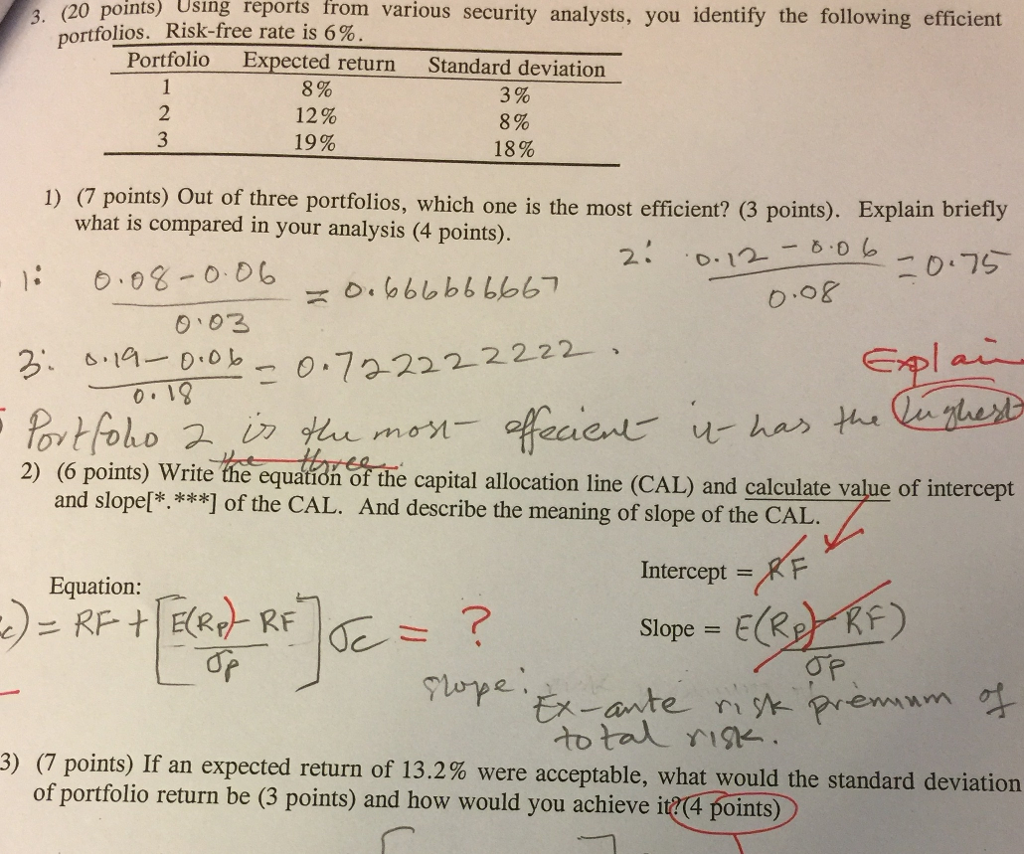

Question: Using reports from various security analysts, you identify the following efficient portfolios. Risk-free rate is 6%. Out of three portfolios, which one is the most

Using reports from various security analysts, you identify the following efficient portfolios. Risk-free rate is 6%. Out of three portfolios, which one is the most efficient?. Explain briefly what is compared in your analysis. Write of the capital allocation line (CAL) and calculate value of intercept and slope[*, ***] of the CAL. And describe the meaning of slope of the CAL. If an expected return of 13.2% were acceptable, what would the standard deviation of portfolio return be and how would you achieve it

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock