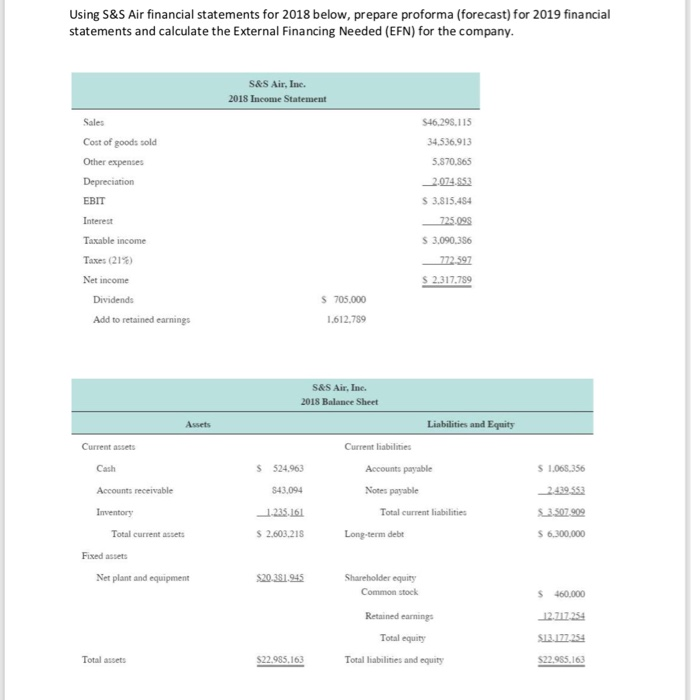

Question: Using S&S Air financial statements for 2018 below, prepare proforma (forecast) for 2019 financial statements and calculate the External Financing Needed (EFN) for the company.

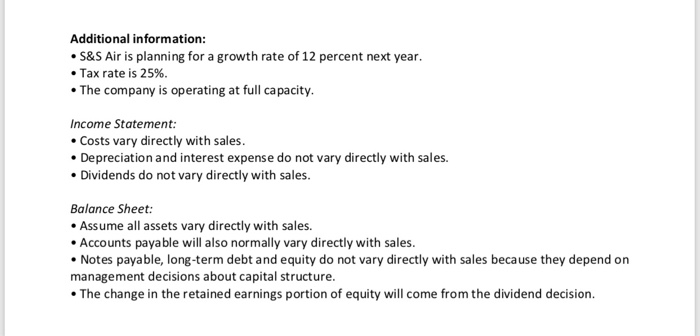

Using S&S Air financial statements for 2018 below, prepare proforma (forecast) for 2019 financial statements and calculate the External Financing Needed (EFN) for the company. S&S Air, Inc 2018 Income Statement Sales $46,298.115 Cost of goods sold 34,536,913 Other expenses 5,870.865 Depreciation 2074.853 $ 3.815.484 EBIT Interest 725.098 S 3,090.386 Taxable income 772 597 Taxes (21%) $ 2.317.799 Net income s 705,000 Dividends Add to retained earnings 1.612.789 S&S Air. Inc 2018 Balance Sheet Liabilities and Equity Assets Current assets Current liabilities S 524,963 S 1,068.356 Cash Accounts payable 2.439 553 Notes payable Accounts receivable S43,094 S3.507.909 Inventory 1235.161 Total current liabilities $ 2.603,21S Total current assets Long-term debt $ 6300.000 Fixed assets Shareholder equity Net plant and equipment $20.351.945 Common stock S 460,000 Retained earnings 12.717.254 Total equity S13.177.254 Total assets $22.985,163 Total liabilities and equity $22.985.163 Additional information: S&S Air is planning for a growth rate of 12 percent next year. Tax rate is 25%. The company is operating at full capacity Income Statement: Costs vary directly with sales Depreciation and interest expense do not vary directly with sales. Dividends do not vary directly with sales Balance Sheet: Assume all assets vary directly with sales. Accounts paya ble will also normally vary directly with sales. Notes paya ble, long-term debt and equity do not vary directly with sales because they depend on management decisions about capital structure. The change in the retained earnings portion of equity will come from the dividend decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts