Question: Using the attached file, let us assume you enter this investment challenge contest with the green, red, and white dice as explained in the attachment:

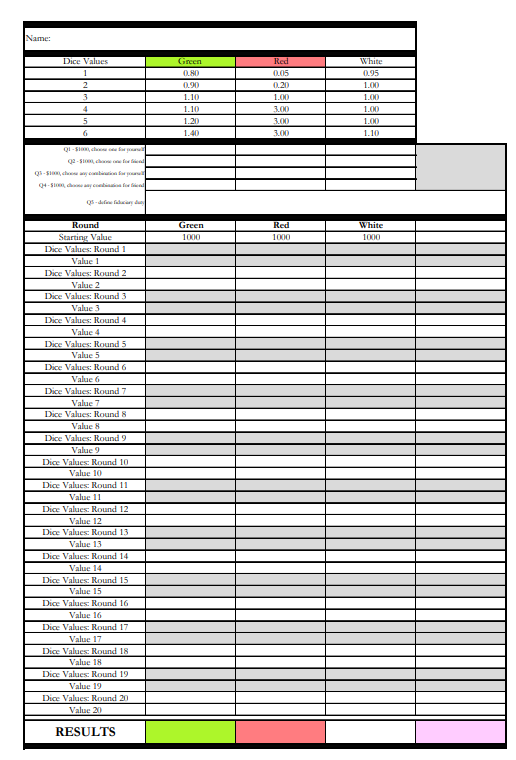

Using the attached file, let us assume you enter this investment "challenge" contest with the green, red, and white dice as explained in the attachment: 20 periods of green, red, and white. You may allocate your $1000 any way you wish: all in one color, or some fraction in each of two or three colors. Your allocations, however, must have a combined volatility (portfolio volatility) of no more than 16%. For the player with the highest return after 20 rounds, you win $1,000,000. Build a model to determine the best allocation for the start of this game such that you maximize your chance of winning.

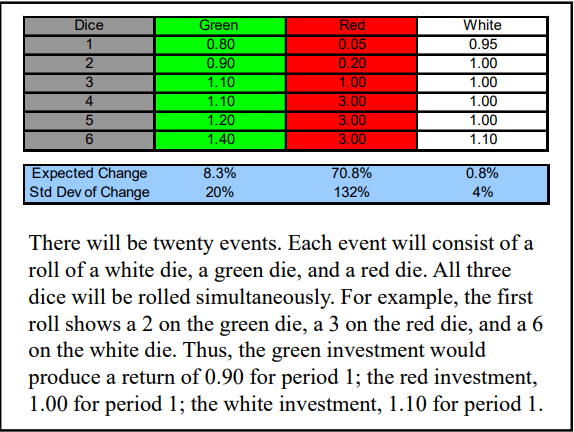

There will be twenty events. Each event will oonsist of a roll of a white die, a green die, and a red die. All three diee will he rolled simultaneously. Fer example, the rst roll shows a 2 on the green die, a 3 on the red die, and e 6 on the vvhite die. Thus, the green investment would produee a return of 0.90 for period 1; the red investment, 1.00 for period 1; the white investment, 1.10 for period 1. \f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts