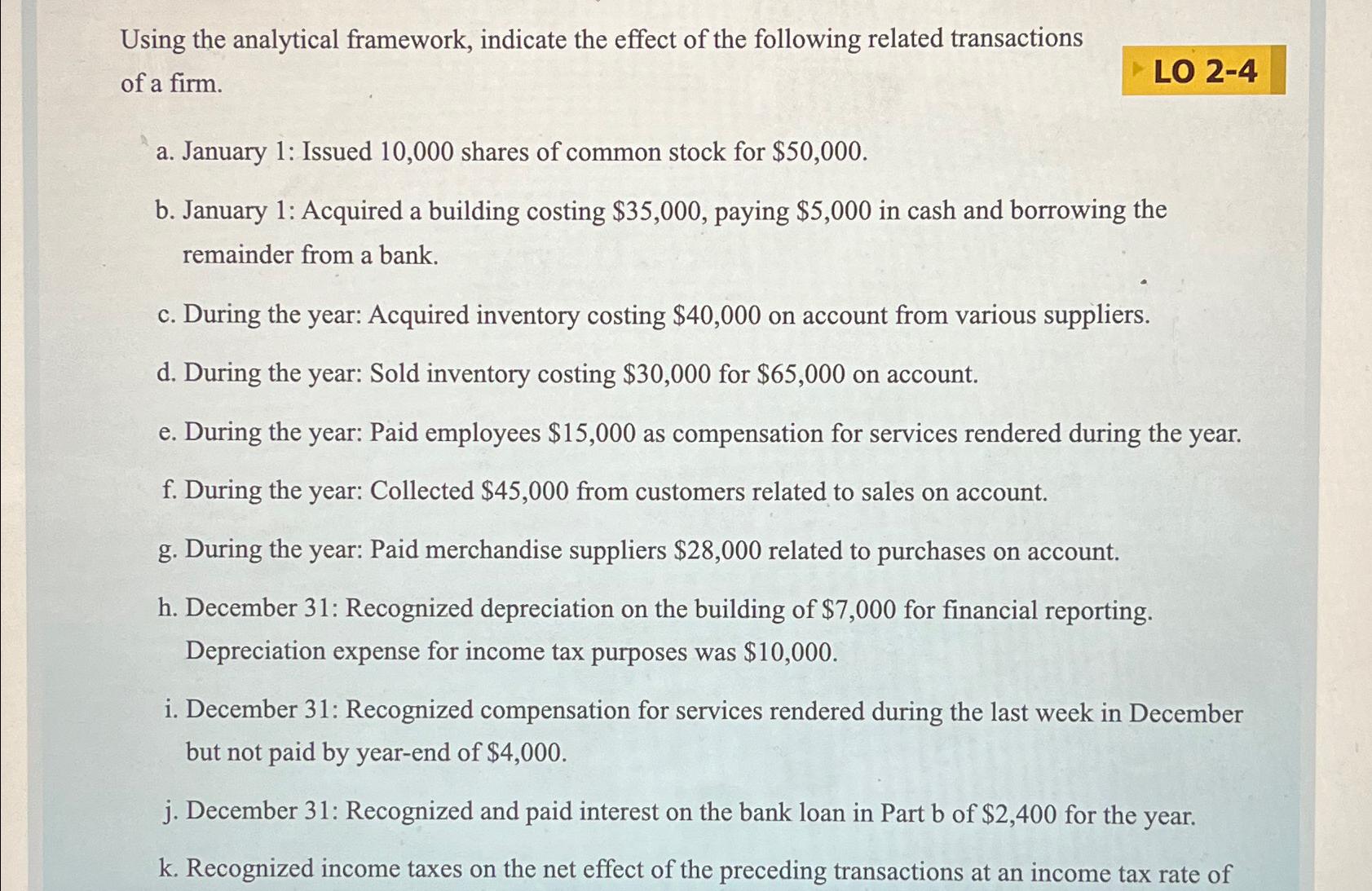

Question: Using the analytical framework, indicate the effect of the following related transactions of a firm. LO 2-4 a. January 1 : Issued 10,000 shares of

Using the analytical framework, indicate the effect of the following related transactions of a firm.\ LO 2-4\ a. January 1 : Issued 10,000 shares of common stock for

$50,000.\ b. January 1: Acquired a building costing

$35,000, paying

$5,000in cash and borrowing the remainder from a bank.\ c. During the year: Acquired inventory costing

$40,000on account from various suppliers.\ d. During the year: Sold inventory costing

$30,000for

$65,000on account.\ e. During the year: Paid employees

$15,000as compensation for services rendered during the year.\ f. During the year: Collected

$45,000from customers related to sales on account.\ g. During the year: Paid merchandise suppliers

$28,000related to purchases on account.\ h. December 31: Recognized depreciation on the building of

$7,000for financial reporting. Depreciation expense for income tax purposes was

$10,000.\ i. December 31: Recognized compensation for services rendered during the last week in December but not paid by year-end of

$4,000.\ j. December 31: Recognized and paid interest on the bank loan in Part b of

$2,400for the year.\

k. Recognized income taxes on the net effect of the preceding transactions at an income tax rate of

Using the analytical framework, indicate the effect of the following related transactions of a firm. a. January 1: Issued 10,000 shares of common stock for $50,000. b. January 1: Acquired a building costing $35,000, paying $5,000 in cash and borrowing the remainder from a bank. c. During the year: Acquired inventory costing $40,000 on account from various suppliers. d. During the year: Sold inventory costing $30,000 for $65,000 on account. e. During the year: Paid employees $15,000 as compensation for services rendered during the year. f. During the year: Collected $45,000 from customers related to sales on account. g. During the year: Paid merchandise suppliers $28,000 related to purchases on account. h. December 31: Recognized depreciation on the building of $7,000 for financial reporting. Depreciation expense for income tax purposes was $10,000. i. December 31: Recognized compensation for services rendered during the last week in December but not paid by year-end of $4,000. j. December 31: Recognized and paid interest on the bank loan in Part b of $2,400 for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts