Question: Using the assumptions from the first image (Pro Forma #1), please help finish second income statement (second picture). This is all the information given. Units

Using the assumptions from the first image (Pro Forma #1), please help finish second income statement (second picture).

This is all the information given.

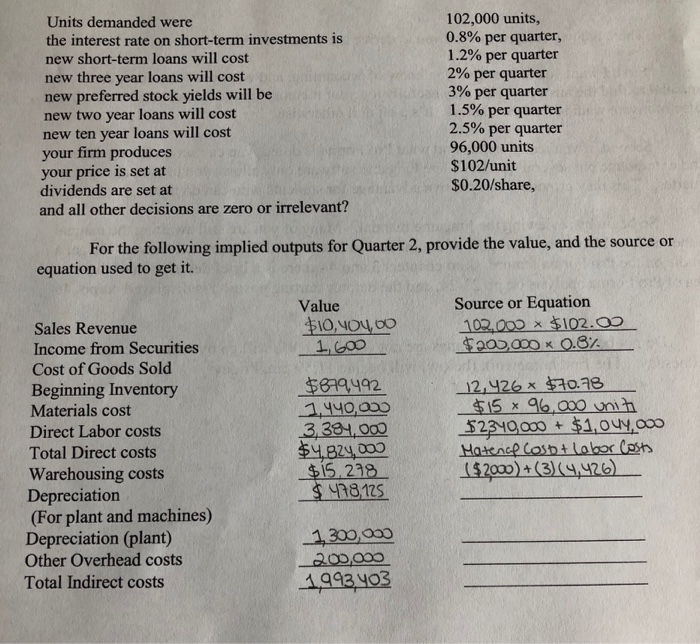

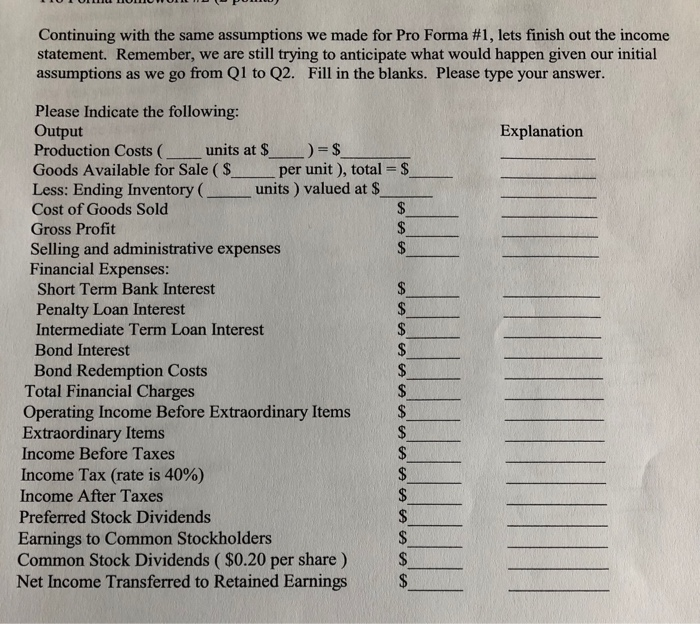

Units demanded were the interest rate on short-term investments is new short-term loans will cost new three year loans will cost new preferred stock yields will be new two year loans will cost new ten year loans will cost your firm produces your price is set at dividends are set at and all other decisions are zero or irrelevant? 102,000 units, 0.8% per quarter, 1.2% per quarter 2% per quarter 3% per quarter 1.5% per quarter 2.5% per quarter 96,000 units $102/unit $0.20/share, For the following implied outputs for Quarter 2, provide the value, and the source or equation used to get it. Value $10,404,00 1,600 Source or Equation 102.000 x $102.0 $200,000 x 0.8% Sales Revenue Income from Securities Cost of Goods Sold Beginning Inventory Materials cost Direct Labor costs Total Direct costs Warehousing costs Depreciation (For plant and machines) Depreciation (plant) Other Overhead costs Total Indirect costs $899,492 1.440,00 3.384.000 $4.824.000 $15.278 $ 478 125 12,426 * $70.78 $15 96,000 uniti $2340,000 + $1,044,000 Materich Cosbt labor costs ($2000) +(3) (4,426) 1.300,000 200,000 1,993, 403 Continuing with the same assumptions we made for Pro Forma #1, lets finish out the income statement. Remember, we are still trying to anticipate what would happen given our initial assumptions as we go from Q1 to Q2. Fill in the blanks. Please type your answer. Explanation $ $ Please Indicate the following: Output Production Costs units at $ =$ Goods Available for Sale ($ per unit), total = $ Less: Ending Inventory ( units ) valued at $ Cost of Goods Sold $ Gross Profit $ Selling and administrative expenses Financial Expenses: Short Term Bank Interest $ Penalty Loan Interest $ Intermediate Term Loan Interest $ Bond Interest $ Bond Redemption Costs Total Financial Charges $ Operating Income Before Extraordinary Items $ Extraordinary Items $ Income Before Taxes $ Income Tax (rate is 40%) $ Income After Taxes $ Preferred Stock Dividends $ Earnings to Common Stockholders $ Common Stock Dividends ( $0.20 per share ) $ Net Income Transferred to Retained Earnings $ Units demanded were the interest rate on short-term investments is new short-term loans will cost new three year loans will cost new preferred stock yields will be new two year loans will cost new ten year loans will cost your firm produces your price is set at dividends are set at and all other decisions are zero or irrelevant? 102,000 units, 0.8% per quarter, 1.2% per quarter 2% per quarter 3% per quarter 1.5% per quarter 2.5% per quarter 96,000 units $102/unit $0.20/share, For the following implied outputs for Quarter 2, provide the value, and the source or equation used to get it. Value $10,404,00 1,600 Source or Equation 102.000 x $102.0 $200,000 x 0.8% Sales Revenue Income from Securities Cost of Goods Sold Beginning Inventory Materials cost Direct Labor costs Total Direct costs Warehousing costs Depreciation (For plant and machines) Depreciation (plant) Other Overhead costs Total Indirect costs $899,492 1.440,00 3.384.000 $4.824.000 $15.278 $ 478 125 12,426 * $70.78 $15 96,000 uniti $2340,000 + $1,044,000 Materich Cosbt labor costs ($2000) +(3) (4,426) 1.300,000 200,000 1,993, 403 Continuing with the same assumptions we made for Pro Forma #1, lets finish out the income statement. Remember, we are still trying to anticipate what would happen given our initial assumptions as we go from Q1 to Q2. Fill in the blanks. Please type your answer. Explanation $ $ Please Indicate the following: Output Production Costs units at $ =$ Goods Available for Sale ($ per unit), total = $ Less: Ending Inventory ( units ) valued at $ Cost of Goods Sold $ Gross Profit $ Selling and administrative expenses Financial Expenses: Short Term Bank Interest $ Penalty Loan Interest $ Intermediate Term Loan Interest $ Bond Interest $ Bond Redemption Costs Total Financial Charges $ Operating Income Before Extraordinary Items $ Extraordinary Items $ Income Before Taxes $ Income Tax (rate is 40%) $ Income After Taxes $ Preferred Stock Dividends $ Earnings to Common Stockholders $ Common Stock Dividends ( $0.20 per share ) $ Net Income Transferred to Retained Earnings $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts