Question: Using the above spreadsheet data, value the property, restructure the loan, and fill in all of the blanks. Include a brief executive summary including quantitative

Using the above spreadsheet data, value the property, restructure the loan, and fill in all of the blanks. Include a brief executive summary including quantitative analysis, terms and conditions suggested for the loan, and conclusions .

Using the above spreadsheet data, value the property, restructure the loan, and fill in all of the blanks. Include a brief executive summary including quantitative analysis, terms and conditions suggested for the loan, and conclusions .

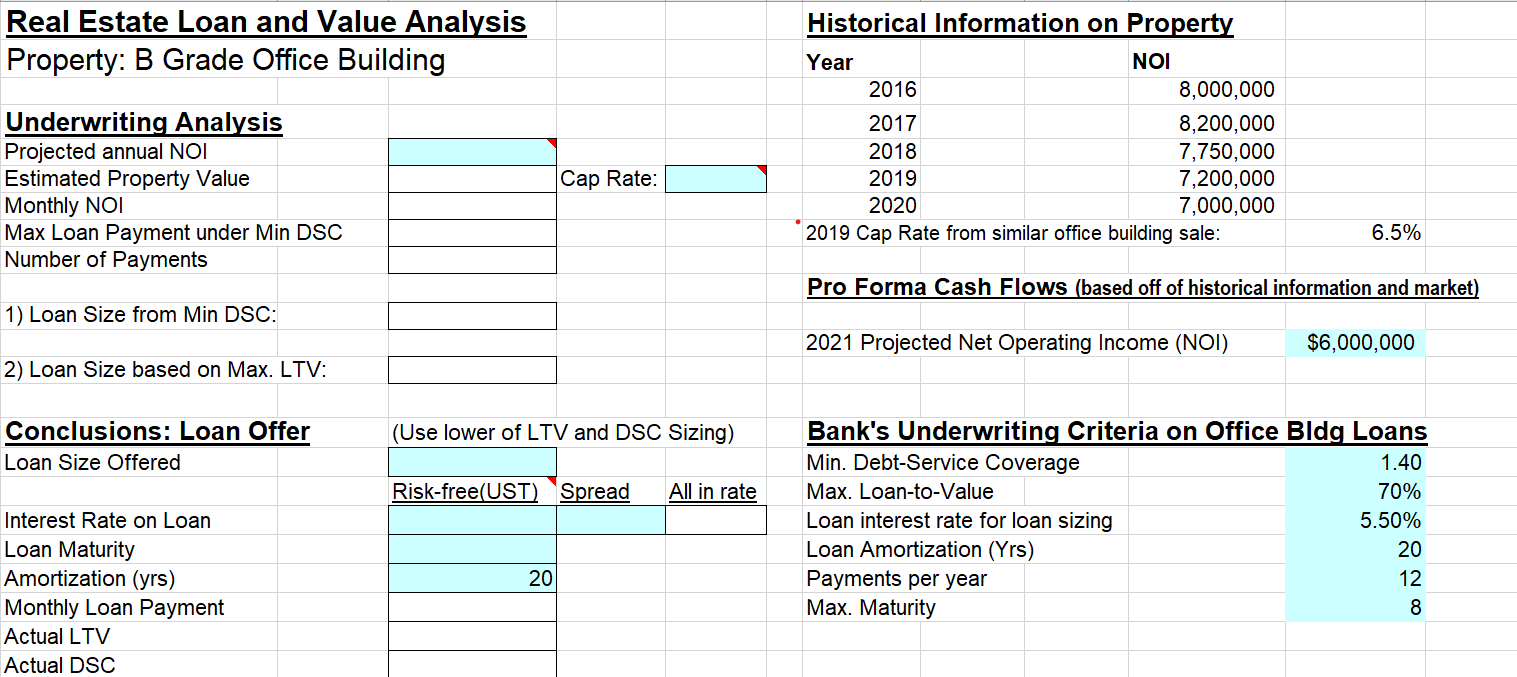

Real Estate Loan and Value Analysis Property: B Grade Office Building Underwriting Analysis Projected annual NOI Estimated Property Value Monthly NOI Max Loan Payment under Min DSC Number of Payments Historical Information on Property Year NOI 2016 8,000,000 2017 8,200,000 2018 7,750,000 2019 7,200,000 2020 7,000,000 2019 Cap Rate from similar office building sale: Cap Rate: 6.5% Pro Forma Cash Flows (based off of historical information and market) 1) Loan Size from Min DSC: 2021 Projected Net Operating Income (NOI) $6,000,000 2) Loan Size based on Max. LTV: (Use lower of LTV and DSC Sizing) Conclusions: Loan Offer Loan Size Offered Risk-free(UST) Spread All in rate Bank's Underwriting Criteria on Office Bldg Loans Min. Debt-Service Coverage 1.40 Max. Loan-to-Value 70% Loan interest rate for loan sizing 5.50% Loan Amortization (Yrs) 20 Payments per year 12 Max. Maturity 8 Interest Rate on Loan Loan Maturity Amortization (yrs) Monthly Loan Payment Actual LTV Actual DSC 20 Real Estate Loan and Value Analysis Property: B Grade Office Building Underwriting Analysis Projected annual NOI Estimated Property Value Monthly NOI Max Loan Payment under Min DSC Number of Payments Historical Information on Property Year NOI 2016 8,000,000 2017 8,200,000 2018 7,750,000 2019 7,200,000 2020 7,000,000 2019 Cap Rate from similar office building sale: Cap Rate: 6.5% Pro Forma Cash Flows (based off of historical information and market) 1) Loan Size from Min DSC: 2021 Projected Net Operating Income (NOI) $6,000,000 2) Loan Size based on Max. LTV: (Use lower of LTV and DSC Sizing) Conclusions: Loan Offer Loan Size Offered Risk-free(UST) Spread All in rate Bank's Underwriting Criteria on Office Bldg Loans Min. Debt-Service Coverage 1.40 Max. Loan-to-Value 70% Loan interest rate for loan sizing 5.50% Loan Amortization (Yrs) 20 Payments per year 12 Max. Maturity 8 Interest Rate on Loan Loan Maturity Amortization (yrs) Monthly Loan Payment Actual LTV Actual DSC 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts