Question: USING R STUDIO 4. Use the following data to answer this question: We anticipate that there is a 15% chance that next years stock returns

USING R STUDIO

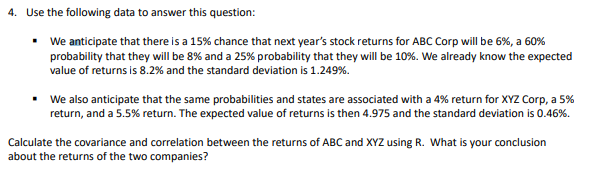

4. Use the following data to answer this question:

We anticipate that there is a 15% chance that next years stock returns for ABC Corp will be 6%, a 60% probability that they will be 8% and a 25% probability that they will be 10%. We already know the expected value of returns is 8.2% and the standard deviation is 1.249%.

We also anticipate that the same probabilities and states are associated with a 4% return for XYZ Corp, a 5% return, and a 5.5% return. The expected value of returns is then 4.975 and the standard deviation is 0.46%.

Calculate the covariance and correlation between the returns of ABC and XYZ using R. What is your conclusion about the returns of the two companies?

4. Use the following data to answer this question: We anticipate that there is a 15% chance that next year's stock returns for ABC Corp will be 6%, a 60% probability that they will be 8% and a 25% probability that they will be 10%. We already know the expected value of returns is 8.2% and the standard deviation is 1.249%. We also anticipate that the same probabilities and states are associated with a 4% return for XYZ Corp, a 5% return, and a 5.5% return. The expected value of returns is then 4.975 and the standard deviation is 0.46%. Calculate the covariance and correlation between the returns of ABC and XYZ using R. What is your conclusion about the returns of the two companies? 4. Use the following data to answer this question: We anticipate that there is a 15% chance that next year's stock returns for ABC Corp will be 6%, a 60% probability that they will be 8% and a 25% probability that they will be 10%. We already know the expected value of returns is 8.2% and the standard deviation is 1.249%. We also anticipate that the same probabilities and states are associated with a 4% return for XYZ Corp, a 5% return, and a 5.5% return. The expected value of returns is then 4.975 and the standard deviation is 0.46%. Calculate the covariance and correlation between the returns of ABC and XYZ using R. What is your conclusion about the returns of the two companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts