Question: Using the approximate YTM formula on test #3, calculate the YTM and after-tax rate for these bonds: #1 $1,000 bond, 10-year bond, coupon of 8%,

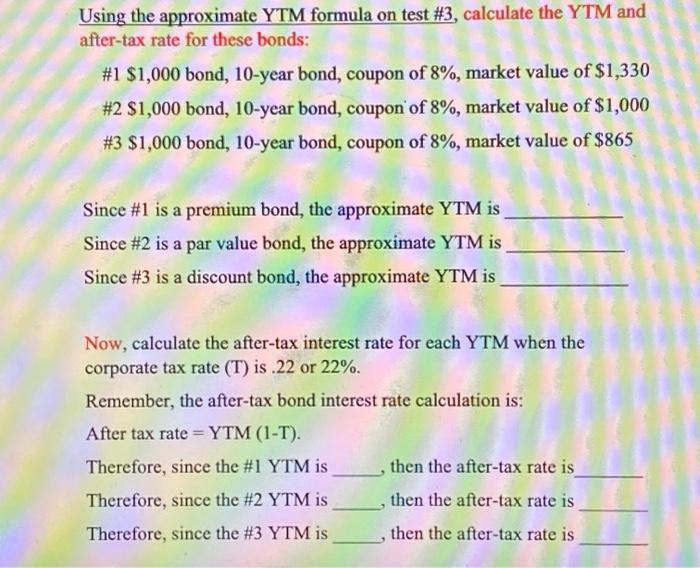

Using the approximate YTM formula on test #3, calculate the YTM and after-tax rate for these bonds: #1 $1,000 bond, 10-year bond, coupon of 8%, market value of $1,330 #2 $1,000 bond, 10-year bond, coupon of 8%, market value of $1,000 #3 $1,000 bond, 10-year bond, coupon of 8%, market value of $865 Since #1 is a premium bond, the approximate YTM is Since #2 is a par value bond, the approximate YTM is Since #3 is a discount bond, the approximate YTM is Now, calculate the after-tax interest rate for each YTM when the corporate tax rate (T) is .22 or 22%. Remember, the after-tax bond interest rate calculation is: After tax rate =YTM (1-T). Therefore, since the #1 YTM is then the after-tax rate is Therefore, since the #2 YTM is then the after-tax rate is Therefore, since the #3 YTM is then the after-tax rate is 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts