Question: Using the appropriate present value table and assuming a 12% annual interest rate, determine the present value on December 31, 2021, of a five-period annual

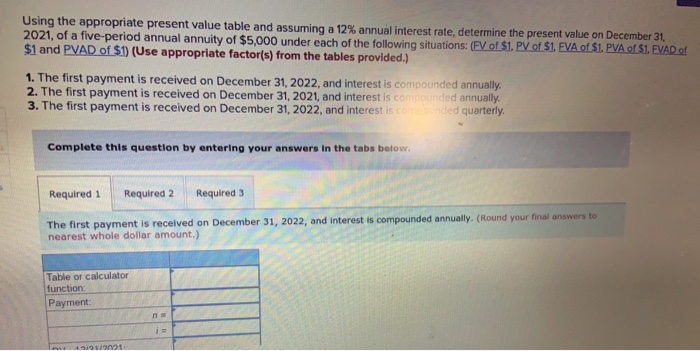

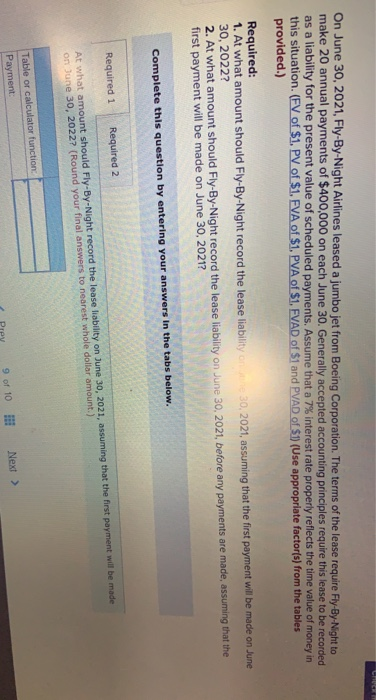

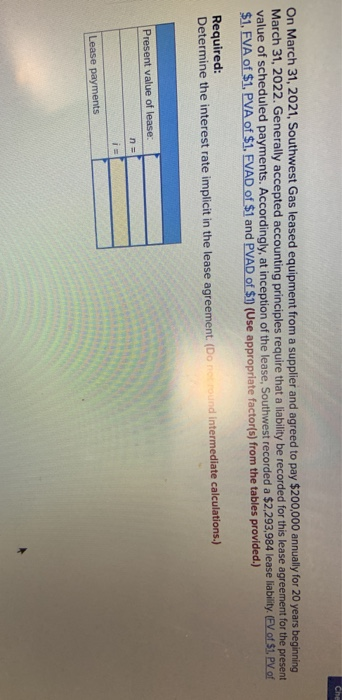

Using the appropriate present value table and assuming a 12% annual interest rate, determine the present value on December 31, 2021, of a five-period annual annuity of $5,000 under each of the following situations: (FV of $1. PV of $1. FVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. The first payment is received on December 31, 2022, and interest is compounded annually. 2. The first payment is received on December 31, 2021, and interest is compounded annually. 3. The first payment is received on December 31, 2022, and interest is contended quarterly. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 The first payment is received on December 31, 2022, and interest is compounded annually. (Round your final answers to nearest whole dollar amount.) Table or calculator function Payment n = 21 LHC On June 30, 2021, Fly-By-Night Airlines leased a jumbo jet from Boeing Corporation. The terms of the lease require Fly-By-Night to make 20 annual payments of $400,000 on each June 30. Generally accepted accounting principles require this lease to be recorded as a liability for the present value of scheduled payments. Assume that a 7% interest rate properly reflects the time value of money in this situation. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. At what amount should Fly-By-Night record the lease liability of 30, 2021, assuming that the first payment will be made on June 30, 2022? 2. At what amount should Fly-By-Night record the lease liability on June 30, 2021, before any payments are made, assuming that the first payment will be made on June 30, 2021? Complete this question by entering your answers in the tabs below. Required 1 Required 2 At what amount should Fly-By-Night record the lease liability on June 30, 2021, assuming that the first payment will be made on June 30, 2022? (Round your final answers to nearest whole dollar amount.) Table or calculator function Payment 9 of 10 Next > Che On March 31, 2021, Southwest Gas leased equipment from a supplier and agreed to pay $200,000 annually for 20 years beginning March 31, 2022. Generally accepted accounting principles require that a liability be recorded for this lease agreement for the present value of scheduled payments. Accordingly, at inception of the lease, Southwest recorded a $2,293,984 lease liability. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.) Required: Determine the interest rate implicit in the lease agreement. (Donound intermediate calculations.) Present value of lease: no Lease payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts