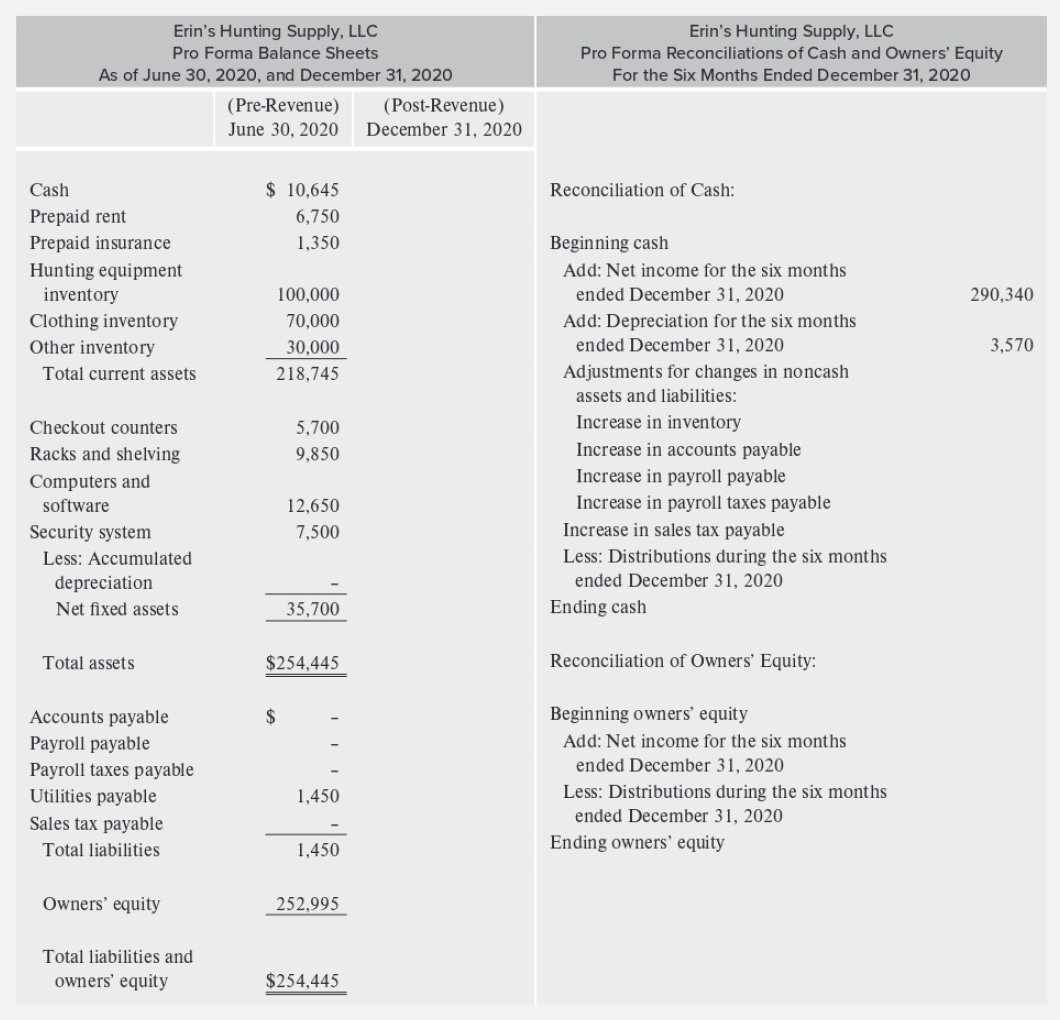

Question: Using the assumptions provided below, complete the following pro forma comparative balance sheets and related reconciliations of cash and owners equity for Erins Hunting Supply:

Using the assumptions provided below, complete the following pro forma comparative balance sheets and related reconciliations of cash and owners equity for Erins Hunting Supply:

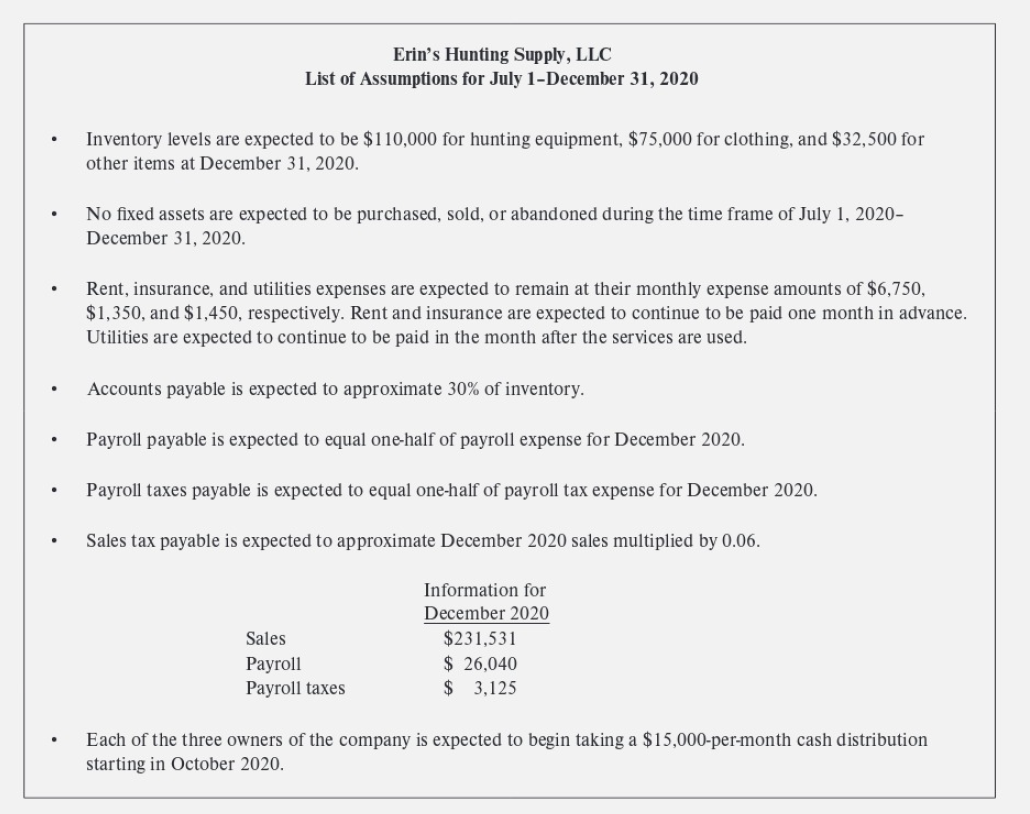

Erin's Hunting Supply, LLC List of Assumptions for July 1-December 31, 2020 Inventory levels are expected to be $110,000 for hunting equipment, $75,000 for clothing, and $32,500 for other items at December 31, 2020. No fixed assets are expected to be purchased, sold, or abandoned during the time frame of July 1, 2020- December 31, 2020. . Rent, insurance, and utilities expenses are expected to remain at their monthly expense amounts of $6,750, $1,350, and $1,450, respectively. Rent and insurance are expected to continue to be paid one month in advance. Utilities are expected to continue to be paid in the month after the services are used. . Accounts payable is expected to approximate 30% of inventory. Payroll payable is expected to equal one-half of payroll expense for December 2020. Payroll taxes payable is expected to equal one-half of payroll tax expense for December 2020. Sales tax payable is expected to approximate December 2020 sales multiplied by 0.06. Sales Payroll Payroll taxes Information for December 2020 $231,531 $ 26,040 $ 3,125 Each of the three owners of the company is expected to begin taking a $15,000-per-month cash distribution starting in October 2020. Erin's Hunting Supply, LLC Pro Forma Balance Sheets As of June 30, 2020, and December 31, 2020 (Pre-Revenue) (Post-Revenue) June 30, 2020 December 31, 2020 Erin's Hunting Supply, LLC Pro Forma Reconciliations of Cash and Owners' Equity For the Six Months Ended December 31, 2020 Reconciliation of Cash: $ 10,645 6,750 1,350 Cash Prepaid rent Prepaid insurance Hunting equipment inventory Clothing inventory Other inventory Total current assets 290,340 100,000 70,000 30,000 218,745 3,570 5,700 9,850 Checkout counters Racks and shelving Computers and software Security system Less: Accumulated depreciation Net fixed assets Beginning cash Add: Net income for the six months ended December 31, 2020 Add: Depreciation for the six months ended December 31, 2020 Adjustments for changes in noncash assets and liabilities: Increase in inventory Increase in accounts payable Increase in payroll payable Increase in payroll taxes payable Increase in sales tax payable Less: Distributions during the six months ended December 31, 2020 Ending cash 12,650 7,500 35,700 Total assets $254,445 Reconciliation of Owners' Equity: $ Accounts payable Payroll payable Payroll taxes payable Utilities payable Sales tax payable Total liabilities Beginning owners' equity Add: Net income for the six months ended December 31, 2020 Less: Distributions during the six months ended December 31, 2020 Ending owners' equity 1,450 1,450 Owners' equity 252,995 Total liabilities and owners' equity $254,445 Erin's Hunting Supply, LLC List of Assumptions for July 1-December 31, 2020 Inventory levels are expected to be $110,000 for hunting equipment, $75,000 for clothing, and $32,500 for other items at December 31, 2020. No fixed assets are expected to be purchased, sold, or abandoned during the time frame of July 1, 2020- December 31, 2020. . Rent, insurance, and utilities expenses are expected to remain at their monthly expense amounts of $6,750, $1,350, and $1,450, respectively. Rent and insurance are expected to continue to be paid one month in advance. Utilities are expected to continue to be paid in the month after the services are used. . Accounts payable is expected to approximate 30% of inventory. Payroll payable is expected to equal one-half of payroll expense for December 2020. Payroll taxes payable is expected to equal one-half of payroll tax expense for December 2020. Sales tax payable is expected to approximate December 2020 sales multiplied by 0.06. Sales Payroll Payroll taxes Information for December 2020 $231,531 $ 26,040 $ 3,125 Each of the three owners of the company is expected to begin taking a $15,000-per-month cash distribution starting in October 2020. Erin's Hunting Supply, LLC Pro Forma Balance Sheets As of June 30, 2020, and December 31, 2020 (Pre-Revenue) (Post-Revenue) June 30, 2020 December 31, 2020 Erin's Hunting Supply, LLC Pro Forma Reconciliations of Cash and Owners' Equity For the Six Months Ended December 31, 2020 Reconciliation of Cash: $ 10,645 6,750 1,350 Cash Prepaid rent Prepaid insurance Hunting equipment inventory Clothing inventory Other inventory Total current assets 290,340 100,000 70,000 30,000 218,745 3,570 5,700 9,850 Checkout counters Racks and shelving Computers and software Security system Less: Accumulated depreciation Net fixed assets Beginning cash Add: Net income for the six months ended December 31, 2020 Add: Depreciation for the six months ended December 31, 2020 Adjustments for changes in noncash assets and liabilities: Increase in inventory Increase in accounts payable Increase in payroll payable Increase in payroll taxes payable Increase in sales tax payable Less: Distributions during the six months ended December 31, 2020 Ending cash 12,650 7,500 35,700 Total assets $254,445 Reconciliation of Owners' Equity: $ Accounts payable Payroll payable Payroll taxes payable Utilities payable Sales tax payable Total liabilities Beginning owners' equity Add: Net income for the six months ended December 31, 2020 Less: Distributions during the six months ended December 31, 2020 Ending owners' equity 1,450 1,450 Owners' equity 252,995 Total liabilities and owners' equity $254,445

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts