Question: Using the 10 transactions create 10 adjusting journal entries using the correct Debit and Credit ADJUSTING JOURNAL ENTRIES: NOTE: Assume that all prior regular journal

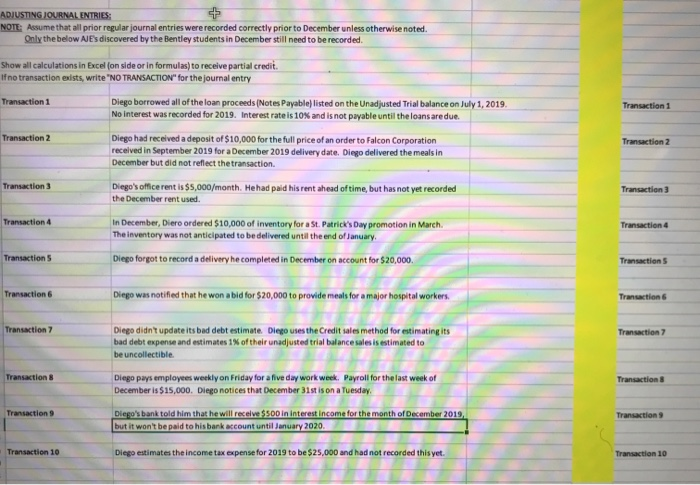

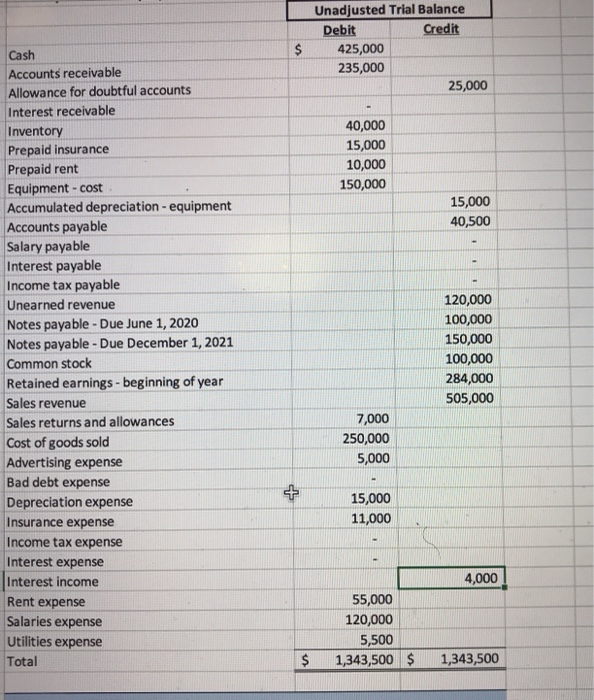

ADJUSTING JOURNAL ENTRIES: NOTE: Assume that all prior regular journal entries were recorded correctly prior to December unless otherwise noted. Only the below AJE's discovered by the Bentley students in December still need to be recorded. Transaction 1 Transaction 2 Show all calculations in Excel (on side or in formulas) to receive partial credit. If no transaction exists, write "NO TRANSACTION" for the journal entry Transaction 1 Diego borrowed all of the loan proceeds (Notes Payable) listed on the Unadjusted Trial balance on July 1, 2019. No interest was recorded for 2019. Interest rate is 10% and is not payable until the loans are due. Transaction 2 Diego had received a deposit of $10,000 for the full price of an order to Falcon Corporation received in September 2019 for a December 2019 delivery date. Diego delivered the meals in December but did not reflect the transaction Transaction 3 Diego's office rent is $5,000/month. He had paid his rent ahead of time, but has not yet recorded the December rent used. Transaction 4 In December, Diero ordered $10,000 of inventory for a St. Patrick's Day promotion in March. The inventory was not anticipated to be delivered until the end of January Transactions Diego forgot to record a delivery he completed in December on account for $20,000, Transaction 3 Transaction 4 Transactions Transactions Diego Was notified that he won a bid for $20,000 to provide meals for a major hospital workers. Transaction 6 Transaction 7 Transaction 7 Transactions Diego didn't update its bad debt estimate Diego uses the Credit sales method for estimating its bad debt expense and estimates 1% of their unadjusted trial balance sales is estimated to be uncollectible Diego pays employees weekly on Friday for a five day work week. Payroll for the last week of December is $15,000. Diego notices that December 31st is on a Tuesday, Diego's bank told him that he will receive $500 in interest income for the month of December 2019, but it won't be paid to his bank account until January 2020. Transaction Transaction 9 Transactions Transaction 10 Diego estimates the income tax expense for 2019 to be $25,000 and had not recorded this yet. Transaction 10 $ Unadjusted Trial Balance Debit Credit 425,000 235,000 25,000 40,000 15,000 10,000 150,000 15,000 40,500 - Cash Accounts receivable Allowance for doubtful accounts Interest receivable Inventory Prepaid insurance Prepaid rent Equipment -cost Accumulated depreciation - equipment Accounts payable Salary payable Interest payable Income tax payable Unearned revenue Notes payable - Due June 1, 2020 Notes payable - Due December 1, 2021 Common stock Retained earnings - beginning of year Sales revenue Sales returns and allowances Cost of goods sold Advertising expense Bad debt expense Depreciation expense Insurance expense Income tax expense Interest expense Interest income Rent expense Salaries expense Utilities expense Total 120,000 100,000 150,000 100,000 284,000 505,000 7,000 250,000 5,000 + 15,000 11,000 4,000 55,000 120,000 5,500 1,343,500 $ $ 1,343,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts