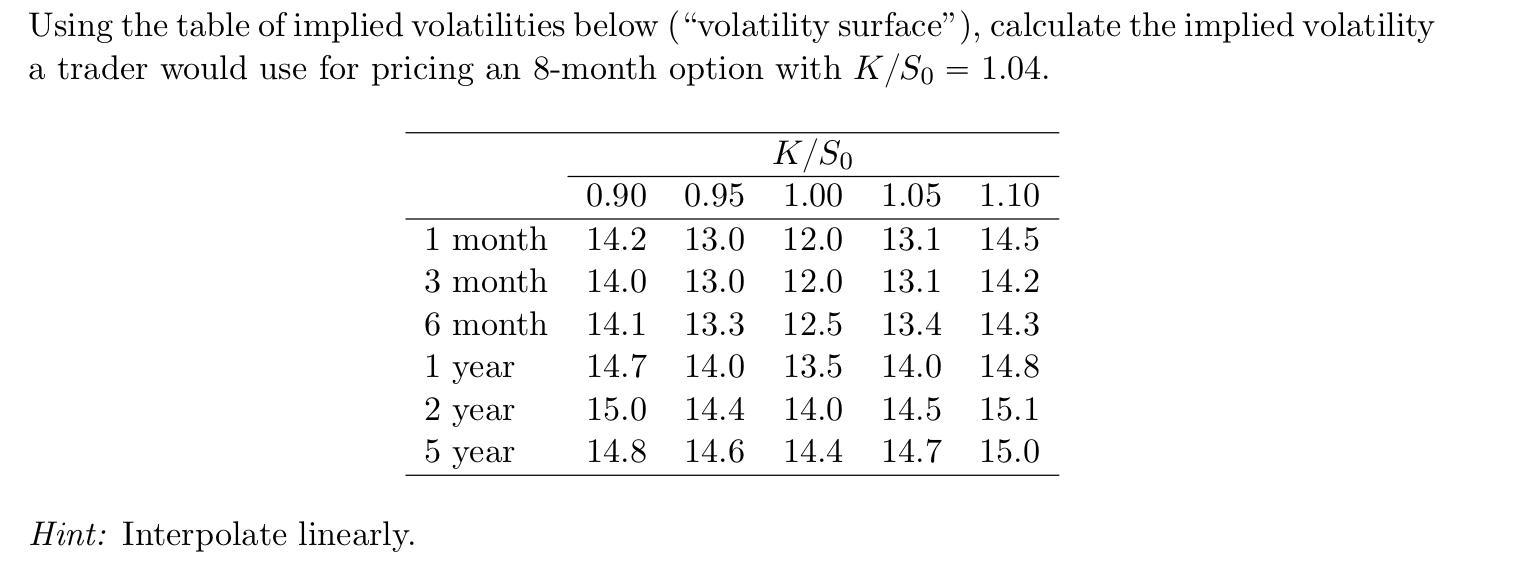

Question: Using the table of implied volatilities below (volatility surface), calculate the implied volatility a trader would use for pricing an 8-month option with K/S0

Using the table of implied volatilities below ("volatility surface"), calculate the implied volatility a trader would use for pricing an 8-month option with K/S0 = 1.04. Hint: Interpolate linearly. 1 month 3 month 6 month 1 year 2 year 5 year K/So 0.90 0.95 1.00 1.05 1.10 14.2 13.0 12.0 14.0 13.0 12.0 13.1 14.1 13.3 12.5 13.4 14.7 14.0 13.5 14.0 15.0 14.4 14.0 14.5 14.8 14.6 14.4 14.7 13.1 14.5 14.2 14.3 14.8 15.1 15.0

Step by Step Solution

There are 3 Steps involved in it

Here are the steps The option expires in 8 months The closest expiration times in the table ... View full answer

Get step-by-step solutions from verified subject matter experts