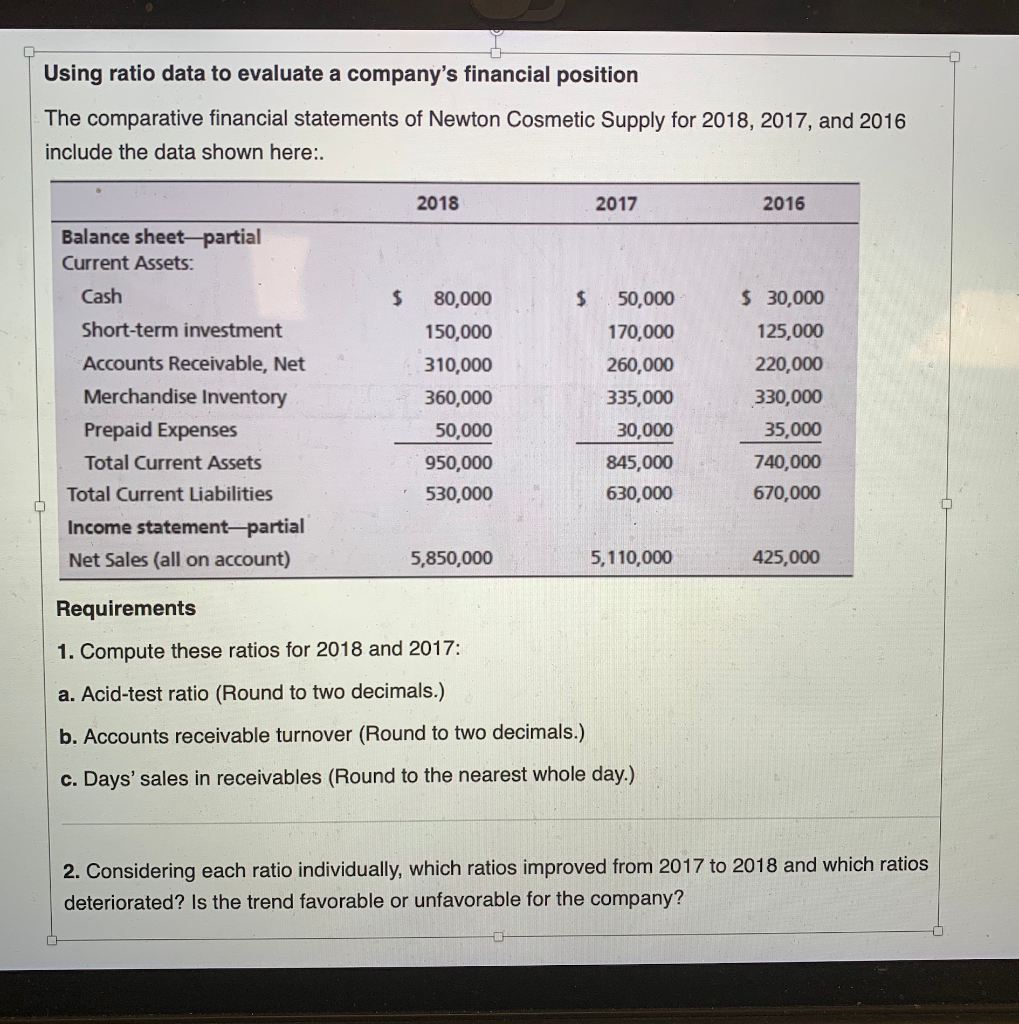

Question: Using ratio data to evaluate a company's financial position The comparative financial statements of Newton Cosmetic Supply for 2018, 2017, and 2016 include the data

Using ratio data to evaluate a company's financial position The comparative financial statements of Newton Cosmetic Supply for 2018, 2017, and 2016 include the data shown here:. 2018 2017 2016 Balance sheet-partial Current Assets: Cash Short-term investment Accounts Receivable, Net Merchandise Inventory Prepaid Expenses Total Current Assets Total Current Liabilities Income statement-partial Net Sales (all on account) 80,000 150,000 310,000 360,000 50,000 950,000 530,000 50,000 170,000 260,000 335,000 30,000 845,000 630,000 $ 30,000 125,000 220,000 330,000 35,000 740,000 670,000 5,850,000 5,110,000 425,000 Requirements 1. Compute these ratios for 2018 and 2017: a. Acid-test ratio (Round to two decimals.) b. Accounts receivable turnover (Round to two decimals.) c. Days' sales in receivables (Round to the nearest whole day.) 2. Considering each ratio individually, which ratios improved from 2017 to 2018 and which ratios deteriorated? Is the trend favorable or unfavorable for the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts