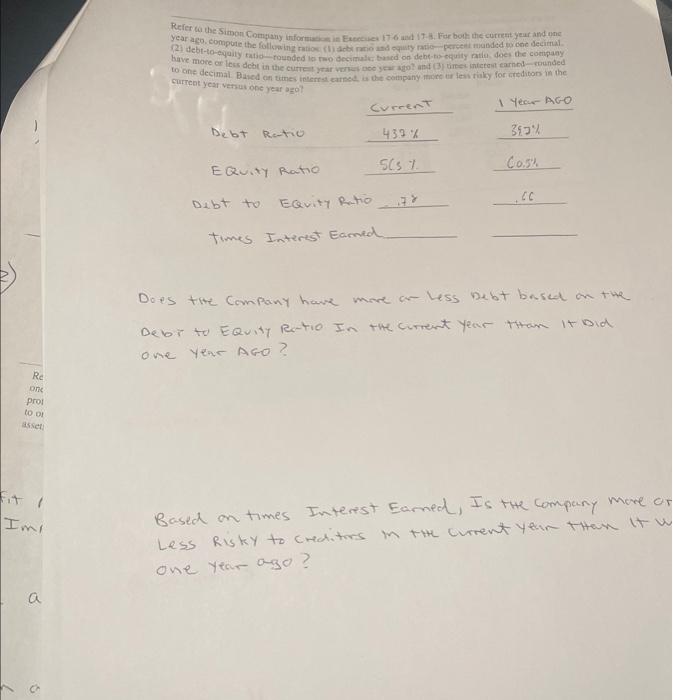

Question: Using the 2 excercises below, calculate times interest earned and answer the two questions beneath it. cournent year verwut one year azo? Does the Company

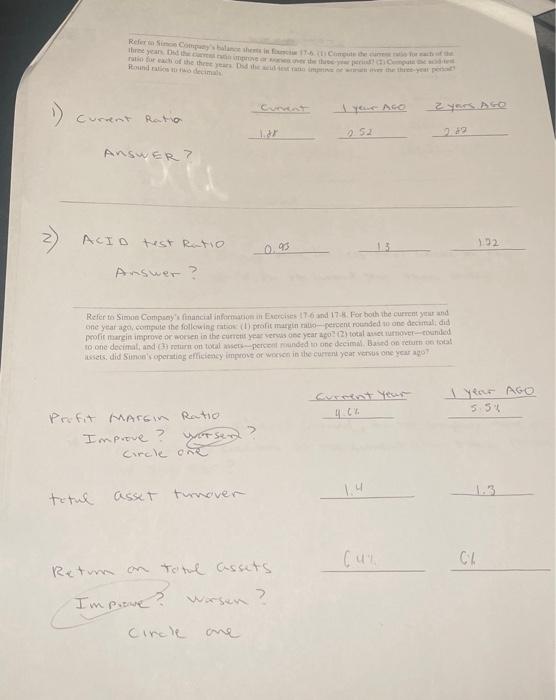

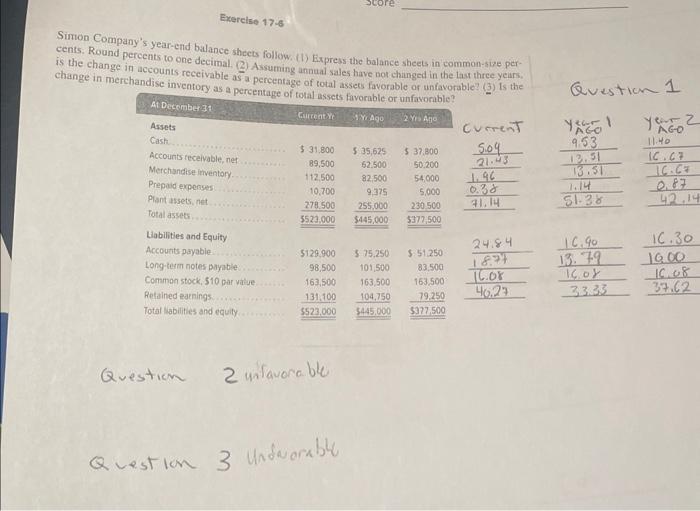

cournent year verwut one year azo? Does the Company have mare ar less bebt basid on the Debir to EQuity Re-tio. In the current year than it Did one Yene AGO? Based on times Interest Eanned, Is the Company more or Less Risky to creditors in the curent yeir than it h one year ago? 1) Curant Ratio Answer? 2) ACIO test Rutio 0.95 13 Answer? Simon Company's year-end balance shects follow. (1) Express the balance sheets in common-sive percents. Round percents to one decimal, (2) Assuming annual sales have not chringed in the thrt three yeurs, is the change in accounts receivable as a percentage of total assets favorable of unfavorable? (3) is the change in merchandise inventory as a percentama inf on..1 Curent 0.381.9621.435.09 40.2716.0818.7724.84 Question 2 uniavorable Question 3 Undwarable cournent year verwut one year azo? Does the Company have mare ar less bebt basid on the Debir to EQuity Re-tio. In the current year than it Did one Yene AGO? Based on times Interest Eanned, Is the Company more or Less Risky to creditors in the curent yeir than it h one year ago? 1) Curant Ratio Answer? 2) ACIO test Rutio 0.95 13 Answer? Simon Company's year-end balance shects follow. (1) Express the balance sheets in common-sive percents. Round percents to one decimal, (2) Assuming annual sales have not chringed in the thrt three yeurs, is the change in accounts receivable as a percentage of total assets favorable of unfavorable? (3) is the change in merchandise inventory as a percentama inf on..1 Curent 0.381.9621.435.09 40.2716.0818.7724.84 Question 2 uniavorable Question 3 Undwarable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts