Question: Using ratio analysis to complete a financial statement Given the following data, reconstruct the balance sheet and income statement of Lovely Company for the year

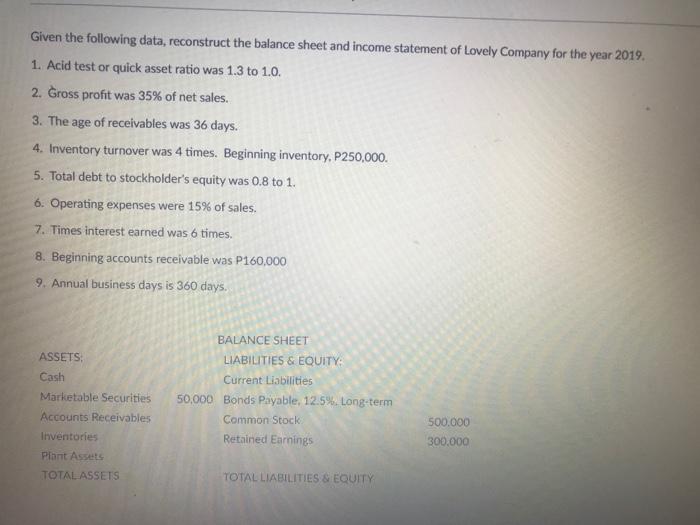

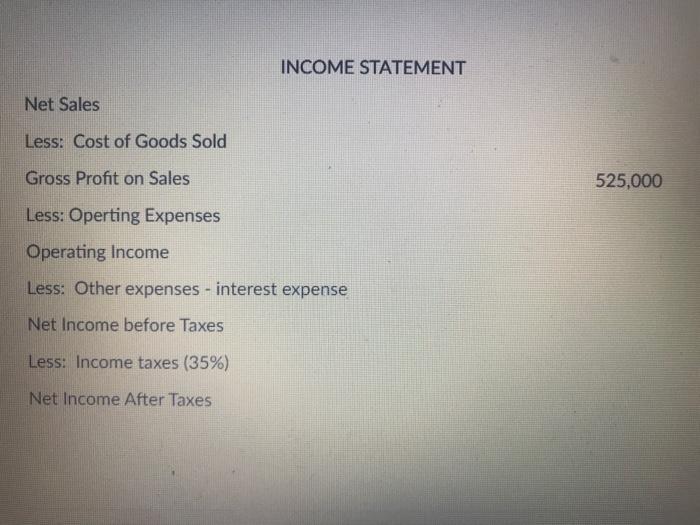

Given the following data, reconstruct the balance sheet and income statement of Lovely Company for the year 2019. 1. Acid test or quick asset ratio was 1.3 to 1.0. 2. Gross profit was 35% of net sales. 3. The age of receivables was 36 days. 4. Inventory turnover was 4 times. Beginning inventory, P250,000. 5. Total debt to stockholder's equity was 0.8 to 1. 6. Operating expenses were 15% of sales. 7. Times interest earned was 6 times. 8. Beginning accounts receivable was P160,000 9. Annual business days is 360 days. ASSETS Cash Marketable Securities Accounts Receivables BALANCE SHEET LIABILITIES & EQUITY Current Liabilities 50,000 Bonds Payable, 12.5%. Long-term Common Stock Retained Earnings Inventories 500.000 300.000 Plant Assets TOTAL ASSETS TOTAL LIABILITIES & EQUITY INCOME STATEMENT Net Sales Less: Cost of Goods Sold Gross Profit on Sales 525,000 Less: Operting Expenses Operating Income Less: Other expenses - interest expense Net Income before Taxes Less: Income taxes (35%) Net Income After Taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts