Question: using sage 50 2019 Continue with the journal entries for the June 7 session date. Payment Cheque #488 Dated June 5, 2021 To Red Deer

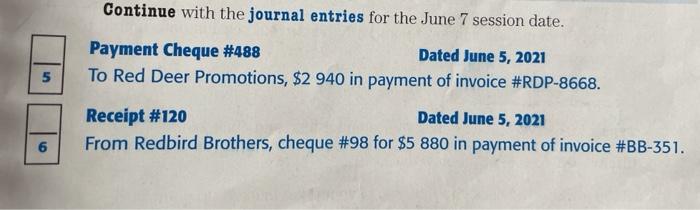

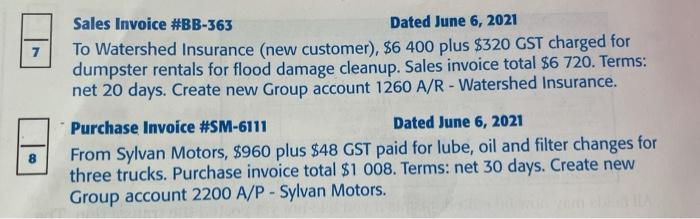

Continue with the journal entries for the June 7 session date. Payment Cheque #488 Dated June 5, 2021 To Red Deer Promotions, $2 940 in payment of invoice #RDP-8668. 5 Receipt #120 Dated June 5, 2021 From Redbird Brothers, cheque #98 for $5 880 in payment of invoice #BB-351. 6 7 Sales Invoice #BB-363 Dated June 6, 2021 To Watershed Insurance (new customer), $6 400 plus $320 GST charged for dumpster rentals for flood damage cleanup. Sales invoice total $6 720. Terms: net 20 days. Create new Group account 1260 A/R - Watershed Insurance. Purchase Invoice #SM-6111 Dated June 6, 2021 From Sylvan Motors, $960 plus $48 GST paid for lube, oil and filter changes for three trucks. Purchase invoice total $1 008. Terms: net 30 days. Create new Group account 2200 A/P - Sylvan Motors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts