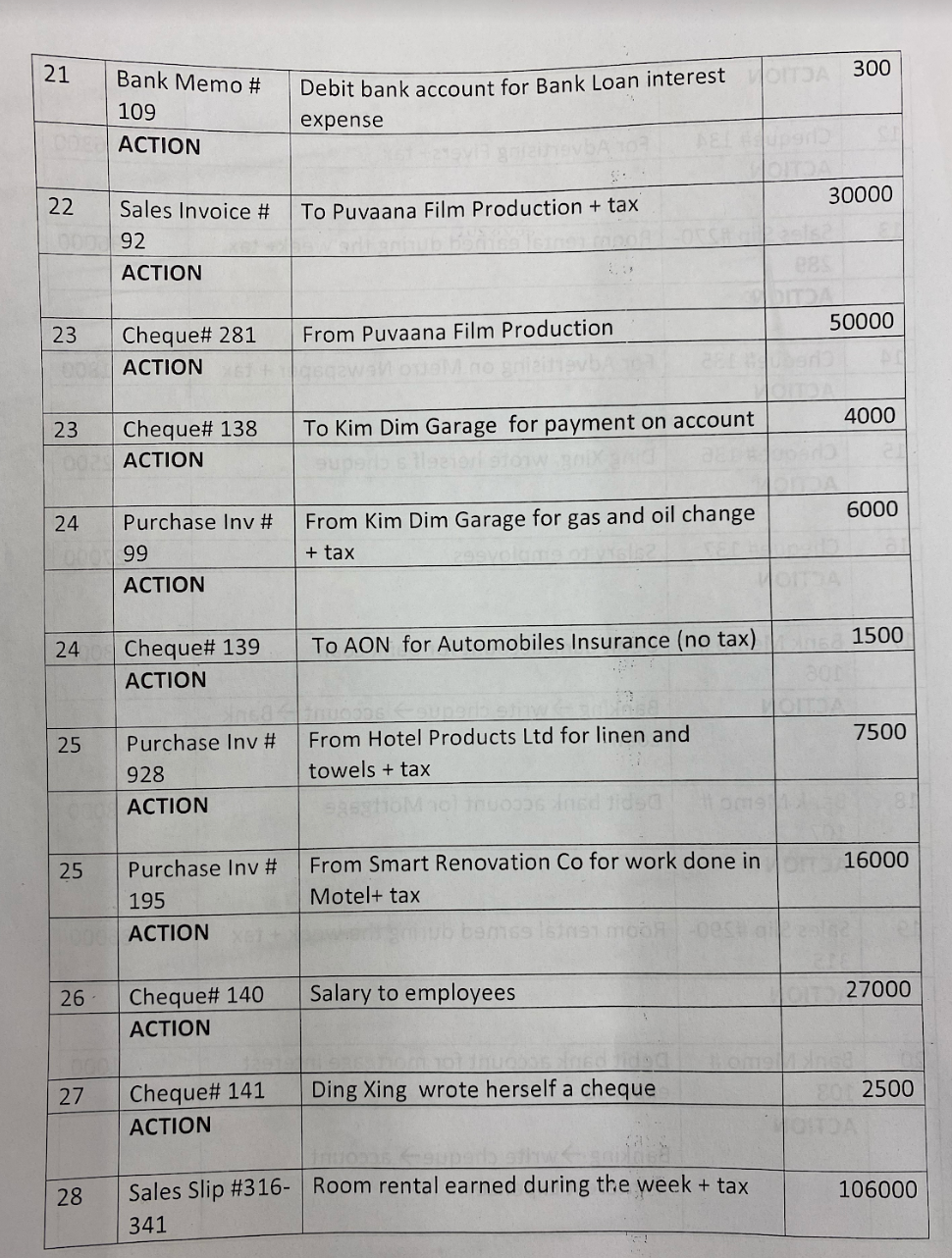

# 4 Sunsetview Motel The following is the Balance Sheet of Sunsetview Motel , owned by What Ups on Jan 01 2017. Sunsetview Motel Balance Sheet Jan 20 March 31 ,2022 ASSETS $ $ Current Assets Cash 23000 A/R - Puvaana Film Production ( use customer centre) 40000 Supplies 27000 90000 TOTAL CURRENT ASSETS Fixed Assets Office Equipment 25000 Furniture 100000 Building 1500000 Automobiles 35000 TOTAL FIXED ASSETS 1660000 Total Assets 1750000 LIABILITIES & OE Current Liabilities A/P - Hotel Products Ltd ( use vendor centre) 16000 A/P- Kim Dim Garage ( use vendor centre) 4000 TOTAL CURRENT LIABILITIES 20000 Long Term Liabilities Bank Loan 150000 Mortgage 1000000 TOTAL LONG TERM LIABILITIES 1150000 OWNER'S EQUITY Ding Xing Capital 580000 TOTAL LIABILITIES & O EQUITY 1750000 A motel is a hotel where people spend the night or a short stay. You are the bookkeeper of Sunsetview Motel and you will be using QuickBooks to record the transactions. You are provided with a list of source documents which you will be using to record the transactions. You will record the transactions in QuickBooks using FormsApril 2022 The transactions are for the month of-Fab Date Source Transactions Amount($) Document April 01 Cheque# 125 Paid for auto repairs + tax 500 ACTION 02 Cheque # 126 Ding Xing wrote herself a cheque 1500 ACTION 03 Cheque # 127 To Hotel Products Ltd 8700 ACTION 04 Cheque # 128 To Bell Canada for telephone expense + tax 1900 ACTION 05 Sales Slip #246- Room rental earned during the week + tax 90000 269 ACTION 08 Purchase Inv # From Hotel Products Lid for cleaning 12000 742 supplies + tax ACTION 10 Cheque # 129 For Ding Xing car repairs 300 ACTION 11 Cheque# 130 For purchase of equipment + tax 15000 ACTION 12 Cheque# 131 For postage and stamps + tax 150 ACTION 12 Cheque# 132 For Electricity Bill + tax 1700 ACTION 12 Cheque# 133 For Water Bill + tax 2500ACTION 12 Cheque# 134 For Advertising Flyers+ tax . . . 6300 ACTION 13 Sales Slip #270- | Room rental earned during the week+ tax 96000 289 ACTION 14 Cheque# 135 For Advertising on Metro Newspaper + tax 1800 ACTION 15 Cheque# 136 Ding Xing wrote herself a cheque 2500 ACTION 16 Cheque# 137 Salary to employees 27000 ACTION 17 Bank Memo # Debit bank account for Bank Loan 3000 106 ACTION Banking > write cheque > account > Bank Loan 18 Bank Memo # Debit bank account for Mortgage 8000 107 ACTION 19 Sales Slip #290- | Room rental earned during the week + tax 86000 315 ACTION 20 Bank Memo # Debit bank account for mortgage interest 1000 108 expense ACTION Banking > write cheque > account Interest Expense21 Bank Memo # Debit bank account for Bank Loan interest OITSA 300 109 expense ACTION 22 Sales Invoice # To Puvaana Film Production + tax 30000 92 ACTION E. : legs 23 Cheque# 281 From Puvaana Film Production 50000 ACTION 23 Cheque# 138 To Kim Dim Garage for payment on account 4000 ACTION 24 Purchase Inv # From Kim Dim Garage for gas and oil change 6000 99 + tax ACTION 24 Cheque# 139 TO AON for Automobiles Insurance (no tax) 1500 ACTION 25 Purchase Inv # From Hotel Products Ltd for linen and 7500 928 towels + tax ACTION asghoMao) tuomas And didsd tome 81 25 Purchase Inv # From Smart Renovation Co for work done in 16000 195 Motel+ tax ACTION ub bemiss lainen moon -bestial 26 . Cheque# 140 Salary to employees 27000 ACTION 27 Cheque# 141 Ding Xing wrote herself a cheque 80 2500 ACTION OITDA 28 Sales Slip #316- |Room rental earned during the week + tax 106000 341