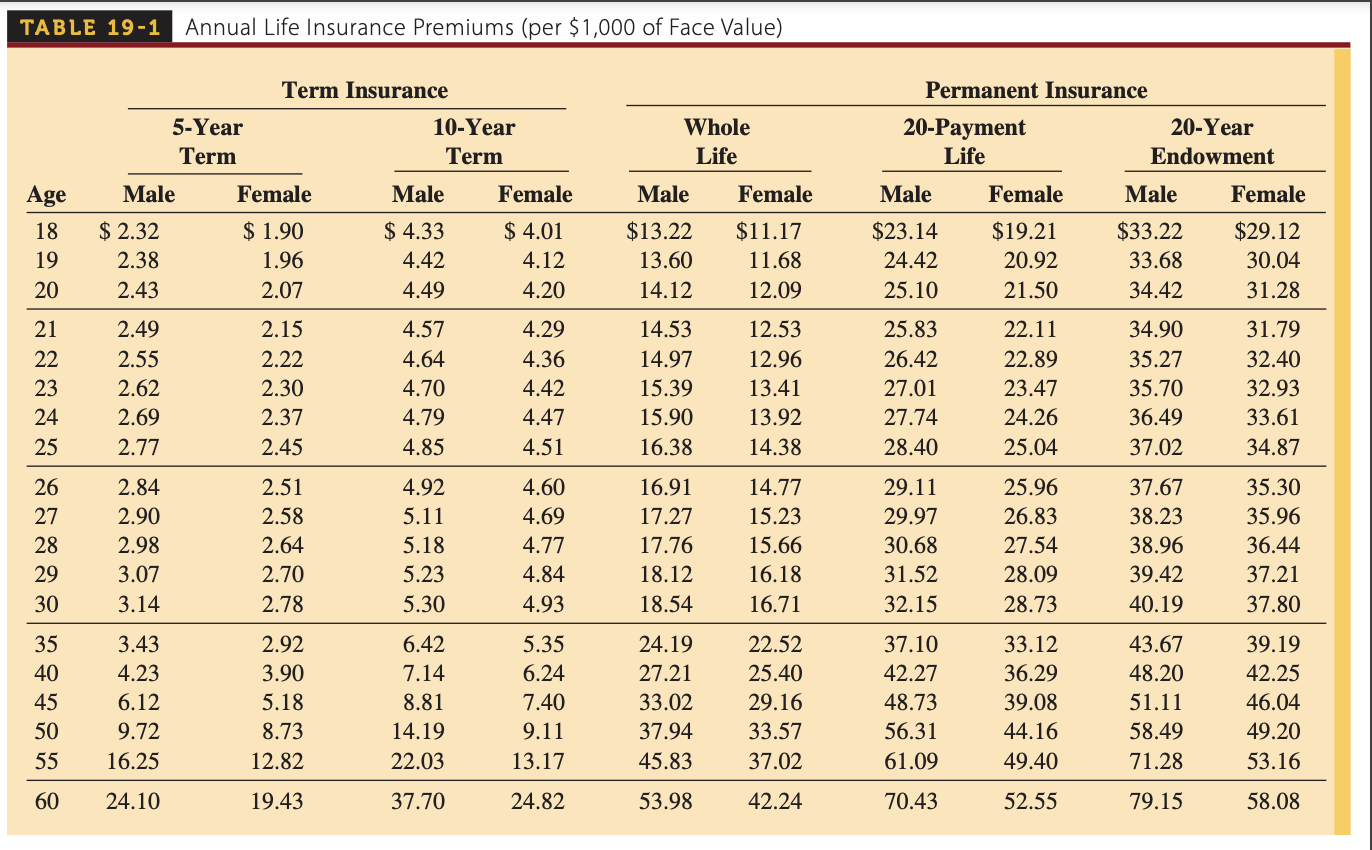

Question: Using Table 1 9 - 1 and Table 1 9 - 2 , calculate the annual, semiannual, quarterly, and monthly premiums ( in $ )

Using Table and Table calculate the annual, semiannual, quarterly, and monthly premiums in $ for the life insurance policy. Round your answers to the nearest cent.

Face Value

of PolicySex and Age

of InsuredType of PolicyAnnual

PremiumSemiannual

PremiumQuarterly

PremiumMonthly

Premium$malewhole life$ $ $ $ TABLE quad Annual Life Insurance Premiums per $ of Face Value

begintabularccccccccccc

hline multirowbAge & multicolumncTerm Insurance & multicolumncPermanent Insurance

hline & multicolumncbegintabularl

Year

Term

endtabular & multicolumncYear Term & multicolumncbegintabularl

Whole

Life

endtabular & multicolumnlPayment Life & multicolumnlbegintabularl

Year

Endowment

endtabular

hline & Male & Female & Male & Female & Male & Female & Male & Female & Male & Female

hline & $ & $ & $ & $ & $ & $ & $ & $ & $ & $

hline & & & & & & & & & &

hline & & & & & & & & & &

hline & & & & & & & & & &

hline & & & & & & & & & &

hline & & & & & & & & & &

hline & & & & & & & & & &

hline & & & & & & & & & &

hline & & & & & & & & & &

hline & & & & & & & & & &

hline & & & & & & & & & &

hline & & & & & & & & & &

hline & & & & & & & & & &

hline & & & & & & & & & &

hline & & & & & & & & & &

hline & & & & & & & & & &

hline & & & & & & & & & &

hline & & & & & & & & & &

hline & & & & & & & & & &

hline

endtabular TABLE

Life InsurancePremium Factors

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock