Question: using the assumptions provided for the uwp corporation, complete their cash flow statements for the period ending December 31, 2020 Statement of Cash Flows Position

using the assumptions provided for the uwp corporation, complete their cash flow statements for the period ending December 31, 2020

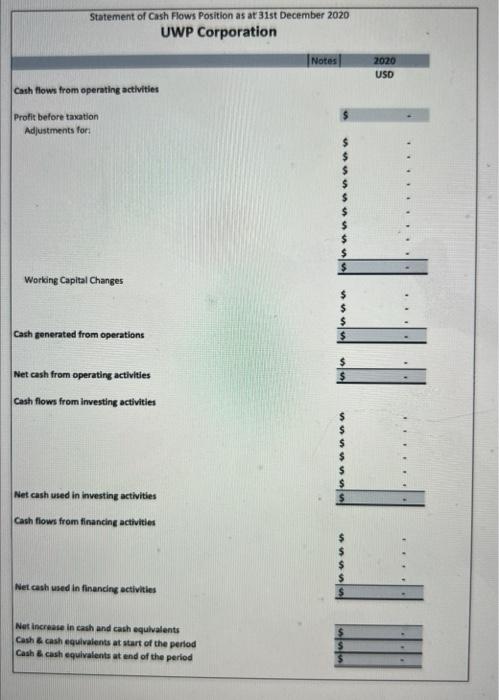

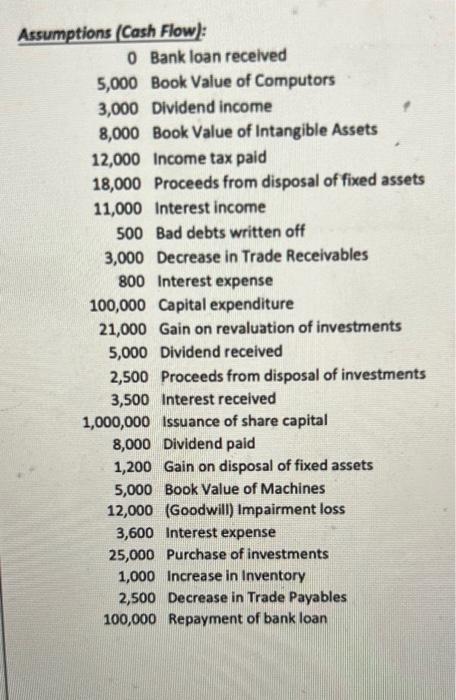

Statement of Cash Flows Position as at 31st December 2020 UWP Corporation Cach flows from operating activities Profit before taxation Adjustments for: Working Capital Changes Cash generated from operations Assumptions (Cash Flow): 0 Bank loan received 5,000 Book Value of Computors 3,000 Dividend income 8,000 Book Value of Intangible Assets 12,000 Income tax paid 18,000 Proceeds from disposal of fixed assets 11,000 Interest income 500 Bad debts written off 3,000 Decrease in Trade Receivables 800 Interest expense 100,000 Capital expenditure 21,000 Gain on revaluation of investments 5,000 Dividend received 2,500 Proceeds from disposal of investments 3,500 Interest received 1,000,000 issuance of share capital 8,000 Dividend paid 1,200 Gain on disposal of fixed assets 5,000 Book Value of Machines 12,000 (Goodwill) Impairment loss 3,600 Interest expense 25,000 Purchase of investments 1,000 Increase in Inventory 2,500 Decrease in Trade Payables 100,000 Repayment of bank loan Statement of Cash Flows Position as at 31st December 2020 UWP Corporation Cach flows from operating activities Profit before taxation Adjustments for: Working Capital Changes Cash generated from operations Assumptions (Cash Flow): 0 Bank loan received 5,000 Book Value of Computors 3,000 Dividend income 8,000 Book Value of Intangible Assets 12,000 Income tax paid 18,000 Proceeds from disposal of fixed assets 11,000 Interest income 500 Bad debts written off 3,000 Decrease in Trade Receivables 800 Interest expense 100,000 Capital expenditure 21,000 Gain on revaluation of investments 5,000 Dividend received 2,500 Proceeds from disposal of investments 3,500 Interest received 1,000,000 issuance of share capital 8,000 Dividend paid 1,200 Gain on disposal of fixed assets 5,000 Book Value of Machines 12,000 (Goodwill) Impairment loss 3,600 Interest expense 25,000 Purchase of investments 1,000 Increase in Inventory 2,500 Decrease in Trade Payables 100,000 Repayment of bank loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts