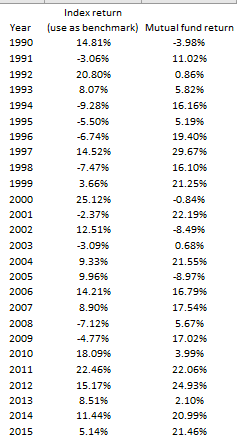

Question: Using the above data, answer the following questions, 1. 2. 3. 4. Year 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001

Using the above data, answer the following questions,

1.

2.

3.

4.

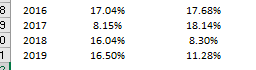

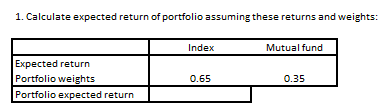

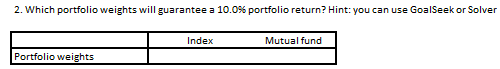

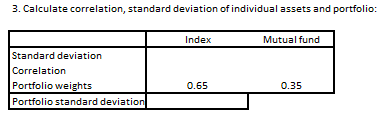

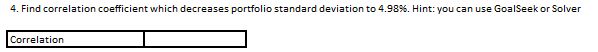

Year 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Index return (use as benchmark) Mutual fund return 14.81% -3.9896 -3.06% 11.0296 20.80% 0.8696 8.0796 5.8296 -9.2896 16.1696 -5.50% 5.1995 -6.74% 19.40% 14.5296 29.6796 -7.4796 16.1096 3.6696 21.2596 25.1296 -0.8496 -2.3796 22.1996 12.5196 -8.4996 -3.0996 0.6896 9.3396 21.5596 9.9696 -8.9796 14.2196 16.7996 8.9096 17.5496 -7.1296 5.6796 -4.7795 17.0296 18.0996 3.999 22.4696 22.06% 15.1796 24.9396 8.5196 2.1096 11.4496 20.9996 5.1496 21.4696 2015 8 3 1 2016 2017 2018 2019 17.0496 8.1596 16.0496 16.5096 % 17.6896 18.1496 8.30% 11.2896 1. Calculate expected return of portfolio assuming these returns and weights: Index Mutual fund Expected return Portfolio weights Portfolio expected return 0.65 0.35 2. Which portfolio weights will guarantee a 10.0% portfolio return? Hint: you can use GoalSeek or Solver Index Mutual fund Portfolio weights 3. Calculate correlation, standard deviation of individual assets and portfolio: Index Mutual fund Standard deviation Correlation Portfolio weights Portfolio Standard deviation 0.65 0.35 4. Find correlation coefficient which decreases portfolio standard deviation to 4.98%. Hint: you can use GoalSeek or Solver Correlation Year 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Index return (use as benchmark) Mutual fund return 14.81% -3.9896 -3.06% 11.0296 20.80% 0.8696 8.0796 5.8296 -9.2896 16.1696 -5.50% 5.1995 -6.74% 19.40% 14.5296 29.6796 -7.4796 16.1096 3.6696 21.2596 25.1296 -0.8496 -2.3796 22.1996 12.5196 -8.4996 -3.0996 0.6896 9.3396 21.5596 9.9696 -8.9796 14.2196 16.7996 8.9096 17.5496 -7.1296 5.6796 -4.7795 17.0296 18.0996 3.999 22.4696 22.06% 15.1796 24.9396 8.5196 2.1096 11.4496 20.9996 5.1496 21.4696 2015 8 3 1 2016 2017 2018 2019 17.0496 8.1596 16.0496 16.5096 % 17.6896 18.1496 8.30% 11.2896 1. Calculate expected return of portfolio assuming these returns and weights: Index Mutual fund Expected return Portfolio weights Portfolio expected return 0.65 0.35 2. Which portfolio weights will guarantee a 10.0% portfolio return? Hint: you can use GoalSeek or Solver Index Mutual fund Portfolio weights 3. Calculate correlation, standard deviation of individual assets and portfolio: Index Mutual fund Standard deviation Correlation Portfolio weights Portfolio Standard deviation 0.65 0.35 4. Find correlation coefficient which decreases portfolio standard deviation to 4.98%. Hint: you can use GoalSeek or Solver Correlation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts